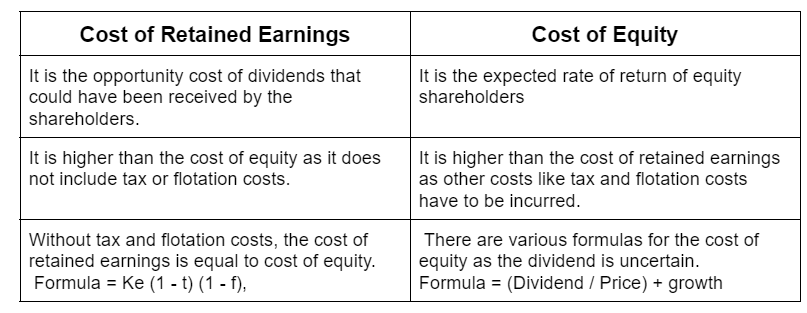

Retained earnings are kept with the company for growth instead of distributing dividends to the shareholders. Therefore the cost of retained earnings refers to its opportunity cost which is the cost of foregoing dividends by the shareholders. Therefore the cost of retained earnings is similar to theRead more

Retained earnings are kept with the company for growth instead of distributing dividends to the shareholders. Therefore the cost of retained earnings refers to its opportunity cost which is the cost of foregoing dividends by the shareholders.

Therefore the cost of retained earnings is similar to the cost of equity without tax and flotation cost. Hence, it can be calculated as

Kr = Ke (1 – t) (1 – f),

Kr = Cost of retained earnings

Ke = Cost of equity

t = tax rate

f = flotation cost

Here, flotation cost means the cost of issuing shares.

EXAMPLE

If cost of equity of a company was 10%, tax rate was 30% and flotation cost was 5%, then

cost of retained earnings = 10% x (1 – 0.30)(1 – 0.05) = 6.65%.

From the above example and formula, it is clear that the cost of retained earnings would always be less than or equal to the cost of equity since retained earnings do not involve flotation costs or tax.

A company usually acquires funds from various sources of finance rather than a single source. Therefore the cost of capital of the company will be the weighted average cost of capital (WACC) of each individual source of finance. The cost of retained earnings is thus an important factor in calculating the overall cost of capital.

Another important factor of WACC is the cost of equity. The cost of equity is sometimes interchanged with the cost of retained earnings. However, they are not the same.

See less

Prepaid Payable Prepaid payable or prepaid expenses refer to the future expenses that have been paid in advance. It is an advance payment made by the business for the goods and services to be received by the business in the future. A prepaid expense is an asset on the balance sheet. The number of prRead more

Prepaid Payable

Prepaid payable or prepaid expenses refer to the future expenses that have been paid in advance. It is an advance payment made by the business for the goods and services to be received by the business in the future.

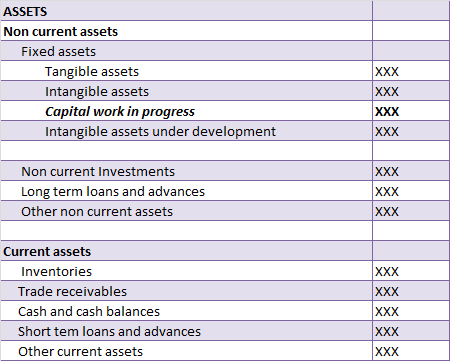

A prepaid expense is an asset on the balance sheet. The number of prepaid expenses that will be used up within one year is reported on a company’s balance sheet as a current asset. According to generally accepted accounting principles (GAAP), expenses should be recorded in the same accounting period as the benefit generated from the related asset.

Example

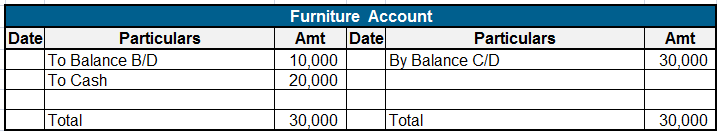

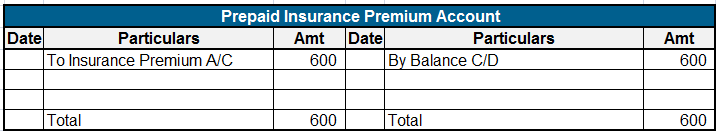

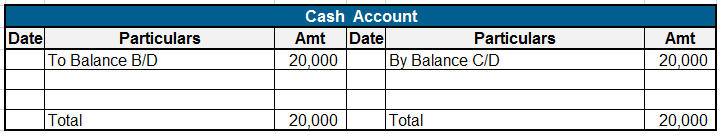

ABC Ltd. purchases insurance for the warehouse. It was ₹2,000 per month. The company pays ₹24,000 in cash upfront for a 12-month insurance policy for the warehouse. Each month an adjusting journal entry will be passed, adjusting the amount of insurance used from the prepaid insurance.

Journal Entry-

Prepaid Expenses in Balance Sheet-

Prepaid expenses are shown in the balance sheet under the current assets heading as it’s a short-term asset and to be consumed within one accounting year.

Balance Sheet (for the year ending…)

See less