A. Furniture B. Capital C. Sales D. Commission earned

Any person, company, or organization that owes us money is a debtor. The amount that is owed to us is called debt. When you are unsure if a debtor is going to pay back the amount owed to you, then a provision for doubtful debts is created. Here, the debtor may or may not pay back the amount owed. WhRead more

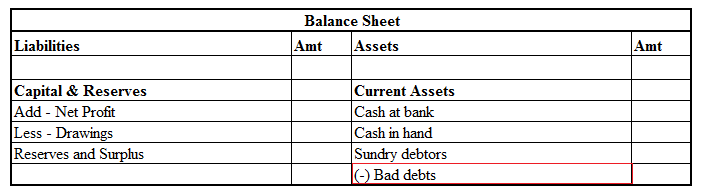

Any person, company, or organization that owes us money is a debtor. The amount that is owed to us is called debt. When you are unsure if a debtor is going to pay back the amount owed to you, then a provision for doubtful debts is created. Here, the debtor may or may not pay back the amount owed. When the debts owed to us is irrecoverable, it is termed as bad debts.

Provision for doubtful debts may become a bad debt at some point. Usually, companies keep a small portion of their debtors as a provision for doubtful debts in accordance with the prudence concept that tells us to account for all possible losses. Provision for doubtful debts is a liability whereas bad debts are recorded as an expense.

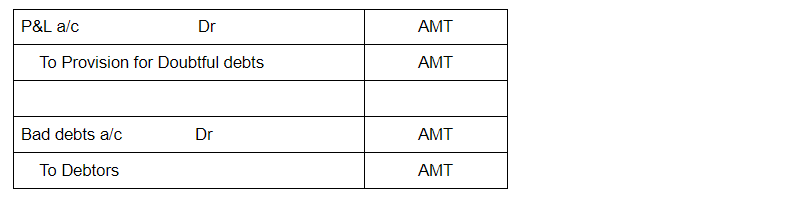

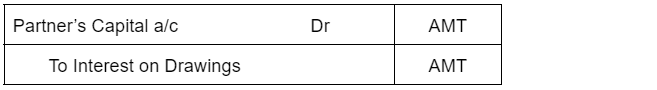

Journal entries for Doubtful debts and bad debts are as follows:

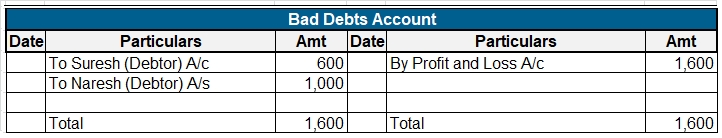

EXAMPLE

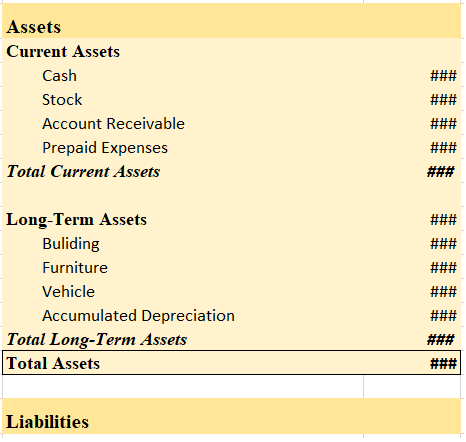

If the balance in the debtors’ account shows an amount of Rs 20,000 and 5% of debtors are treated as doubtful, then Rs 1,000 is recorded as a provision for doubtful debts. This amount is deducted from debtors in the balance sheet.

Now if Rs 400 was recorded as actual bad debts, then it is deducted from the provision for doubtful debts instead of debtors. Further another 400 is added back to provision for doubtful debts to maintain the percentage.

See less

Definition Where the total of the debit side is more than the credit side therefore the difference is the debit balance and is placed credit side as “ by balance c/d “ A furniture account that is an asset has a debit balance. Debit balance may arise due to timing differences in which case income wilRead more

Definition

Where the total of the debit side is more than the credit side therefore the difference is the debit balance and is placed credit side as “ by balance c/d “

A furniture account that is an asset has a debit balance.

Debit balance may arise due to timing differences in which case income will be accrued at the year’s end to offset the debit.

The amount is shown in the record of a company s finances, by which its total debits are greater than its total credits.

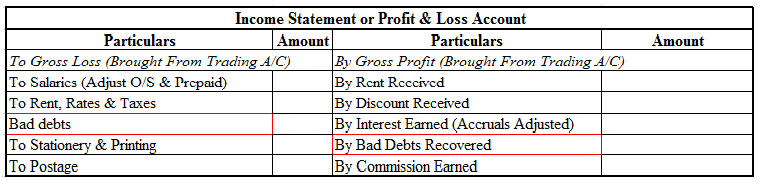

The account which has debit balances are as follows:

Land, furniture, building machinery, etc

Salary, rent, insurance, etc

Bad debts, loss by fire, etc

Personal drawings of cash or assets

Balances of these accounts

The account has credit balances as follows:

Creditors, bills payable, etc

Salary received, interest received, etc

Dividends, interest, etc

Partners Capital

Here are some examples showing the debit balances and credit balances of the accounts :

See less