Software is not depreciated but amortized, as it is an intangible asset. As per companies act the useful life of software is 3 years. The treatment of depreciation is the same as computers. Following are the software depreciation rates as per the companies act: As of 2021 Nature of Asset Useful LifeRead more

Software is not depreciated but amortized, as it is an intangible asset. As per companies act the useful life of software is 3 years. The treatment of depreciation is the same as computers. Following are the software depreciation rates as per the companies act:

As of 2021

| Nature of Asset | Useful Life | Depreciation | |

| WDV | SLM | ||

| Servers and networks | 6 years | 39.30% | 15.83% |

| End-user devices such as desktops, laptops, etc. | 3 years | 63.16% | 31.67% |

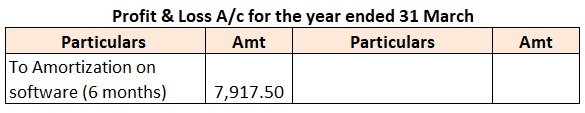

For example, XYZ Ltd purchased a new accounting software on 1 October for Rs.50,000. As per the Companies Act, the useful life of software is 3 years. Hence, the software will be amortized for 3 years and the company amortizes on the straight-line method.

Amortization amount = 50,000*31.67%

For full year = Rs.15,835

As the software was purchased on 1 October hence it will be amortized for 6 months.

For 6 months = 15,835*6/12

= Rs.7,917.50

Amortization is the same as depreciation. Hence, treatment will also be the same. The amortization amount will be transferred to the Profit & Loss A/c on the debit side as a non-cash expense.

See less

Debtors and Creditors Points of Distinction Debtors Creditors Meaning A debtor is a person or entity that owes money to the other party (the other party is also known as the creditor). A creditor is a person or entity to whom money is owed or who lends money. Nature The debtors will have a debit balRead more

Debtors and Creditors

Example:

Mr. A purchases raw materials from its supplier Mr. D on credit.

Here for Mr. D, Mr. A will be a debtor because the amount is receivable from him.

Similarly, for Mr. A, Mr. D will be his creditor because the amount is payable to him.

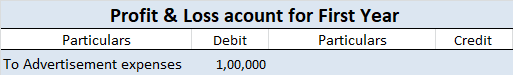

Profit and Gain

Profit = Total Income-Total Expenses

Net profit

Operating profit

Capital gain

Long term capital gain

Short term capital gain

Example: A company’s sales for the period are $60,000 and expenses incurred are $40,000. Here the profit calculated will be $20,000 because revenue exceeds expenses.

Profit = Total Income-Total Expenses

= 60,000 – 40,000

= $20,000

Mr. X owned land worth $10,00,000 and after 10 years he sold it at a current market value of $14,00,000. So the gain he earned is $4,00,000. This gain of $4,00,000 will be termed as a capital gain since land is a capital asset.

See less