In the books of Rural Literacy Society Income & Expenditure A/c for the year ended 31 March 2019 Expenditure Amt Amt Income Amt Amt To General Expenses 32,000 By Subscription (W.N.1) 2,72,000 To Newspapers 18,500 By Legacy 12,500 To Electricity 30,000 By Government Grant 1,20,000 To Rent 65,000Read more

In the books of Rural Literacy Society

Income & Expenditure A/c for the year ended 31 March 2019

| Expenditure | Amt | Amt | Income | Amt | Amt |

| To General Expenses | 32,000 | By Subscription (W.N.1) | 2,72,000 | ||

| To Newspapers | 18,500 | By Legacy | 12,500 | ||

| To Electricity | 30,000 | By Government Grant | 1,20,000 | ||

| To Rent | 65,000 | By Interest Received on Fixed Deposit | 9,000 | ||

| Less: Prepaid Rent (65,000/13) | -5,000 | 60,000 | (1,80,000*10%*6/12) | ||

| To Salary | 36,000 | ||||

| Add: Outstanding Salary | 6,000 | 42,000 | |||

| To Postage Charges | 3,000 | ||||

| To Loss on Sale of Furniture (W.N.2) | 13,000 | ||||

| To Surplus (excess of income over expenditure) | 2,15,000 | ||||

| 4,13,500 | 4,13,500 |

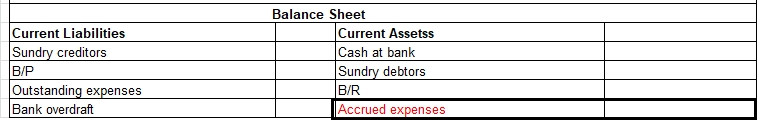

Balance Sheet as on 31 March 2019

| Liabilities | Amt | Amt | Assets | Amt | Amt |

| Capital Fund (W.N.3) | 3,85,500 | Fixed Deposit | 1,80,000 | ||

| Add: Surplus | 2,15,000 | ||||

| Advance Subscription | 5,000 | Books | 50,000 | ||

| Outstanding Salaries | 6,000 | Add: Purchased | 70,000 | 1,20,000 | |

| Furniture | 1,20,000 | ||||

| Add: Purchased | 1,05,000 | ||||

| Less: Sold | -50,000 | 1,75,000 | |||

| Outstanding Subscription | 15,000 | ||||

| Prepaid Rent | 5,000 | ||||

| Cash in Hand | 30,000 | ||||

| Cash at Bank | 82,000 | ||||

| Accrued Interest (W.N.4) | 4,500 | ||||

| 6,11,500 | 6,11,500 |

Working Notes:

W.N.1: Calculation of Subscription

| Subscription for 2018-19 | 2,65,000 |

| Add: Outstanding Subscription (31 March 2019) | 15,000 |

| Less: Outstanding Subscription (2017-18) | -8,000 |

| Total Subscription | 2,72,000 |

In the above calculation, for the year 2017-18 subscription amount was 12,000, and in the adjustment at the end of the year subscription was 20,000 so the difference of 8,000 is the amount of subscription that was outstanding.

W.N.2: Calculation of loss on sale of furniture

| Book Value of Furniture | 50,000 |

| Less: Sold | -37,000 |

| Loss on Sale of Furniture | 13,000 |

W.N.3: Calculation of Capital Fund

Balance Sheet as on 31 March 2018

| Liabilities | Amt | Assets | Amt |

| Capital Fund (Balancing Figure) | 3,85,500 | Books | 50,000 |

| Furniture | 1,20,000 | ||

| Outstanding Subscription | 20,000 | ||

| Cash in Hand | 40,000 | ||

| Cash at Bank | 1,55,500 | ||

| 3,85,500 | 3,85,500 |

W.N.4: Calculation of Accrued Interest

| Interest as of 30 September 2018 | 9,000 |

| Less: Interest as of 31 March 2019 | -4,500 |

| Accrued Interest | 4,500 |

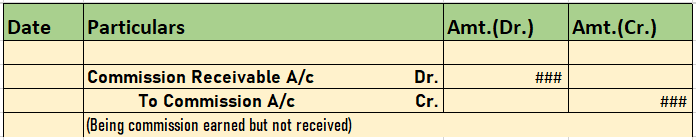

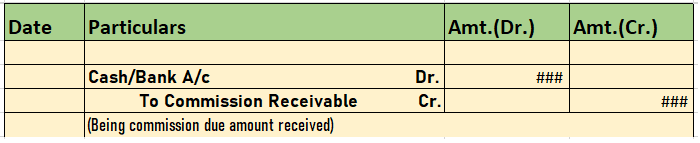

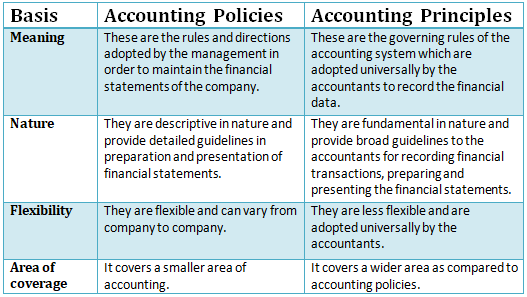

To proceed with how to make a partnership deed, let me explain to you in short what is partnership deed? A partnership deed is the written agreement between the partners who have agreed to share profits of a business carried on by them. This basically contains terms and conditions to be followed betRead more

To proceed with how to make a partnership deed, let me explain to you in short what is partnership deed?

A partnership deed is the written agreement between the partners who have agreed to share profits of a business carried on by them. This basically contains terms and conditions to be followed between the partners.

Few contents of the partnership deed are as follows:

Generally, a partnership deed contains all those matters which can affect the relationship between the partners. However, if there is no such agreement the partnership should follow the provisions mentioned under The Partnership Act, 1932.

Now coming to the main question how to make a partnership deed? See the process is not so complicated. The partnership deed may be oral or written, but as the oral agreement has no value for obtaining tax benefits, a partnership firm always prefers a written agreement.

To prepare the same the partnership deed must be prepared on a stamp paper and signed by all the partners as per Indian Stamp Act and copies of the same should be with all the partners and also must be filed by the registrar of the firm.

A deed may vary depending on the nature of the partnership they are engaged in. Generally, partnerships are of three types

the process of making deed is same for all but, the content of deed may vary depending on the liability of partners in the partnership.

Further to know more about the registration process of partnership firm you can refer the following link https://www.mca.gov.in/Ministry/actsbills/pdf/Partnership_Act_1932.pdf

See less