A) No entries made at all in the general ledger for items paid by petty cash B) The same number of entries in the general ledger. C) Fewer entries made in the ...

Secondary books of accounts are most commonly known as subsidiary books of accounts or day books. They are prepared to record the same type of journals in an ordered manner in a special book. They are nothing, but special journals. Recording all the journals entries in a single journal and these posRead more

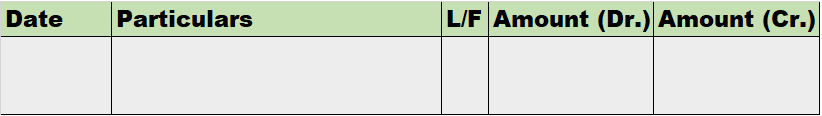

Secondary books of accounts are most commonly known as subsidiary books of accounts or day books. They are prepared to record the same type of journals in an ordered manner in a special book. They are nothing, but special journals.

Recording all the journals entries in a single journal and these posting them to different ledgers can be very difficult if the number of transactions is huge.

So, recording the same type of transactions in a special journal proves to be useful in efficient book-keeping and also information retrieval.

There are eight subsidiary books:

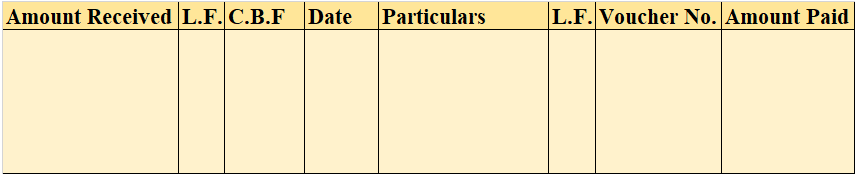

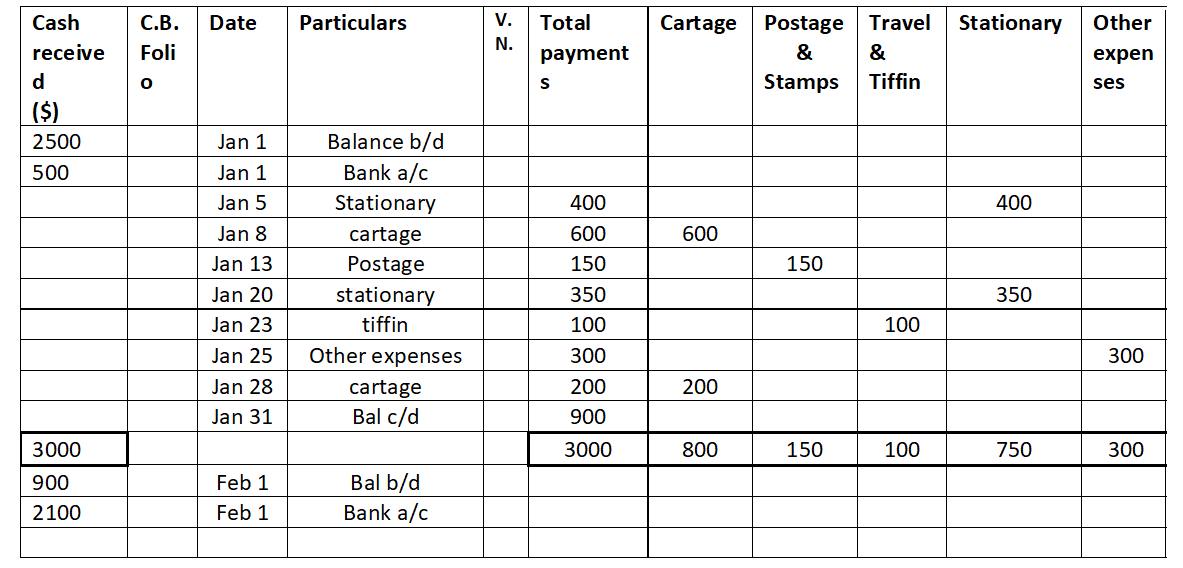

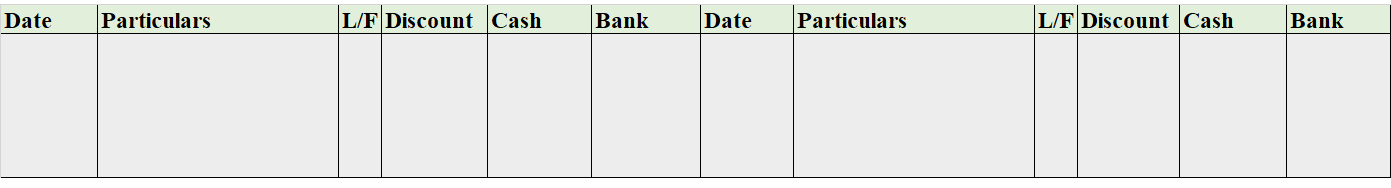

- Cashbook – It is three types. (a) Single column cash book – It records only cash receipts and cash payments. (b) Double column cash book – Apart from cash receipts and cash payments, it also records bank receipts and bank payments. (c) Triple column cash book – It additionally records the discount allowed and discount received.

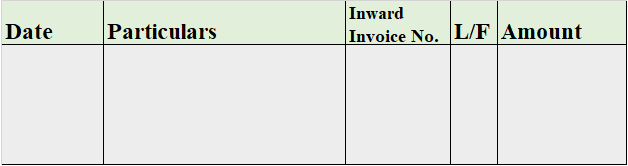

- Purchase book – It records all the credit purchases except the purchase of assets.

