Unrecorded Assets are the assets that are completely written off but still physically available in the company or assets that are not shown in the books of the company. Unrecorded assets are generally recorded or recognized at the event of admission, retirement, death of a partner when all the assetRead more

Unrecorded Assets are the assets that are completely written off but still physically available in the company or assets that are not shown in the books of the company.

Unrecorded assets are generally recorded or recognized at the event of admission, retirement, death of a partner when all the assets and liabilities are revalued or dissolution of the firm.

Since Accounting Standards require firms to record all the assets and liabilities in their books, it is therefore mandatory to record such unrecorded assets.

There can be two cases for treatment of such unrecorded assets:

- Unrecorded Asset entered into the business and recorded in books

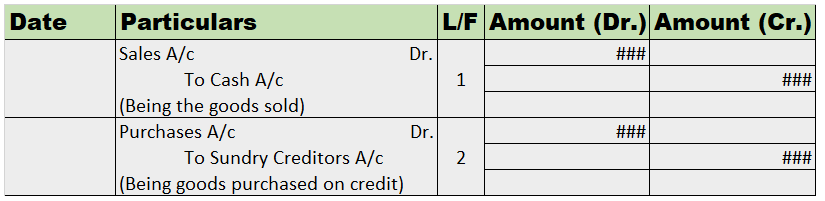

| Unrecorded Asset A/c (Dr.) | Amt | |

| To Revaluation A/c | Amt |

The unrecorded asset is now debited since it has to be recorded in the books now and Revaluation Account is credited since it is again for the business which will eventually be transferred to Partners’ Capital Account.

- Unrecorded Asset taken over by a partner and paid cash

| Cash A/c (Dr.) | Amt | |

| To Partners’ Capital A/c | Amt |

If a partner decides to take over an unrecorded asset then his account is credited with that amount and since cash paid by the partner comes into business Cash Account is debited.

- Unrecorded Asset discovered during Dissolution

| Cash/ A/c (Dr) | Amt | |

| To Realization A/c | Amt |

When an unrecorded asset is discovered during the dissolution of the firm, such an asset is sold directly to the outsider and as a result, cash A/c is debited since the cash is entering the business. The entry is made through the Revaluation A/c and it is hence credited.

Example:

At the time of revaluation, firms find a typewriter that has not been recorded in the books and is valued at Rs 10,000. The journal entry to record that typewriter will be:

| Typewriter A/c (Dr.) | 10,000 | |

| To Revaluation A/c | 10,000 |

See less

Preliminary expenses are those expenses that are incurred before the company’s business commences. These expenses are written off annually which does not involve any flow of cash. Therefore, in the cash flow statement, preliminary expenses are added back to net profit before tax and extraordinary itRead more

Preliminary expenses are those expenses that are incurred before the company’s business commences. These expenses are written off annually which does not involve any flow of cash. Therefore, in the cash flow statement, preliminary expenses are added back to net profit before tax and extraordinary items under the head operating activities (indirect method).

A cash flow statement is a financial statement that summarises the cash and cash equivalents entering and leaving the company. They can be classified into operating activities, investing activities and financing activities.

Reason for Treatment

Operating activities refer to those sources or usage of cash that relates to business activities.

As per the indirect method, the cash flow statement for operating activities begins with net profit before tax and extraordinary items. Since the company records non-cash expenditures also, they should add these back to net profit to find out the true cash flows. This is why preliminary expenses are added to net profit in the indirect method.

As per the direct method, all cash receipts are added and all cash expenses are subtracted to get cash flow from operating activities. Since preliminary expenses are a non-cash activity, they do not require any treatment in the direct method.

Preliminary expenses do not fall under the head investing activities as investing activities involve the acquisition or disposal of long term assets or investments. They do not fit in financing activities either as financing activities relate to change in capital or borrowings of the company.

Example

If the balance in preliminary expenses for the year 2019 was Rs.5,000 and its balance in 2020 reduced to 3,000, then its treatment in the cash flow statement would be:

See less