The term set off in English means to offset something against something else. It thereby refers to reducing the value of an item. In accounting terms, when a debtor can reduce the amount owed to a creditor by cancelling the amount owed by the creditor to the debtor, it is termed as set off. It is coRead more

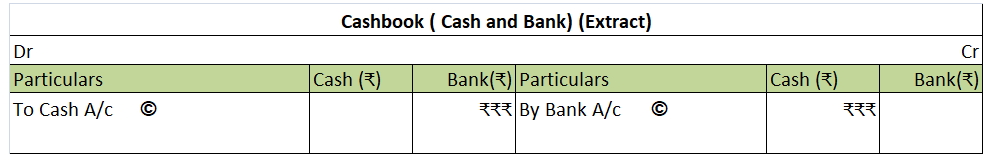

The term set off in English means to offset something against something else. It thereby refers to reducing the value of an item. In accounting terms, when a debtor can reduce the amount owed to a creditor by cancelling the amount owed by the creditor to the debtor, it is termed as set off.

It is commonly used by banks where they seize the amount in a customer’s account to set off the amount of loan unpaid by the customer.

Types

There are various types of set-offs as given below:

- Transaction set-off – This is where a debtor can simply reduce the amount he is owed from the amount he owes to the creditor.

- Contractual set-off – Sometimes, a debtor agrees to not set off any amount and hence he would have to pay the entire amount to the creditor even if the creditor owed some amount to the debtor.

- Insolvency set-off – These rules are mandatory and have to be followed under the Insolvency rules 2016.

- Bankers set-off – Here, the bank sets off the amount of a customer with another account of the customer.

Example

Let’s say Divya owes Rs 20,000 to Sherin for the purchase of goods. But, Sherin owed Rs 6,000 to Divya already for use of her Machinery. Therefore, the amount of 6,000 can be set off against the 20,000 owed to Sherin and hence Divya would effectively owe Sherin Rs 14,000.

This helps in reducing the number of transactions and unnecessary flow of cash.

See less

Depreciation is an accounting method that is used to write off the cost of an asset. The company must record depreciation in the profit and loss account. It is done so that the cost of an asset can be realised over the years rather than one single year. Furniture is an important asset for a businessRead more

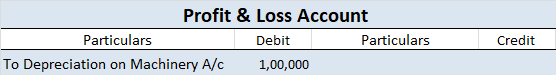

Depreciation is an accounting method that is used to write off the cost of an asset. The company must record depreciation in the profit and loss account. It is done so that the cost of an asset can be realised over the years rather than one single year.

Furniture is an important asset for a business. As per the Income Tax Act, the rate of depreciation for furniture and fittings is 10%. However, for accounting purposes, the company is free to set its own rate.

JOURNAL ENTRY

Journal entry for depreciation of furniture is:

Here, depreciation is debited since it is an expense and as per the rules of accounting, “increase in expenses are debited”. Furniture is credited because a “ decrease in assets is credited”, and the value of furniture is reducing.

TYPES OF DEPRECIATION

Furniture can be depreciated in any of the following ways:

For accounting purposes, the two many methods used for depreciating furniture is the straight-line method and the diminishing value method. However, for tax purposes, they are combined into a block of furniture, where the purchase of new furniture is added and the sale of furniture is subtracted and the resulting amount is depreciated by 10% based on the written downvalue method.

EXAMPLE

If a company buys furniture worth Rs 30,000 and charges depreciation of 10%, then by straight-line method, Rs 3,000 would be depreciated every year for 10 years.

Now if the company decided to use the diminishing value method (or written down value method), then Rs 3,000 (30,000 x 10%) would be depreciated in the first year, and in the second year, the book value of the furniture would be Rs 27,000 (30,000-3,000). Hence depreciation for the second year would be Rs 2,700 (27,000 x 10%) and so on.

See less