1) Liability 2) Asset 3) Expenses 4) Income

A bills receivable book is a subsidiary book that shows the details of various bills receivables drawn on customers. It shows the amount, due date, date when the bill was drawn, name of the acceptor, and various other details pertaining to each bill. A bills payable book is a subsidiary book that shRead more

A bills receivable book is a subsidiary book that shows the details of various bills receivables drawn on customers. It shows the amount, due date, date when the bill was drawn, name of the acceptor, and various other details pertaining to each bill.

A bills payable book is a subsidiary book that shows the details of various bills that suppliers have drawn on the business. It shows the amount, due date, date when the bill was drawn, name of the drawer and various other details pertaining to each bill.

The total of both these books is ultimately transferred to the general ledger. From there, it is used in drafting the balance sheet.

Importance of bills receivable and bills payable books

Bills receivable books help us know the amount that each customer is liable to pay us on specific dates while bills payable books help us know the amounts that we have to pay our various suppliers on certain dates.

Together these books help us handle our cash flows in an efficient manner.

We can evaluate our credit cycle. Bills receivable books help us avoid bad debts while bills payable books help us to avoid defaults.

Difference between bills receivable and bills payable

These are the primary differences between bills payable and bills receivable:

- Bills receivable represent the amounts that the business is to receive from customers while bills payable represent the amounts that the business has to pay to suppliers.

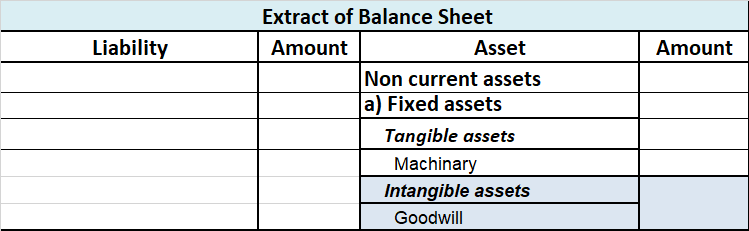

- Bills receivable are recorded as an asset in the balance sheet while bills payable are recorded as a liability.

- Bills receivable are drawn by the business on the customers while the bills payable are drawn by the suppliers on the business.

- Bills receivable are the outcome of credit sales while bills payable are the outcome of credit purchases.

- Bills receivable result in an inflow of cash while bills payable result in an outflow of cash.

- The dishonor of a bill receivable is recorded as an increase in the debtors of the business. Default on payment of bills payable may occur either because the business has become bankrupt or the business may record an increase in creditors.

We can conclude that both bills receivable and bills payable books are subsidiary books. Bills receivable shows the details of every bill that the business has drawn on each credit customer. Bills payable show the details of every bill that each credit supplier has drawn on the business.

See less

Therefore, 2) Asset is the correct option. Explanation The petty cash book is managed and made by not an accountant but the petty cashier and is done to record small incomes and expenditures that are not recordable in the cash book. Therefore, the desired result we obtain from the deduction oRead more

Therefore, 2) Asset is the correct option.

Explanation

The petty cash book is managed and made by not an accountant but the petty cashier and is done to record small incomes and expenditures that are not recordable in the cash book. Therefore, the desired result we obtain from the deduction of the total expenditure and total cash receipt is the closing balance of the petty cash book.

Petty cash refers to the in-hand physical cash that a business holds to pay for small and unplanned expenses.

Asset: The closing balance of the petty cash book is considered an asset because the petty cash book is a type of cash book. The petty cash book also deals in outflow and inflow of the cash, it also maintains and records income and expenditure that are similar to the cash book.

The petty cash book since being a part of the cash book, which records all the inflow and outflow of cash in a business, which is an asset, thus petty cash book’s closing balance is considered an asset. Also, the balance of the petty cash book is never closed. Their closing balance is carried forward to the next year.

Liability: The closing balance of the petty cash book is not considered a liability because that closing balance of the petty cash book doesn’t create a liability for the business. In fact, the closing of the petty cash book is placed under the head current asset in the balance sheet as mentioned above, it’s a part of the cash book which records the transactions of cash a/c which is an asset itself.

Expenses or Income: It is not an expense because the closing balance of the petty cash book is calculated by deducting the total expenditure from the total cash receipt.

That is an asset and it is considered to be a current asset, neither an income nor an expense. It is used for paying out petty expenses.

Therefore, the closing balance of the petty cash book is considered an asset.

See less