There are two types of ledger accounts in the accounting system – temporary and permanent. Temporary accounts are those whose balances zero out and we do not carry forward balances to the next year. Examples are revenue and expenses accounts or nominal accounts. The balances of such accounts are traRead more

There are two types of ledger accounts in the accounting system – temporary and permanent.

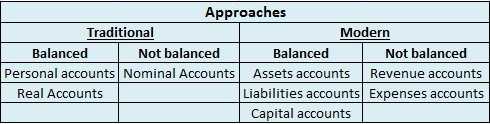

Temporary accounts are those whose balances zero out and we do not carry forward balances to the next year. Examples are revenue and expenses accounts or nominal accounts. The balances of such accounts are transferred to the profit and loss account and therefore are not balanced.

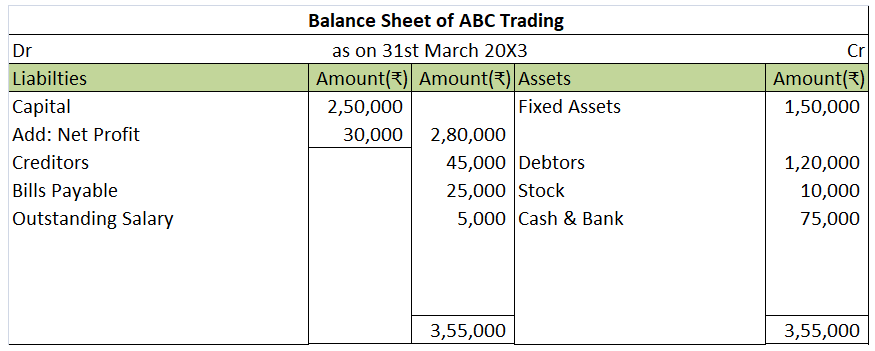

Permanent accounts are those whose balances are carried forward to the next accounting year in form of opening balances. These accounts are balanced and such balances are transferred to the balance sheet. Examples are assets, liability and capital accounts or personal and real accounts.

Balancing an account means equaling both the debit and the credit side of the account. Generally, there is a difference between the accounts recorded as a carry down balance in the case of permanent accounts and as a transfer balance in the case of temporary accounts.

Balancing serves as a check to the double-entry rule of accounting.

Balanced accounts

As discussed above, the balanced accounts are shown in the balance sheet and the balancing figure for such accounts are carried forward to the next accounting period.

Unbalanced accounts

As per the above discussion, the balancing figures of unbalanced accounts are transferred to the profit and loss account and no balances are carried forward to the next accounting period.

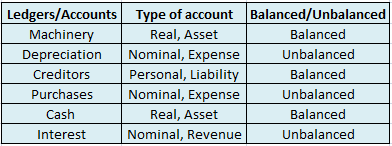

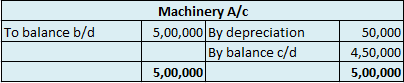

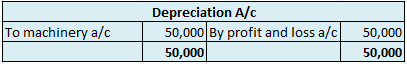

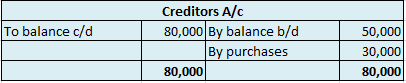

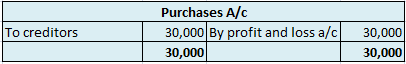

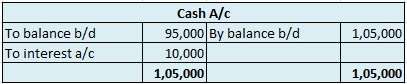

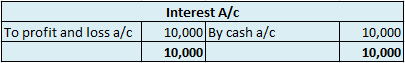

Suppose a company Shine Ltd. has machinery costing 5,00,000 at the beginning of the accounting period and charges depreciation of 10% on the asset. The company also has creditors amounting to 50,000 at the beginning of the period and purchases goods amounting to 30,000 on credit. It has a cash balance of 95,000 at the beginning of the period and earns interest amounting to 10,000.

Following ledgers would be prepared to record the above entries:

The above ledgers can be shown as follows:

The balance of the machinery account will be shown in the balance sheet and therefore it is a balanced account.

