The profits earned by a company are distributed to its shareholders monthly, quarterly, half-yearly, or yearly in the form of dividends. The dividend payable by the company is transferred to the Dividend Account and is then claimed by the shareholders. If the dividend is not claimed by the members aRead more

The profits earned by a company are distributed to its shareholders monthly, quarterly, half-yearly, or yearly in the form of dividends. The dividend payable by the company is transferred to the Dividend Account and is then claimed by the shareholders.

If the dividend is not claimed by the members after transferring it to the Dividend Account, it is called Unclaimed Dividend. Such a dividend is a liability for the company and it is shown under the head Current Liabilities.

The dividend is transferred from the Dividend Account to the Unclaimed Dividend Account if it is not claimed by the shareholders within 37 days of declaration of dividend.

For the Cash Flow Statement, unclaimed dividend comes under the head Financing Activities.

Items shown under the head Financing Activities are those that are used to finance the operations of the company. Since, money raised through the issue of shares finances the company, any item related to shareholding or dividend is shown under the head Financing Activities.

However, there are two approaches to deal with the treatment of Unclaimed Dividend:

First, since there is no inflow or outflow of cash, there is no need to show it in the cash flow statement.

Second, the unclaimed dividend is deducted from the Appropriations, that is, when Net Profit before Tax and Extraordinary Activities is calculated.

Then, it is added under the head Financing Activities because the amount of dividend that has to flow out of the company (that is Dividend Paid amount which has already been deducted from Financing Activities) remained in the company only since it has not been claimed by the members.

The second approach to the treatment of an Unclaimed Dividend is used when the company has not transferred the unclaimed dividend amount from the Dividend Account to a separate account.

See less

No, drawings are not shown in the statement of profit or loss. By drawings, we mean the withdrawal of cash or goods by the owner of the business for his personal use. Drawings are actually shown in the balance sheet as a deduction from the capital account. Let’s take an example, Mr X runs a tradingRead more

No, drawings are not shown in the statement of profit or loss. By drawings, we mean the withdrawal of cash or goods by the owner of the business for his personal use.

Drawings are actually shown in the balance sheet as a deduction from the capital account.

Let’s take an example, Mr X runs a trading business. For meeting his personal expense we withdrew cash from his business cash of amount Rs. 15,000. It shall be reported like this:

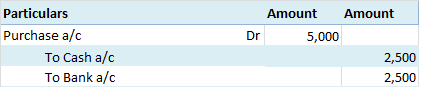

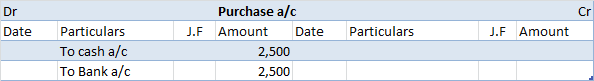

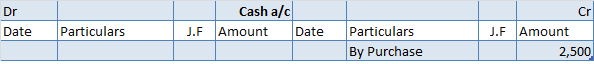

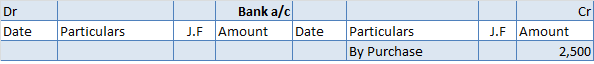

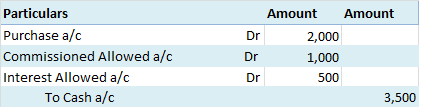

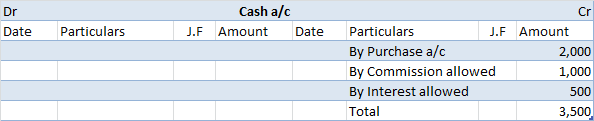

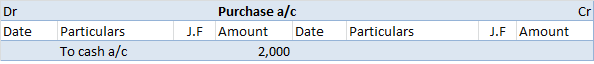

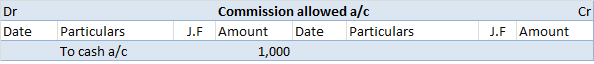

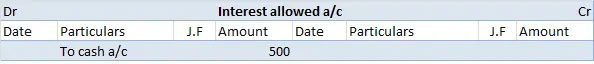

Journal Entries:

