Effective Capital is an amount calculated for purpose of arriving at the maximum limit of managerial remuneration as per the Companies Act, 2013 where profit is inadequate or no profit. Other than that it has no use. Computation of effective capital is given in Explanation I to Schedule II of the CoRead more

Effective Capital is an amount calculated for purpose of arriving at the maximum limit of managerial remuneration as per the Companies Act, 2013 where profit is inadequate or no profit. Other than that it has no use.

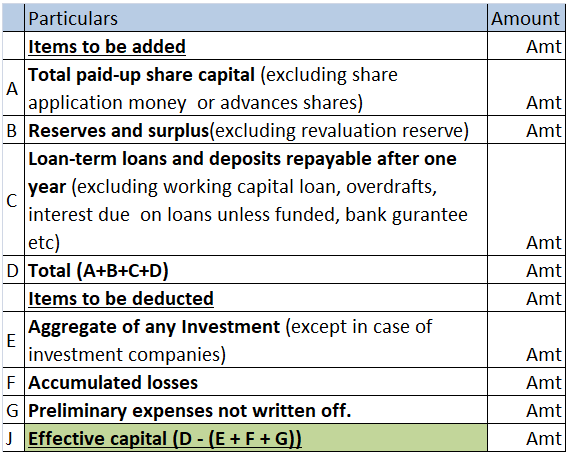

Computation of effective capital is given in Explanation I to Schedule II of the Companies Act. Schedule II deals with remuneration payable to managers in case of no profit or inadequate profit in the following manner:

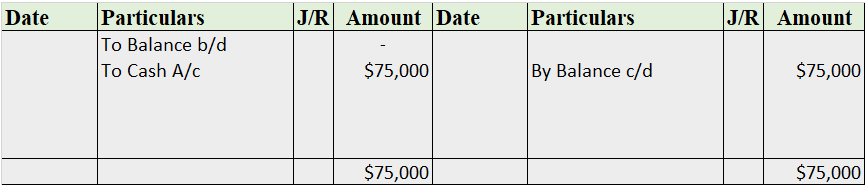

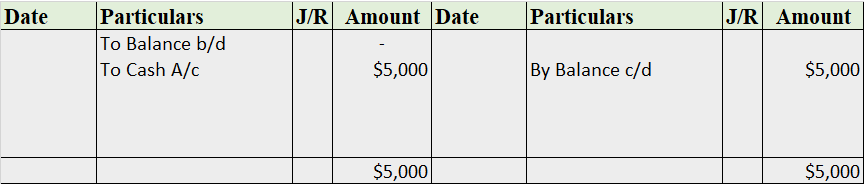

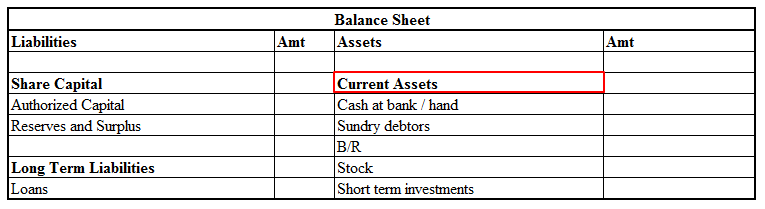

Computation of effective capital is done in the following manner:

