The correct answer is 4. To ascertain the collective effect of all transactions pertaining to a particular account. The reason being is that in the ledger account all the effects are recorded for example, how much money is spent on a particular type of expense or how much money is receivable from aRead more

The correct answer is 4. To ascertain the collective effect of all transactions pertaining to a particular account. The reason being is that in the ledger account all the effects are recorded for example, how much money is spent on a particular type of expense or how much money is receivable from a debtor. In ledger accounts, information can be obtained about a particular account.

Ledger is the Principal book of accounts and also called the book of final entry. It summarises all types of accounts whether it is an Asset A/c, Liability A/c, Income A/c, or Expense A/c. The transactions recorded in the Journal/Subsidiary books are transferred to the respective ledger accounts opened.

Importance of preparing ledger accounts:

- Ledger accounts get the ready results i.e. helps in identifying the amount payable or receivable.

- It is necessary for the preparation of the Trial Balance.

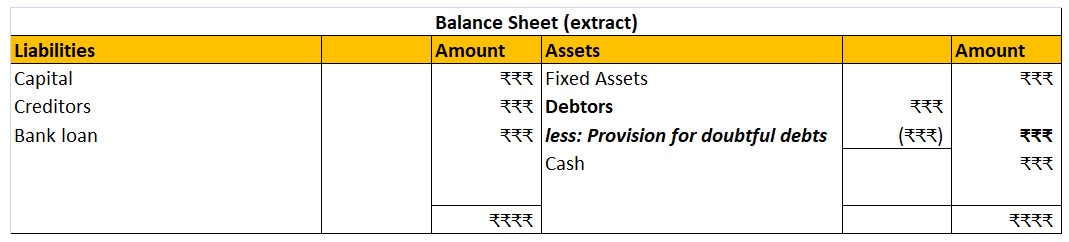

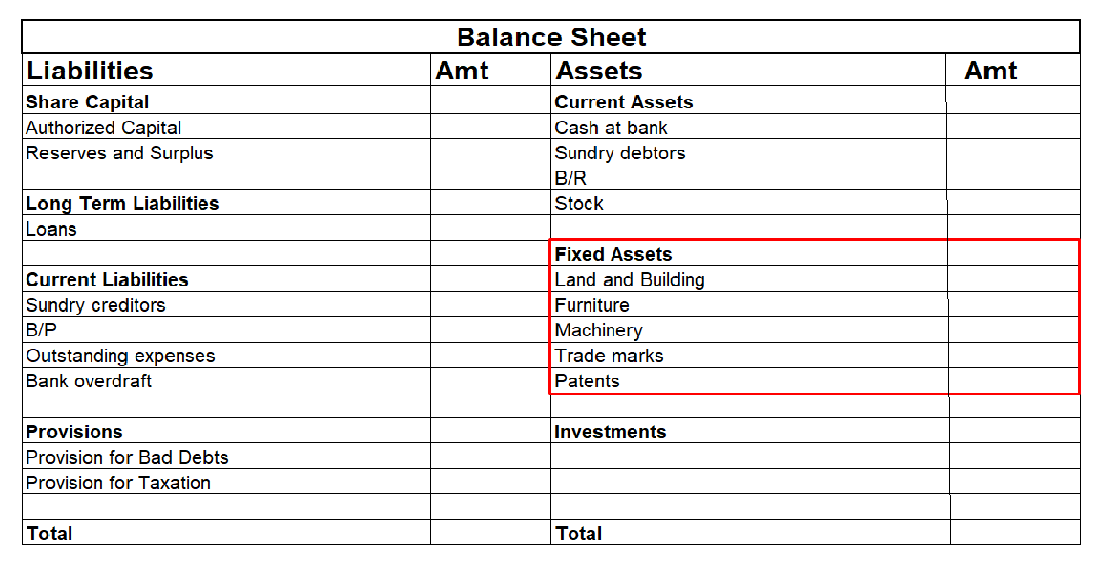

- The financial position of the business is easily available with the help of Assets A/c and Liabilities A/c.

- It helps in preparing various types of income statements on the basis of balances shown in ledger accounts.

- It can be used as a control tool as it shows balances of various accounts.

- It is useful for the management to forecast or plan for the future.

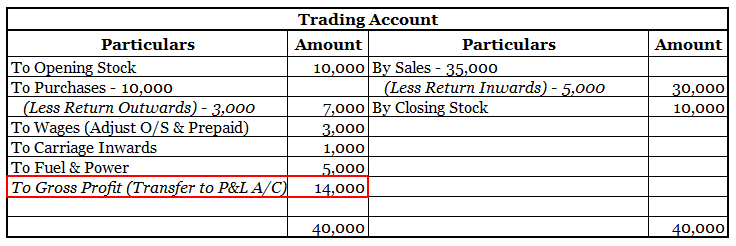

The Furniture and Fixture is depreciated @10% according to the income tax act and as per the companies act, 2013 @9.50% under Straight line method and @25.89% under written down value method. Furniture and fixture form a major part to furnish an office. For Example, the chair, table, bookshelves, etRead more

The Furniture and Fixture is depreciated @10% according to the income tax act and as per the companies act, 2013 @9.50% under Straight line method and @25.89% under written down value method.

Furniture and fixture form a major part to furnish an office. For Example, the chair, table, bookshelves, etc. all comes under Furniture and Fixture. The useful life of Furniture and Fixtures is estimated as 5-10 years depending upon the kind of furniture.

Rate of depreciation in reference to days

- If the furniture is bought but is not put to use, then no depreciation will be charged.

See less