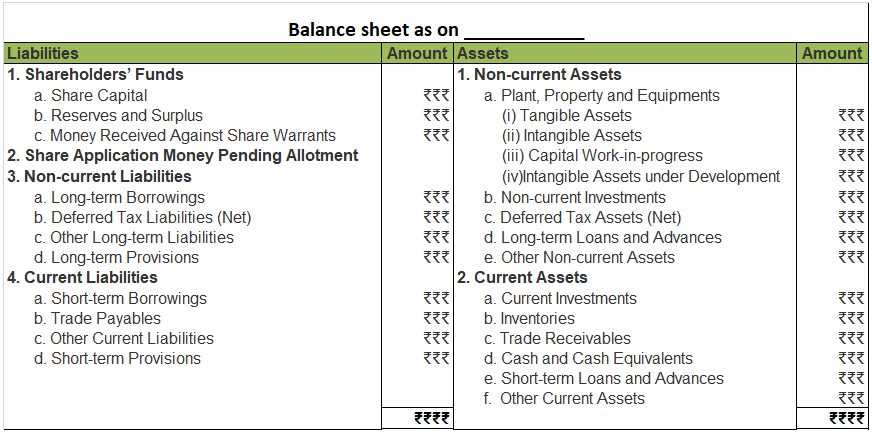

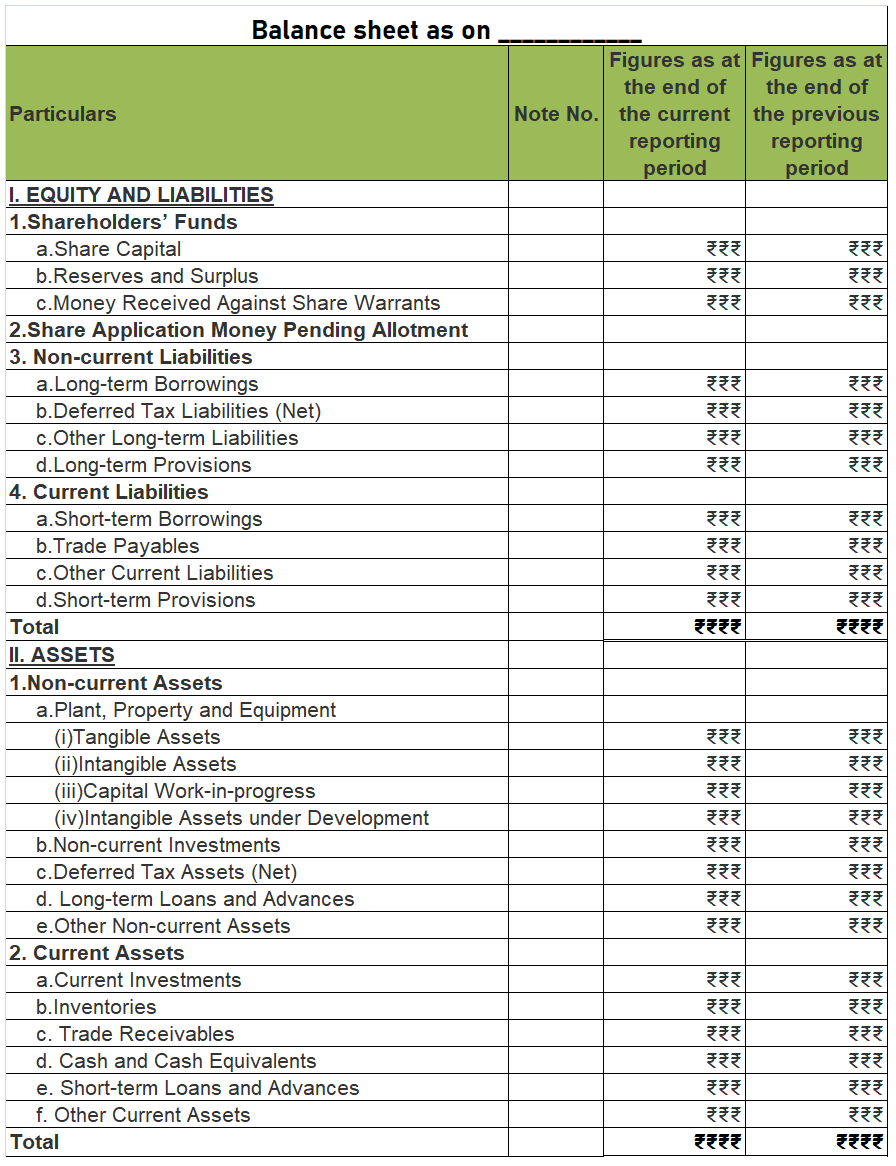

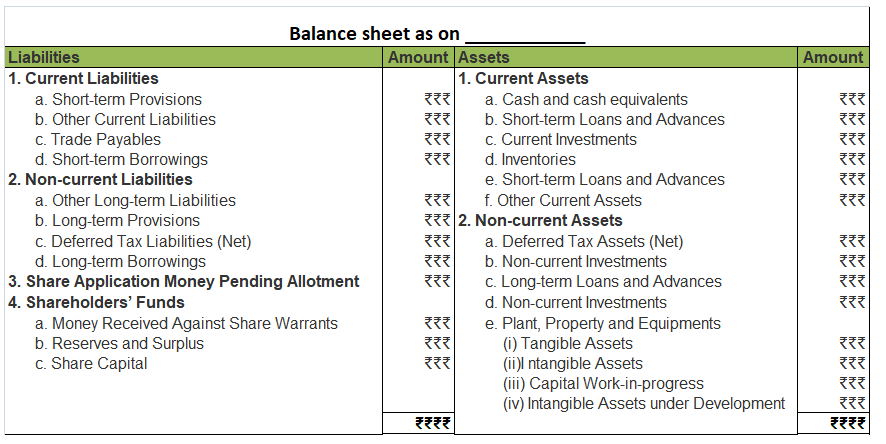

Balance sheet:

Profit and loss account reports only the nominal accounts i.e. incomes and expenses. That’s why drawings are not shown in the statement of profit or loss because it is neither an expense nor an income.

It represents the owner’s withdrawal of capital from business for personal use. Hence, the drawings account is a personal account. Drawings lead to a simultaneous reduction in capital and cash or stock of a business which has nothing to do with Profit and loss A/c.

Therefore it is reported in the balance sheet only.

See less