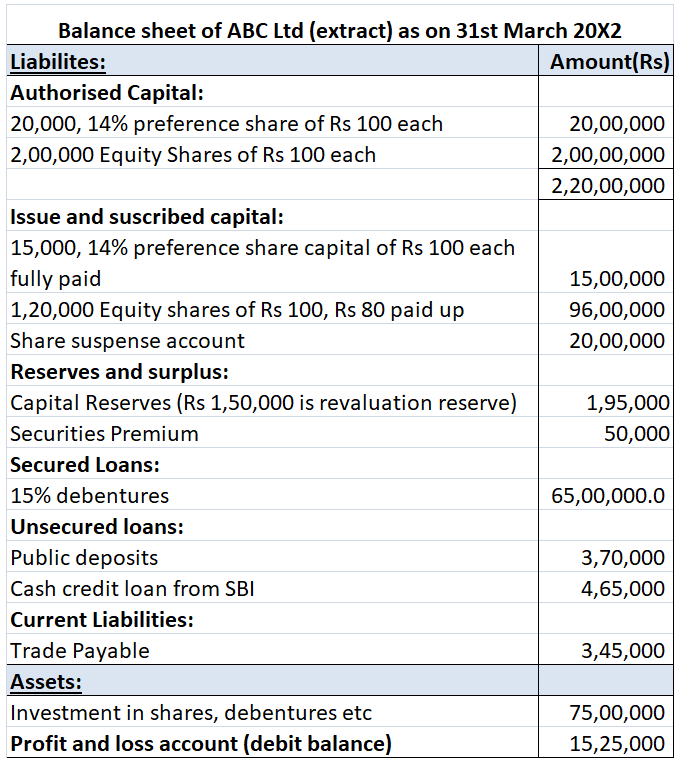

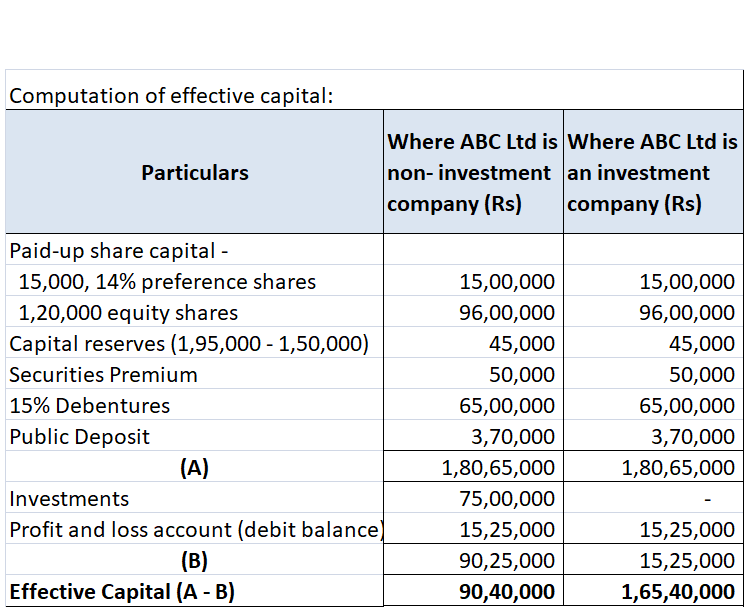

Numerical example:

ABC Ltd reports its balance sheet as given below:

We will compute its effective capital for both an investment company and a non-investment company.

Let’s understand what a cashbook is: A petty cash book is a cash book maintained to record petty expenses. By petty expenses, we mean small or minute expenses for which the payment is made in coins or a few notes like tea or coffee expense, bus or taxi fare, stationery expense etc. Such expenses areRead more

Let’s understand what a cashbook is:

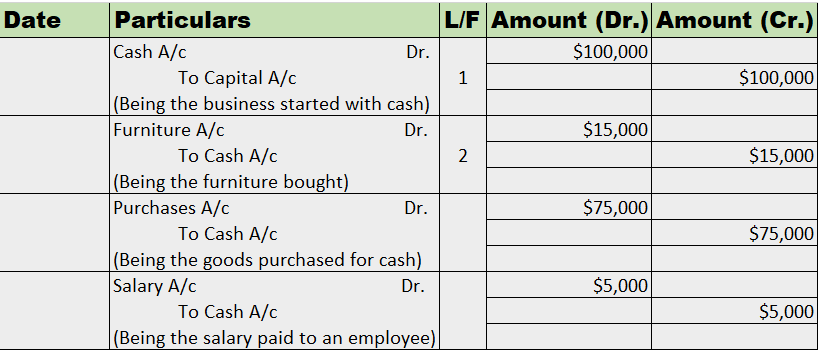

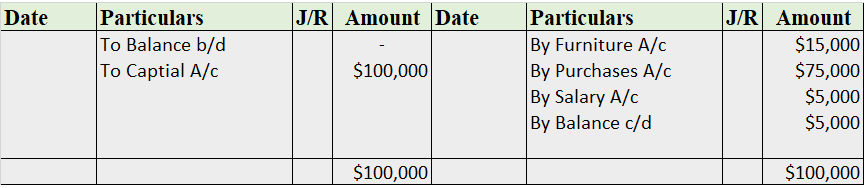

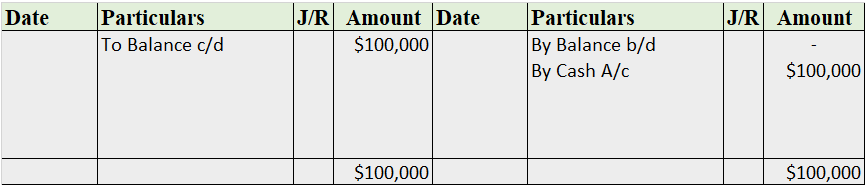

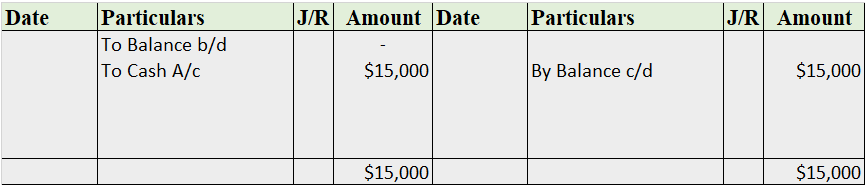

The manner in which entries are made

When cash is given to the petty cashier, entry is made on the debit side and in the petty cashbook and credit entry in the general cashbook.

Entries for all the expenses are made on the credit side.

Generally, the petty cashbook is prepared as per the Imprest system. As per the Imprest system, the petty expenses for a period (month or week) are estimated and a fixed amount is given to the petty cashier to spend for that period.

At the end of the period, the petty cashier sends the details to the chief cashier and he is reimbursed the amount spent. In this way, the debit balance of the petty cashbook always remains the same.

Format and items which appear in the petty cashbook

The format of the petty cashbook depends upon the type of petty cash book is prepared and the items appearing in it are nothing but petty expenses. Let’s see an example:-

A business incurred the following petty expenses for the month of April:-

Now we will prepare two types of cashbooks:

Here, the Petty cash book is of the same format as the general cash book.

The cash allocated for petty expenses is recorded on the debit side of the petty cash book and on the credit side of the general cash book.

Here, there are separate amount columns for each type of expense. As the name suggests, this type of petty cashbook helps to analyse the petty cash spending on basis of the type of expense.

See less