The entry for a loan (taken for any purpose) and a car loan are quite different. When you take a bank loan, you'll receive the money from the bank and subsequently, you'll start paying interest on it. In the case of a car loan, you don't receive the money from the bank. Once the car has been purchasRead more

The entry for a loan (taken for any purpose) and a car loan are quite different. When you take a bank loan, you’ll receive the money from the bank and subsequently, you’ll start paying interest on it.

In the case of a car loan, you don’t receive the money from the bank. Once the car has been purchased you’ll make the down payment and the remaining amount will be paid by the bank on your behalf. This car loan should then be paid to the bank in installments.

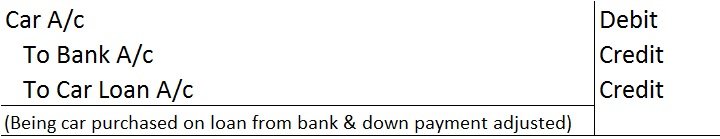

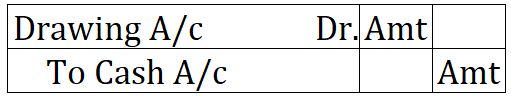

The following journal entry is posted to record the car loan taken for office use:

Car A/c is debited as there is an increase in the asset. Bank A/c is credited as the down payment for the car is made which reduces the assets. Car Loan A/c is credited as it increases liability.

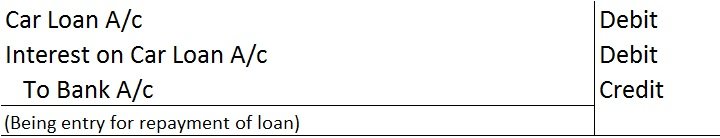

The following entry is recorded for the repayment of the loan (first installment) to the bank.

Let me explain this with an example,

Kumar purchased a car for 25,00,000 for his office use. He made a down payment of 2,00,000 and took a car loan from HDFC Bank for 23,00,000. The following entry will be made to record this transaction.

| Car A/c | 25,00,000 |

| To Bank A/c | 2,00,000 |

| To Car Loan A/c | 23,00,000 |

| (Being car purchased through a loan from HDFC bank) |

See less

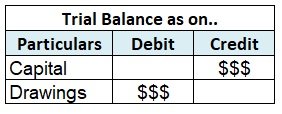

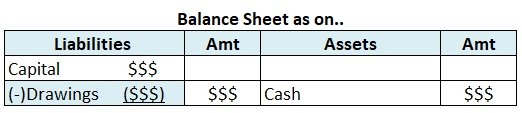

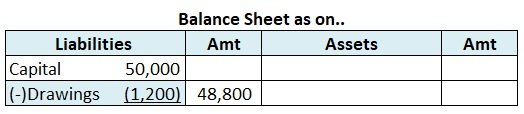

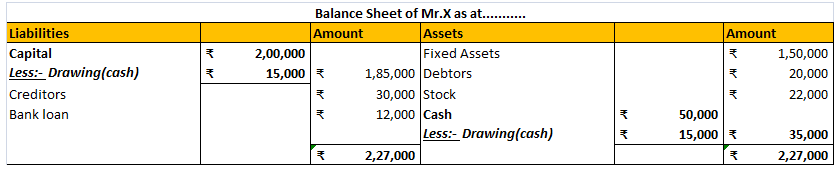

Interest on capital Interest on capital is interest payable to the owner/partners for providing a firm with the required capital to commence the business. Normally, it is charged for a full year on the balance of capital at the beginning of the year unless some fresh capital is introduced during theRead more

Interest on capital

Interest on capital is interest payable to the owner/partners for providing a firm with the required capital to commence the business. Normally, it is charged for a full year on the balance of capital at the beginning of the year unless some fresh capital is introduced during the year.

When the business firm faces a loss, the interest on capital will not be provided. It is permitted only when the business earns a profit. Such payment of interest is generally observed in partnership firms. It is provided before the division of profits among the partners in a partnership firm.

If an owner or partner introduces additional capital to the business then, it is also taken into account for providing interest on capital.

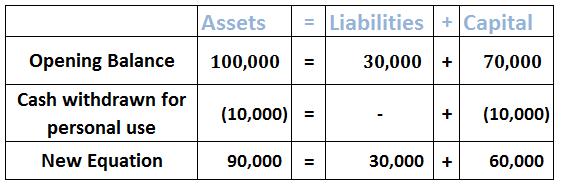

Interest on capital in the accounting equations

Interest on capital is an expense from a business point of view, as it is payable to the owner and is not paid in cash. Being an income from the owner’s point of view, it is added to his capital account. And being a business expense from the business point of view, it is therefore deducted from the capital.

Hence, it further doesn’t create any change in the accounting equation mathematically but it’s mandatory to be shown as it plays a vital role in the profit and loss a/c and even helps the business save tax.

Example

Z started a business with cash and stock of ₹45,000 and ₹5,000 respectively. Further, he received interest on capital of ₹1,000. The accounting equation for the following transactions will be as follows:

Accounting Equation

See less