Shareholders are the entities that hold some amount or number of shares of a company. As we know that ownership of a company is divided into its shares, a shareholder is actually a part-owner of a company. By entity, it means a shareholder may be: An individual Any other company Any other incorporatRead more

Shareholders are the entities that hold some amount or number of shares of a company. As we know that ownership of a company is divided into its shares, a shareholder is actually a part-owner of a company.

By entity, it means a shareholder may be:

- An individual

- Any other company

- Any other incorporated entity

- Cooperative society

- BOI( Body of Individuals)

- AOP(Association of Persons)

- Artificial Juridical Person

The rights of shareholders depend on the type of shareholder one is.

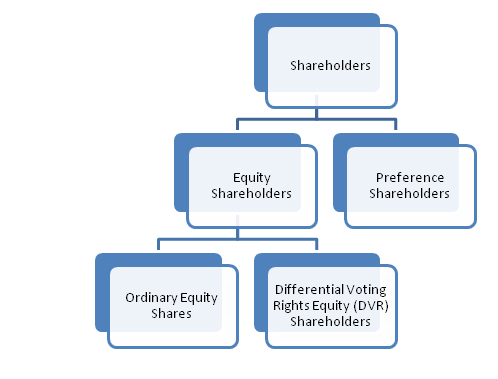

Types of shareholders

1. Equity Shareholders: By the term ‘shareholders’ we usually mean equity shareholders. They are permanent in nature i.e. they are not repaid the money they have invested into the company until the company is liquidated or wound up. Equity shareholders have the following rights:

- Right to have a share in profits made by the company. The profit made by a company, when distributed to its equity shareholders is known as a dividend.

- Right to vote on all resolutions to be passed in the Annual General Meeting of a company.

- Right to get repaid in event of winding up of the company. However, they are paid after meeting the obligations of outsiders and of preference shareholders.

- Right to transfer ownership of the shares. A shareholder may sell its shares to some willing buyer and cease to be a shareholder of a company.

2. Preference Shareholders: They are shareholders who are given preference regarding:

- Dividend

- Repayment at time of winding up

Unlike equity shareholders, they are not of permanent nature. Preference shares are redeemable i.e. they are to be repaid after a period which cannot be more than 20 years from the date of allotment of such shares (as the Companies Act, 2013). Also, a company cannot issue irredeemable preference shares. The rights of preference shareholders are as follows:-

- By preference as to dividend, it means preference shareholders have the right to receive a fixed dividend as a certain percentage on the nominal value of the share and that too before equity shareholders are paid.

- Right to get repaid at the date of redemption.

- If the company get liquidated before redemption of the preference shareholder, then they have the right to get repaid before equity shareholders.

3. Differential Voting Rights Shareholders: These shareholders hold equity shares but with differential, right as to voting i.e. they may either have less voting rights or more voting right as compared to ordinary equity shares. Generally, DVR shares carry less voting power.

For example, a DVR shareholder gets 1 vote for 10 shares whereas an ordinary equity shareholder gets 10 votes for 10 shares i.e. one vote for every share. DVR shares issued to raise not only permanent capital but also prevent dilution of voting rights.

The rest of the right remains the same as the equity shareholders.

See less

Meaning The term ‘Sundry creditors’ consist of two words: ‘Sundry’ and ‘creditors’. The word ‘sundry’ means the items which are not significant enough to be named separately. It also refers to a collection of miscellaneous items. Creditors are the person from whom money is borrowed or goods are puRead more

Meaning

The term ‘Sundry creditors’ consist of two words: ‘Sundry’ and ‘creditors’.

The word ‘sundry’ means the items which are not significant enough to be named separately. It also refers to a collection of miscellaneous items.

Creditors are the person from whom money is borrowed or goods are purchased on credit by a business or a non-business entity. They have to be repaid after a period of time which is usually less than or up to one year.

By combining the meaning of both words, ’sundry’ and ‘creditor’, the term ‘sundry creditor’ will refer to the collection of insignificant creditors of an entity.

Back in the days when accounting records were maintained on paper, only the records of those creditors were maintained separately, from whom goods are purchased regularly and in large amounts.

But there used to be numerous other creditors with whom the transactions were occasional and insignificant. To reduce the paperwork, records of all such creditors were maintained on a single page or book under the head ‘Sundry Creditors’

Nowadays, as accounting records are maintained digitally, hence maintaining records of each and every creditor is not a problem.

Hence, every creditor whether small or big, is grouped under the head ‘Sundry creditor’ or ‘Trade Creditor’.

Accounting Treatment

Sundry creditors are the persons to whom a business owes money.

Hence, as per golden rules of accounting, Sundry creditor is a personal account and the golden rule for personal account is, ‘Debit the receiver and credit the giver’

We know sundry creditors are liabilities, hence, as per modern rule of accounting, sundry creditors are credited in case of increase and debited in case of decrease.

Example, a business purchased goods for Rs. 10,000 from ABC & Co. The journal entry will as follows:

Here, ABC & Co is the creditor. It is credited as it is a personal account and the creditor has given the goods to the business, hence the giver is credited.

From point of view of modern rules of accounting, ABC & Co. is a creditor, a liability. On purchase of goods on credit, a liability is created. Hence, ABC & Co A/c is credited.

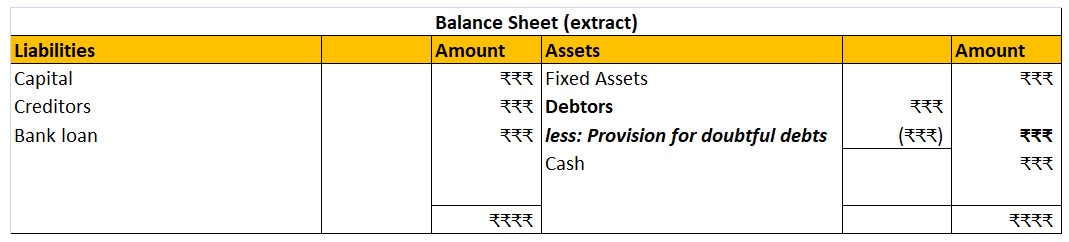

Balance sheet

Sundry creditor is a current liability, so it is shown on the liabilities side of a balance sheet. Trade payable and accounts payable mean sundry creditors only.

See less