Return inwards in simple terms means sending back goods by the customer to the seller. Simply speaking when your customer purchases items from your business but is not satisfied with the items so received they return those items back to you. Some of the reasons for sending back the items are statedRead more

Return inwards in simple terms means sending back goods by the customer to the seller. Simply speaking when your customer purchases items from your business but is not satisfied with the items so received they return those items back to you. Some of the reasons for sending back the items are stated below:

- Incorrect items delivered by the seller

- The excess amount delivered to the buyer

- Return of expired/ spoiled good

In such a case, the return is initiated by the buyer and a credit note is issued to the buyer, and the same is recorded in the books of accounts. Also, this return inward is deducted from the total sales.

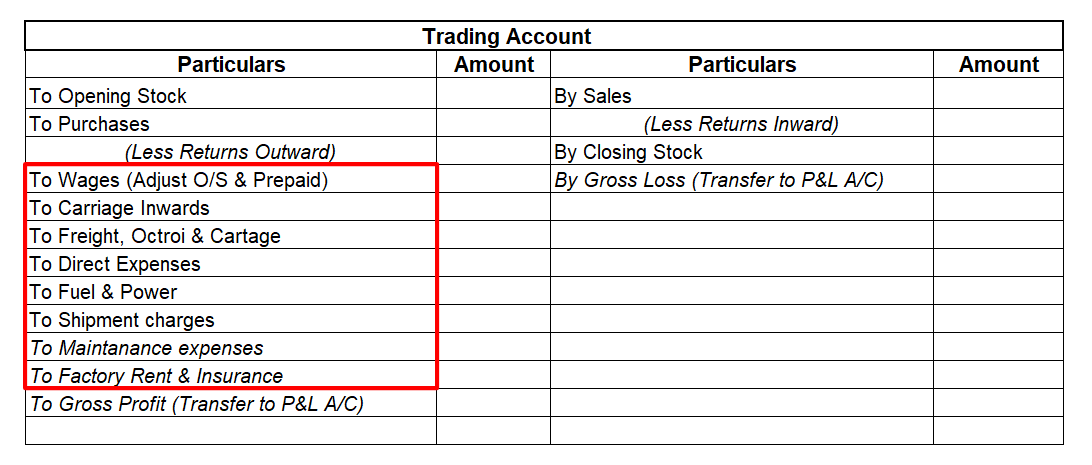

Example: M/s Pest ltd sold 4 units of fertilizers spraying tools of Rs 10,000 each to Mr. Zen. On inspection, he found 1 unit worth Rs 10,000 so received to be defective. Therefore the return of Rs 10,000 was initiated and goods were returned to the seller. A credit note of Rs 10,000 will be raised by the seller (M/s Pest ltd) to the buyer (Mr. Zen). The following adjustment will be shown in the trading account.

Return outwards means returning the goods by the buyer to the supplier. In layman language, when you purchase items for your business and you are not happy with the items then you may decide to return them.

In this case, a debit note is issued to the seller and is recorded in the books of accounts, and the same is reduced from the total purchases in the trading account so prepared.

Example: Suppose you are dealing in a business of clothing. You purchased 20 shirts for Rs.10,000 from a wholesale market. When you sold these shirts, you found 10 shirts worth Rs 5,000 to be defective which were returned by your customer. Therefore you will return these shirts to the wholesale market from where you purchased them. The following adjustment will be shown in the trading account.

See less

Definition Contingent Asset is an asset the existence, ownership, or value of which may be known or determined only on the occurrence or non-occurrence of one or more uncertain future events. However, the difference between Contingent assets is not disclosed whereas Contingent liabilities are discloRead more

Definition

Contingent Asset is an asset the existence, ownership, or value of which may be known or determined only on the occurrence or non-occurrence of one or more uncertain future events.

However, the difference between Contingent assets is not disclosed whereas Contingent liabilities are disclosed by way of notes they do have different criteria for recognition which are discussed below.

For example:– a claim that an enterprise is pursuing through the legal process, where the outcome is uncertain, is a contingent asset.

Contingent liabilities are defined as obligations relating to existing conditions or situations which may arise in the future depending on the occurrence or non-occurrence of one or more uncertain events.

For example:- Billis discounted but not yet matured, arrears of dividend on cum –preferences-shares, etc.

Meaning as per AS – 29

Now let me try to explain to you the meaning according to Accounting Standard 29 of the above contingent assets and liabilities which is as follows:-

• Contingent asset

A contingent asset is a possible asset that arises from past events the existence of which will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events.

Not wholly within the control of the enterprise.

It usually arises from unplanned or unexpected events that give rise to the possibility of an inflow of economic benefits to the enterprise.

• Contingent liability

A possible obligation that arises from past events the existence of which will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events.

Not wholly within the control of the enterprise.

A present obligation that arises from past events but is not recognized because it is not probable that the outflow of resources embodying economic benefits will be required to settle the obligation or,

A reliable estimate of the amount of obligation cannot be made.

Recognition In Financial Statements

Contingent assets and liabilities are recognized as follows:-

• Contingent Assets

As per the prudence concept s well as present accounting standards, an enterprise should not recognize a contingent asset.

It is possible that the recognition of contingent assets may result in the recognition of income that may never be realized.

However, when the realization of income is virtually certain, the related asset no longer remains contingent.

• Contingent liability

As per the rules, it is not recognized by an enterprise.

When recognized?

Contingent assets are assessed continually and if it has become virtuality an outflow of economic benefits will arise.

The assets and the related income are recognized in the financial statements of the period in which the change occurs.

Contingent liability is assessed continually to determine whether an outflow of resources embodying economic benefits has become probable.

And if it becomes probable that an outflow or future economic benefits will require for an item previously dealt with as a contingent liability.

A provision is recognized in financial statements of the period in which the change probability occurs except in extremely rare circumstances where no reliable estimate can be made.

Disclosure

Now we will see how contingent assets and liability are disclosed which is mentioned below:-

• Contingent asset

These contingent assets are not disclosed in financial statements.

A contingent asset is usually disclosed in the report of the approving authority ( ie.e., Board Of Directors in the case of a company, and the corresponding approving authority in case of any enterprise), if ab inflow of economic benefits is probable.

• Contingent Assets

A contingent liability is required to be disclosed by way of a note to the balance sheet unless the possibility of an outflow of a resource embodying economic benefit is remote.

See less