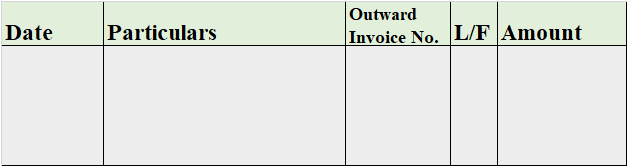

- Sales book – It records all the credit sales except the sale of assets.

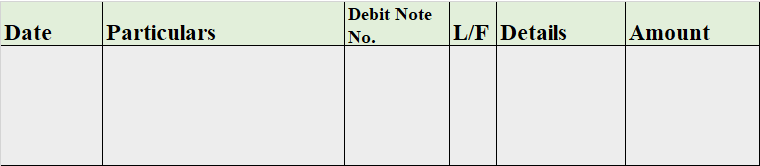

- Purchase return book – It records all the transactions related to the return of purchased goods.

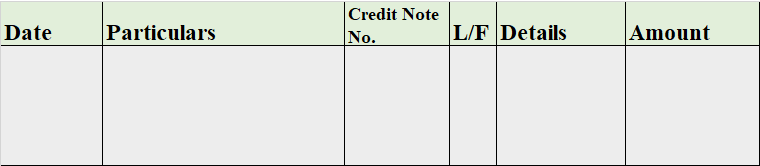

- Sale return book – It records all the transactions related to the return of goods from customers.

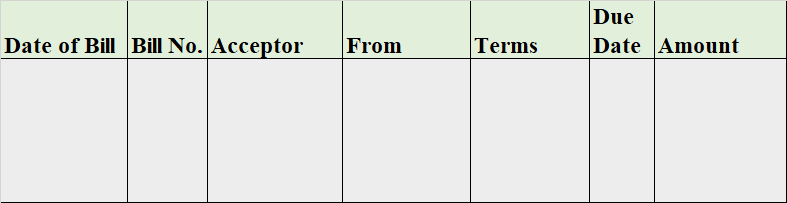

- Bills receivable book – It records the particulars of all the bills drawn in favour of the business.

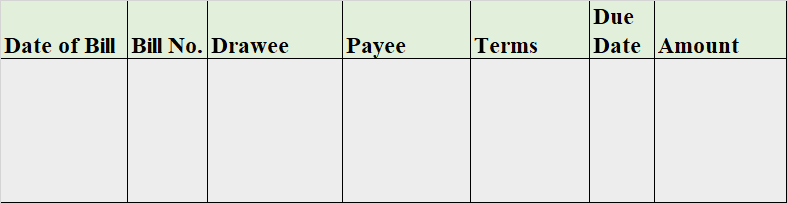

- Bills payable book – It records the particulars of all the bills drawn in the name of the business.

- Journal proper – It records those transactions which cannot be recorded in any of the above-mentioned books. For example, entry related to depreciation charged on assets.

Also, there are a few more things to know:-

- Subsidiary books may look like ledger accounts but they are not ledgers. Ledgers are books of final entry and subsidiary books can be said to be the book of intermediate entry and are not but special journals.

- Once transactions are recorded in the subsidiary books, they are then posted to the ledgers.

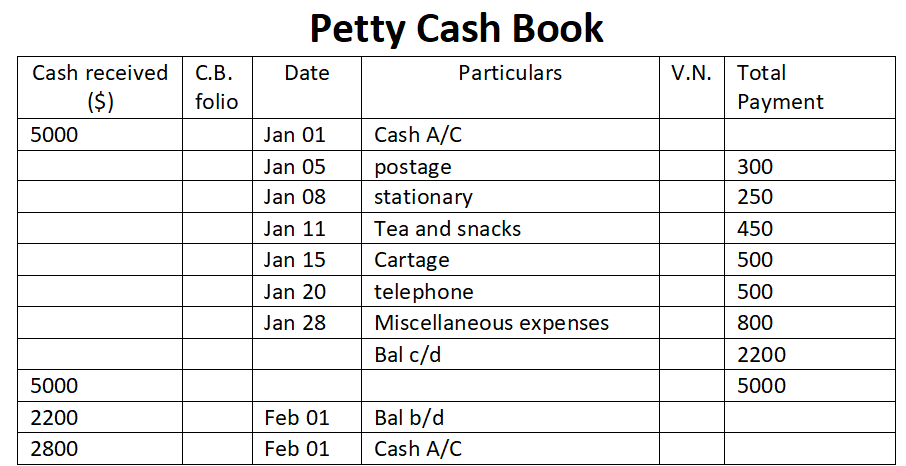

The correct option is D) Fewer entries in the general ledger To understand why option D is correct, we need to understand the concept. Petty cashbook is a special cashbook prepared for recording petty or small cash expenses. The benefit is that the chief cashier can focus on large cash and bank tranRead more

The correct option is D) Fewer entries in the general ledger

To understand why option D is correct, we need to understand the concept.

Option A ‘No entries made at all in the general ledger for items paid by petty cash ‘ is wrong. It is not possible to omit entries of petty expense just because there is a petty cashbook. There will be entries related to:

Petty cash A/c Dr. Amt

To Cash A/c Amt

Option (B) ‘The same number of entries in the general ledger is wrong because there can never be the same number of entries as all the petty expenses are recorded in the petty cashbook and only the entries for transfer of cash to the petty cashier is recorded in the main cash book.

Option D ‘More entries made in the general ledger’ is wrong because the number of entries actually reduce as only petty cash transfer entries are recorded in the main cashbook instead of numerous entries of petty cash transactions.

See less