When a partnership firm decides to admit a new partner into their firm, the old partners have to forego a part of their share for the new partner. Therefore, sacrificing Ratio is the proportion in which the existing partners of a company give up a part of their share for the new partner. The partnerRead more

When a partnership firm decides to admit a new partner into their firm, the old partners have to forego a part of their share for the new partner. Therefore, sacrificing Ratio is the proportion in which the existing partners of a company give up a part of their share for the new partner. The partners can choose to forego their shares equally or in an agreed proportion.

Before admission of the new partner, the existing partners would be sharing their profits in the old ratio. Upon admission, the profit-sharing ratio would change to accommodate the new partner. This would give rise to the new ratio. Hence Sacrificing ratio formula can be calculated as:

Sacrificing Ratio = Old Ratio – New Ratio

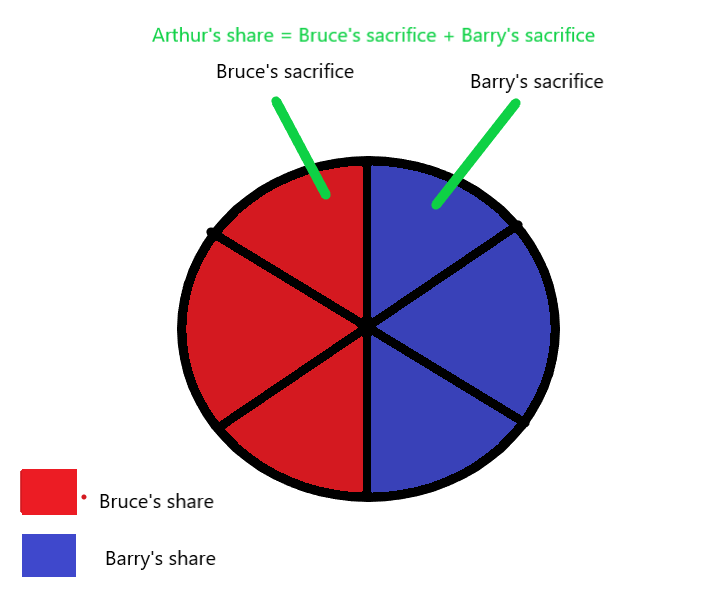

To further understand the formula, let’s say Bruce and Barry are sharing a pizza of 6 slices equally (3 slices each). They decide to share their pizza with Arthur such that they all get equal slices (2 slices each). Hence, we can use the formula to calculate their sacrifice as follows:

Bruce’s sacrifice = 3 – 2 = 1 slice

Barry’s sacrifice = 3 – 2 = 1 slice

Therefore, their sacrificing ratio = 1:1. In this same way, we can solve various problems to calculate the sacrifice of partners during a change in their profit sharing ratio.

For example, Joshua and Edwin are partners, sharing profits in the ratio 7:3. They admit Adam into their partnership such that the new profit-sharing ratio is 5:2:3. Therefore, their sacrificing ratio can be calculated as:

Joshua’s sacrifice = old share – new share = 7/10 – 5/10 = 2/10

Edwin’s sacrifice = old share – new share = 3/10 – 2/10 = 1/10

Hence, sacrificing ratio of Joshua and Edwin is 2:1. Once the denominators are equal, we ignore them and only consider numerators while showing sacrificing ratio.

See less

When a partnership firm consisting of some partners, decide to admit a new partner into their firm, they have to forego a part of their share for the new partner. Therefore, sacrificing Ratio is the proportion in which the existing partners of a company give up a part of their share to give to the nRead more

When a partnership firm consisting of some partners, decide to admit a new partner into their firm, they have to forego a part of their share for the new partner. Therefore, sacrificing Ratio is the proportion in which the existing partners of a company give up a part of their share to give to the new partner. The partners can choose to forego their shares equally or in an agreed proportion.

Before admission of the new partner, the existing partners would be sharing their profits in the old ratio. Upon admission, the profit-sharing ratio would change to accommodate the new partner. This would give rise to the new ratio. Hence Sacrificing ratio can be calculated as:

Sacrificing Ratio = Old Ratio – New Ratio

For example, Tony and Steve are partners in a firm, sharing profits in the ratio of 3:2. They decide to admit Bruce into the partnership such that the new profit-sharing ratio is 2:1:2. Now, to calculate the sacrificing ratio of Tony and Steve, we subtract their new share from their old share.

Tony’s Sacrifice = 3/5 – 2/5 = 1/5

Steve’s Sacrifice = 2/5 – 1/5 = 1/5

Therefore, the Sacrificing ratio of Tony and Steve is 1:1. This shows that Tony gave up 1/5th of his share while Steve also sacrificed 1/5th of his share.

Calculation of sacrificing ratio is important in a partnership as it helps in measuring that portion of the share of existing partners that have to be sacrificed. This ensures a smooth reconstitution of the partnership. Since the old partners are foregoing a part of their share in profits, the new partner has to bring in some amount as goodwill to compensate for their loss.

See less