The balance is transferred to the profit and loss account and therefore depreciation account is an unbalanced account.

The balance of creditors account will be shown in the balance sheet and therefore it is a balanced account.

The balance is transferred to the profit and loss account and therefore purchases account is an unbalanced account.

The balance of the cash account will be shown in the balance sheet and therefore it is a balanced account.

The balance is transferred to the profit and loss account and therefore interest account is an unbalanced account.

See less

Trading A/c is a nominal account which follows the rule "Debit all expenses and losses, Credit all incomes and gains". So, all expenses relating to the purchase or manufacturing of goods are shown on the debit side of the Trading A/c. It includes Opening Stock, Purchases, Wages, Carriage Inward, ManRead more

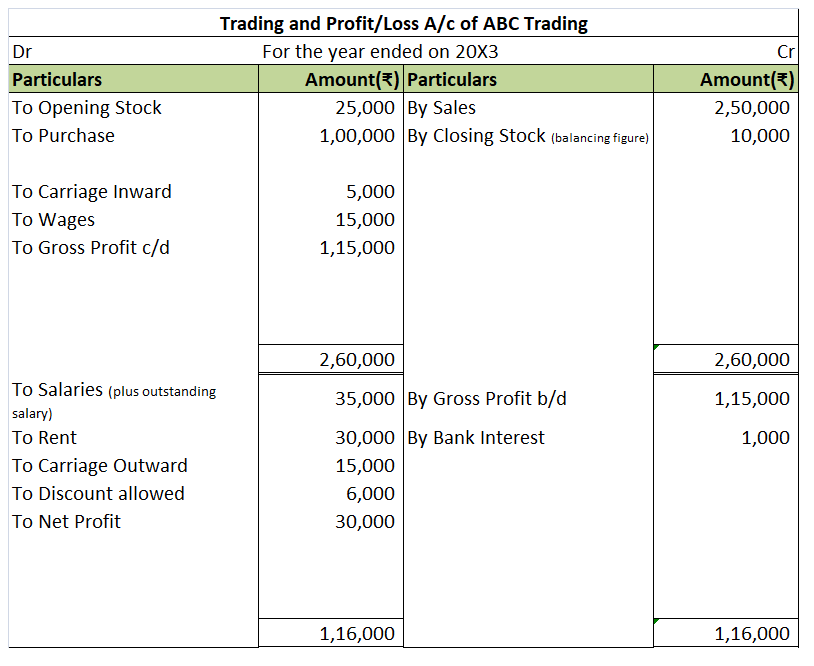

Trading A/c is a nominal account which follows the rule “Debit all expenses and losses, Credit all incomes and gains”.

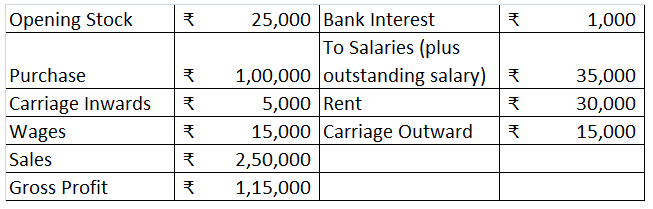

So, all expenses relating to the purchase or manufacturing of goods are shown on the debit side of the Trading A/c. It includes Opening Stock, Purchases, Wages, Carriage Inward, Manufacturing Expenses, Dock charges, and other direct expenses that are directly related to the manufacturing or purchase.

TRADING ACCOUNT

Trading A/c is prepared for calculating the Gross Profit or Gross Loss arising from the trading activities of a business.

Trading activities are mostly related to buying and selling of goods. However, in between buying and selling, a lot of activities are involved like transportation, warehousing, etc. So, all the expenses that are directly related to manufacturing or purchase of goods are also recorded in the Trading A/c.

DEBIT SIDE OF TRADING A/C

The items shown on the Dr. side are,

OPENING STOCK – Stock is nothing but goods that are either obtained for resale or manufactured for sale and are yet unsold on any particular date.

