The term ‘contra’ means opposite or against. In financial accounting, we encounter the term ‘contra’ in: Contra accounts Contra entries The meaning of contra in the above mention terms is also the same as their general meaning. Contra accounts mean the account which is opposite of the account it corRead more

The term ‘contra’ means opposite or against. In financial accounting, we encounter the term ‘contra’ in:

- Contra accounts

- Contra entries

The meaning of contra in the above mention terms is also the same as their general meaning. Contra accounts mean the account which is opposite of the account it corresponds to.

Contra entries are entries of the debit and credit aspects related to the same parent account. Let’s discuss them in detail.

Contra accounts

Any account which is created with the purpose of reducing or offsetting the balance of another account is known as a contra account.

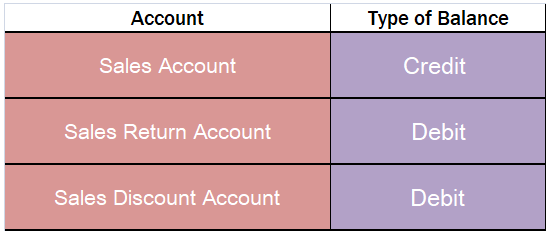

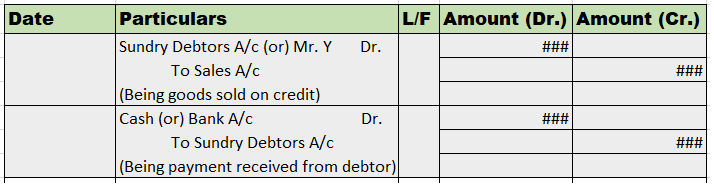

A contra account is just the opposite of the account to which it relates. The most common examples are the sales discount account and sales return account which is the contra account of the sales account. They are just the opposite of the sales accounts.

Contra Entries

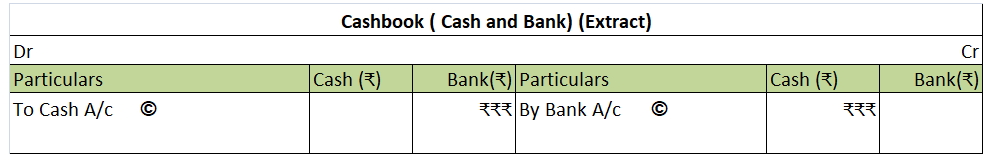

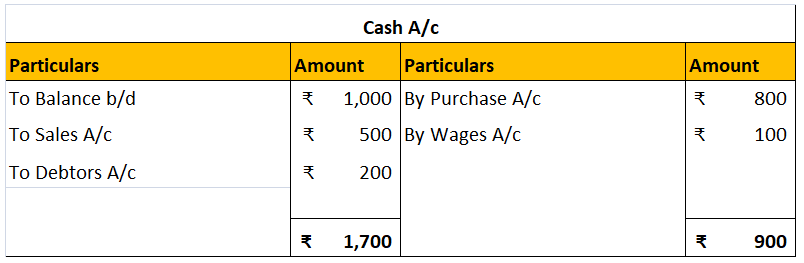

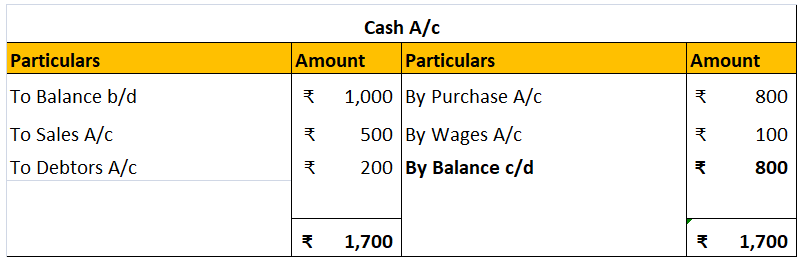

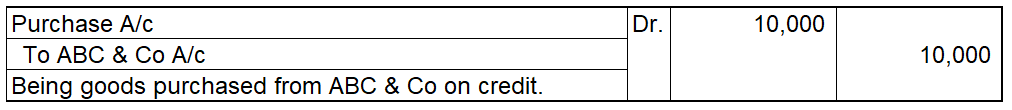

Contra entries refer to the entries which show the movement of the amount within the same parent account. Here, the debit and credit entry is posted on the debit and credit side respectively of a single parent account. Mainly, contra entries are the entries involving cash and bank accounts.

The following transactions are recorded as contra entries:

- Cash to Bank transactions: Deposit of cash into the bank account by the entity.

- Bank to Cash transactions: Withdrawal of cash from the bank.

- Cash to cash transactions: Transfer of cash to the petty cash account.

- Bank to Bank transactions: Transfer of amounts from one bank account to other bank accounts of the same entity.

Contra entries are marked by the letter ‘C’ beside the postings in the ledger. Deposit of cash in to bank will be posted in cashbook as below:

What is Impairment of Assets? Impairment of assets means a decline in the value of assets due to unforeseen circumstances. Assets are impaired when the carrying value of assets increases its market value or “realizable value”. Impairment can be caused due to factors that are internal or external toRead more

What is Impairment of Assets?

Impairment of assets means a decline in the value of assets due to unforeseen circumstances. Assets are impaired when the carrying value of assets increases its market value or “realizable value”.

Impairment can be caused due to factors that are internal or external to the firm. Internal factors such as physical damage, obsolescence or poor management and external factors such as a change in legal or economic circumstances, increased competition or reduction in asset’s fair value in the market result in impairment.

Impairment Vs Depreciation

Asset impairment is often confused with asset depreciation, which is rather a recurring and expected event, unlike impairment that reflects an abrupt decrease in the value of the asset.

Impairment Loss

Impairment is always treated as a loss in accounting. It is the amount by which the carrying value or the asset’s book value exceeds its fair market value.

Before recording Impairment loss, a company must determine the recoverable value of the asset which is higher of the asset’s net realizable value or value in use. Then it is to be compared with the book value of the asset.

If the carrying value exceeds the recoverable value then the impairment loss is to be recorded at the exceeding value i.e. difference of carrying value and realizable value.

Example

Suppose a company Royal Ltd. has an asset with a carrying value of 50,000, which has suffered physical damage. According to the company’s calculation, the asset has a net realizable value of 30,000 and a value in use of 25,000.

Then, the recoverable value would be higher of the asset’s net realizable value or value in use, i.e., 30,000 which is still lower than the carrying amount of 50,000. Therefore, Royal ltd. will have to record 20,000 (50,000-30,000) as impairment loss.

This is will increase Royal Ltd’s expenses by 20,000 and decrease the asset’s value by the same amount.

See less