A cheque that has been issued but yet not presented to the bank for payment is known as an unpresented cheque Generally what happens is when a cheque is issued to a party or say, creditor, the business immediately records them in the bank column of the cash book but the creditor might not present thRead more

A cheque that has been issued but yet not presented to the bank for payment is known as an unpresented cheque

Generally what happens is when a cheque is issued to a party or say, creditor, the business immediately records them in the bank column of the cash book but the creditor might not present them immediately to the bank for payment on the same date. The bank will only debit the account when it will be presented to it, therefore as long as the cheque remains unpresented there will be a difference in both the books i.e cash book and passbook.

Let me give you a short example of the above treatment

Suppose on 27th January, in the books of Mr. Shyam, the balance of the bank column as per the cash book is Rs 10,000. He received a cheque of Rs 5,000 from Mr. Hari, one of his debtors, which was sent to the bank for collection. The amount of the cheque was not collected by the bank until 31st January. Due to this, there arises a difference of Rs 5,000 in the cash book and pass book of Mr. Shyam.

Following will be the entry in Mr. Shyam cash book and passbook

In the books of Mr. Shaym

Cash book (bank column only)

| Date | Particulars | Bank (Rs) | Date | Particulars | Bank (Rs) |

| 27th Jan | To balance b/d | 10,000 | |||

| 27th Jan | To Hari | 5,000 | |||

| 31st Jan | By balance c/d | 15,000 | |||

| 15000 | 15000 |

Mr. Shyam

Bank Statement

| Date | Particulars | Debit (Withdraw) | Credit (Deposite) | Debit or Credit | Balance |

| 31st Jan | To balance b/d | credit | 10,000 |

How it is treated in the bank reconciliation statement?

There lies a temporary difference in both the books as the represented cheques will eventually be presented. Therefore we will not alter the cash book. The bank statement shows the greater amount of Rs 5,000 as compared to the cashbook, therefore we will debit the amount of unpresented cheque which will eventually make it balance to the level of bank statement.

See less

Capital Expenditure: Capital expenditure is the expenditure incurred by an entity or organization to acquire or purchase a fixed asset. This expenditure forms part of non-current assets. The fixed asset is not expensed at the time of purchase instead, it is depreciated or amortized over its useful lRead more

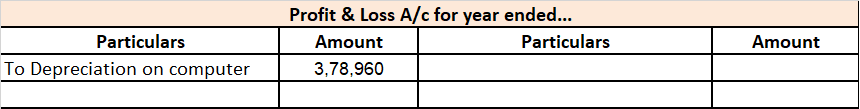

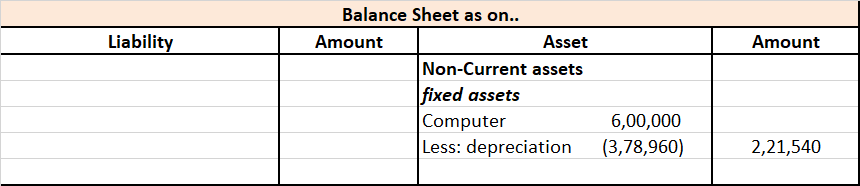

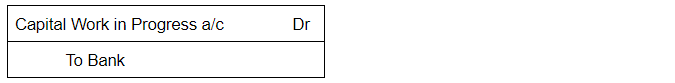

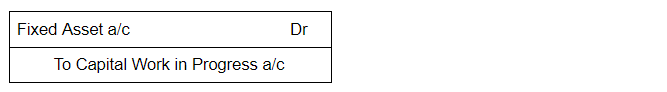

Capital Expenditure:

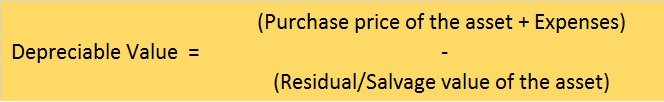

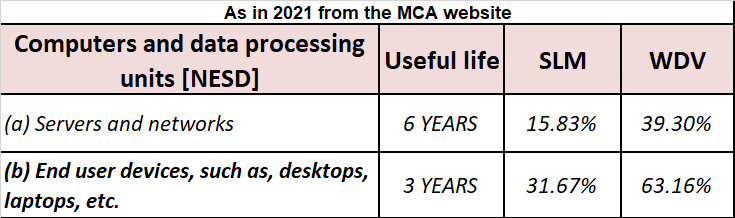

Capital expenditure is the expenditure incurred by an entity or organization to acquire or purchase a fixed asset. This expenditure forms part of non-current assets. The fixed asset is not expensed at the time of purchase instead, it is depreciated or amortized over its useful life.

Example of Capital Expenditure:

For example, XYZ Ltd purchased machinery worth $1,00,000 and its useful life is 10 years.

In this case, XYZ Ltd will capitalize the amount of machinery because it will be using it for more than one accounting year. Any asset used for more than one accounting year should be capitalized.

In the above example cost of the machine is given as $1,00,000 and at the time of installation company incurred a further expenditure of $10,000. Here, the company will add the amount of installation with the cost of machinery because the installation charge is a one-time expense. The total cost of the machine will be $1,10,000.

In the above example, after installation charges were incurred historic cost of the machine was $1,10,000. After a few years, the company made some improvements to the machine which amounted to $20,000 and the machine’s useful life was extended to more 5 years.

The improvement cost of $20,000 will be added to the historical cost of $1,10,000. The total amount of $1,30,000 ($1,10,000+$20,000) will be shown in the balance sheet.

Revenue Expenditure:

Revenue expenditure is expenditure incurred for the purpose of trade or to maintain non-current assets. These are short-term expenses and consumed within one accounting year and also known as operating expenses.

Examples of Revenue Expenditure:

For example, a company rented premises for business purposes and paid a monthly rent of $10,000. This expenditure of $10,000 incurred will fall under revenue expenditure because the company is incurring this expenditure monthly.

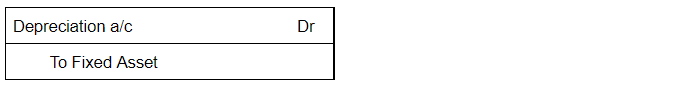

For example, a company purchased an asset worth $2,00,000 and charges 10% depreciation every year for 10 years. Since, the company will charge 10% depreciation every year it is recurring in nature and hence, should be considered as revenue expenditure.

For example, a manufacturing company orders stock of its raw material every quarter. Here, the company is going to reorder stock in every quarter and hence, this will be a revenue expenditure.

Capital expenditure can be capitalized as a part of non-current assets. Revenue expenditure cannot be capitalized and must be expensed in the statement of profit and loss.

See less