The value of stock at the beginning of an accounting year is called Opening stock while the value of the stock at the end of an accounting year is called closing stock.

The closing stock of the last year becomes the opening stock of the current year.

Opening stock includes,

For example – Suppose you are in the business of manufacturing and trading shirts. On 31st March 2023, there was unused raw material worth $10,000 and shirts worth $50,000 remained unsold.

So, we have Closing Stock of Raw material – $10,000

Closing Stock of Finished Goods – $50,000

This closing stock of last year becomes your opening stock during the current year i.e. on 1st April 2023, we have

Opening Stock of raw material – $10,000

Opening Stock of Finished Goods – $50,000

PURCHASES – Goods that have been bought for resale or raw materials purchased for manufacturing the product are terms as Purchases. These goods must be related to the business you are doing.

It includes cash as well as credit Purchases.

Continuing with the above example, suppose you bought raw material worth $ 1,00,000 for manufacturing and shirts worth $50,000 for resale (and not for personal consumption) then both these will be termed as purchases for you. So, your purchases will be $1,50,000 ($1,00,000 + $50,000)

PURCHASES RETURN – When goods bought are returned to the suppliers due to any reason. This is known as Purchase return. Purchase return is deducted from the Purchases.

In the above example, you bought shirts worth $50,000 for resale. Out of which shirts worth $20,000 were defective. So, you returned them to the supplier. This return of $20,000 is your purchase return or return outwards (as goods are going out)

WAGES – Wages are paid to the workers who are directly engaged in the loading, unloading and production of goods.

For example – Paid $10,000 to workers for manufacturing shirts.

However, it would be included in Trading A/c only if the wages are paid for work which is directly related to the manufacturing or purchase of goods otherwise it will be shown in P&L A/c.

Suppose you hired a manager to take care of your business and paid him $20,000 as salary. This salary is indeed an expense for the business but is not directly related to the manufacturing of goods. Since it is an indirect expense, it can only be recorded in P&L A/c and not in the Trading A/c.

CARRIAGE or CARRIAGE INWARDS or FREIGHT – It refers to the cost of transporting goods from the supplier.

Suppose, you ordered raw material in bulk which was transported to you by a van and you paid its fare. This fare is nothing but your carriage inwards.

However, if carriage or freight is paid on bringing an asset, the amount should be added to the asset account and must not be debited to the trading account.

MANUFACTURING EXPENSES – All expenses incurred in the manufacture of goods such as Coal, Gas, Fuel, Water, Power, Factory rent, Factory lighting etc.

DOCK CHARGES – These are charged by port authorities when unloading goods at a dock or wharf. Such charges paid in connection with goods purchased are considered direct expenses and are debited to Trading a/c.

IMPORT DUTY or CUSTOM DUTY – It is a tax collected on imports and specific exports by a country’s customs authorities. If import duty is paid on the import of goods, then they are shown on the Dr. side of the Trading A/c.

For example – Paid $15,000 as import duty for importing shirts for resale.

ROYALTY – Royalty refers to the amount paid for the use of assets belonging to another person. It includes royalty for the use of intangible assets, such as copyrights, trademarks, or franchisee agreements. It is also paid for the use of natural resources, such as mining leases.

Royalty is charged to the Trading A/c as it increases the cost of production.

GROSS PROFIT – When sales exceed the amount of purchases and the expenses directly connected with such purchases i.e. when Credit side> Debit side.

CREDIT SIDE OF TRADING A/C

SALES – When goods are sold to earn a profit, it is called sales. It can be cash sales or credit sales.

SALES RETURN – When the goods sold are returned by the customer, it is known as a sales return. Sales return is deducted from the sales.

CLOSING STOCK – The goods remaining unsold at the end of the year are termed as closing stock. It is valued at cost price or market price whichever is less.

GROSS LOSS – If purchases and direct expenses exceed sales, then it is a Gross loss. In other words, when Debit side > Credit side.

See less