Let me explain to you in short what is unrecorded assets in the partnership. Basically, these are the assets that are not recorded in the books of accounts but are still present in the business in physical form. These assets are directly credited to the realization account at the time of dissolutionRead more

Let me explain to you in short what is unrecorded assets in the partnership. Basically, these are the assets that are not recorded in the books of accounts but are still present in the business in physical form. These assets are directly credited to the realization account at the time of dissolution of the partnership firm

Unrecorded assets are treated in two ways:

- Either they can be sold for cash.

- Taken over by any of the partners.

The journal entry for the unrecorded assets sold in cash is as follows:

| Bank A/c ……..Dr | xxx | |

| To Realization A/c | xxx | |

| (Being unrecorded assets sold for cash) |

To make the entries more simple for you let me give you a small example

A partnership firm has decided to dissolve its business. The firm had old furniture which was completely written off. They decide to sell the furniture for Rs 3,000. Here we can see that the firm has decided to realize its furniture by selling them in cash. Therefore the journal entry would be

| Bank A/c ……..Dr | 3,000 | |

| To Realisation A/c | 3,000 | |

| (Being old furniture sold for cash) |

And the journal entry for unrecorded assets taken over by the partner is as follows:

| Partner’s capital A/c ……..Dr | xxx | |

| To Realization A/c | xxx | |

| (Being unrecorded taken over by the partner) |

For example:

A partnership firm has decided to dissolve its business. The firm had old furniture which was completely written off. One of the pieces of furniture was taken over by one of the partners for Rs 3,000. Here we can see that the firm has decided to realize its furniture by taking over the partner. Therefore the journal entry would be

| Bank A/c ……..Dr | 3,000 | |

| To Partnership A/c | 3,000 | |

| (Being old furniture taken by partner) |

As realization is a nominal account it debits all expenses and losses while credit all incomes and gains. Therefore when a business treats unrecorded assets either by selling them or is taken over by the partner’s, it brings a certain amount of cash into the business hence Bank A/c and Partner’s capital account is debited in the journal entry and appear on the credit side of the realization account.

See less

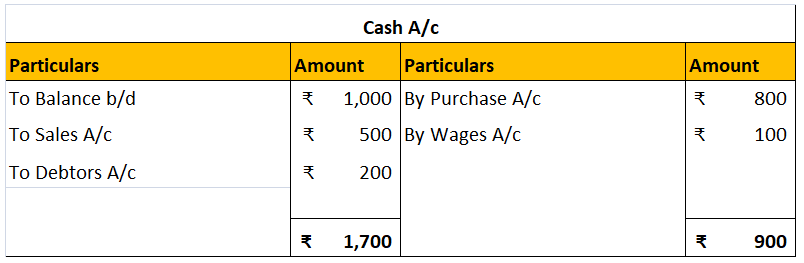

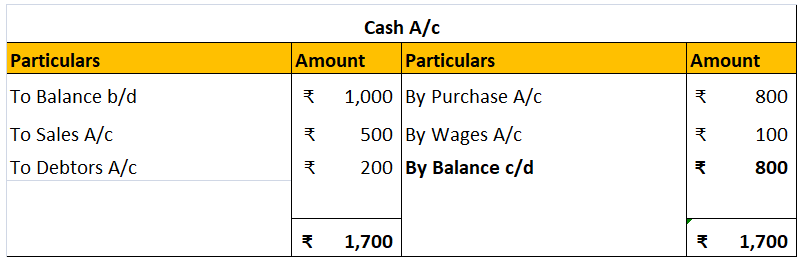

Bank Reconciliation Statement or BRS is a statement prepared to reconcile the bank account balance as per the cashbook with the bank balance as per the passbook. This is done so because often the bank balance as per the cashbook does not match with the bank balance as per the passbook. BRS is usuallRead more

Bank Reconciliation Statement or BRS is a statement prepared to reconcile the bank account balance as per the cashbook with the bank balance as per the passbook. This is done so because often the bank balance as per the cashbook does not match with the bank balance as per the passbook.

BRS is usually prepared by the accountant of an entity to find out the causes of the difference between the bank balance as per cashbook and the bank balance as reported in the passbook. The frequency of preparation of BRS is usually monthly. Nowadays, many enterprises have computerised accounting systems which help in automatic bank reconciliation.

Sometimes, BRS is also prepared by auditors during the audit of financial statements.

The balance of the bank account column of the cashbook does not match the bank balance as per the passbook. This is due to many transactions like the following that go unnoticed by the accountant:

Differences also occur due to accounting errors like posting wrong amounts in the cashbook.

To prepare the BRS, we have to start either with the bank balance as per cashbook, then add or subtract amounts to arrive at the bank balance as per passbook. Or we can do the vice verse. Here, the amounts we add or subtract are the amounts of items that are causes for the difference between the two balances.

See less