Generally, Assets are classified into two types. Non-Current Assets Current Assets Non-Current Asset Noncurrent assets are also known as Fixed assets. These assets are an organization's long-term investments that are not easily converted to cash or are not expected to become cash within an acRead more

Generally, Assets are classified into two types.

- Non-Current Assets

- Current Assets

Non-Current Asset

Noncurrent assets are also known as Fixed assets. These assets are an organization’s long-term investments that are not easily converted to cash or are not expected to become cash within an accounting year.

In general terms, In accounting, fixed assets are assets that cannot be converted into cash immediately. They are primarily tangible assets used in production having a useful life of more than one accounting period. Unlike current assets or liquid assets, fixed assets are for the purpose of deriving long-term benefits.

Unlike other assets, fixed assets are written off differently as they provide long-term income. They are also called “long-lived assets” or “Property Plant & Equipment”.

Examples of Fixed Assets

- Land

- Land improvement (e.g. irrigation)

- Building

- Building (work in progress)

- Machinery

- Vehicles

- Furniture

- Computer hardware

- Computer software

- Office equipment

- Leasehold improvements (e.g. air conditioning)

- Intangible assets like trademarks, patents, goodwill, etc. (non-current assets)

Valuation of Fixed asset

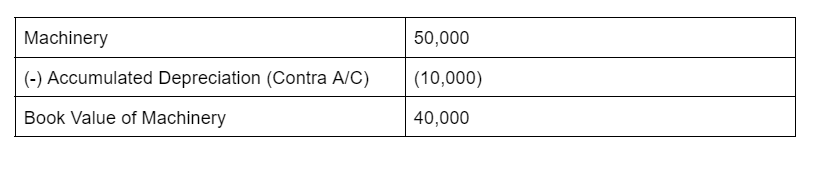

fixed assets are recorded at their net book value, which is the difference between the “historical cost of the asset” and “accumulated depreciation”.

“Net book value = Historical cost of the asset – Accumulated depreciation”

Example:

Hasley Co. purchases Furniture for their company at a price of 1,00,000. The Furniture has a constant depreciation of 10,000 per year. So, after 5 years, the net book value of the computer will be recorded as

1,00,000 – (5 x 10,000) = 50,000.

Therefore, the furniture value should be shown as 50,000 on the balance sheet.

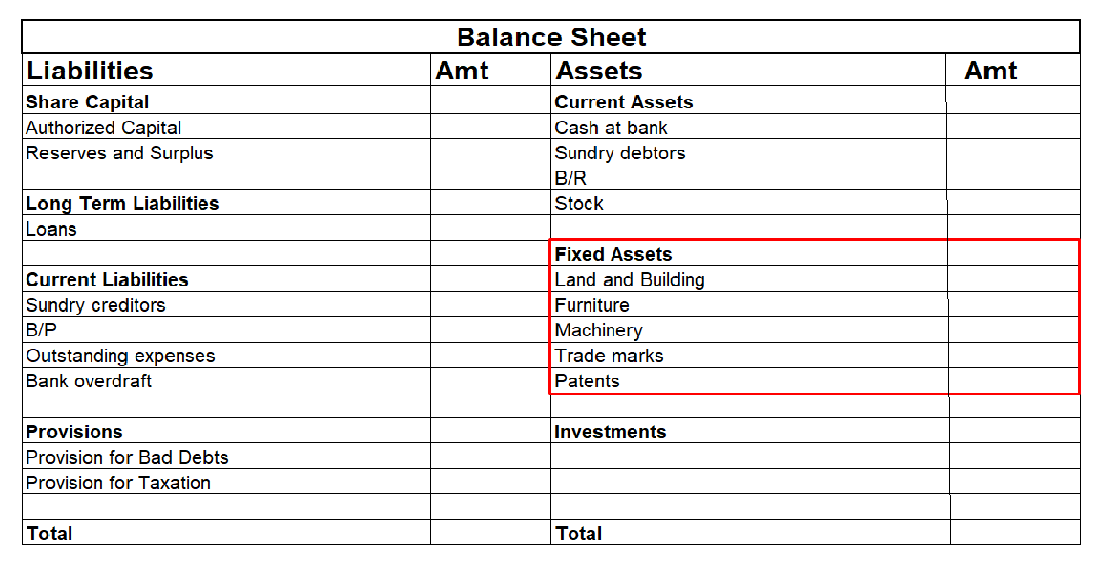

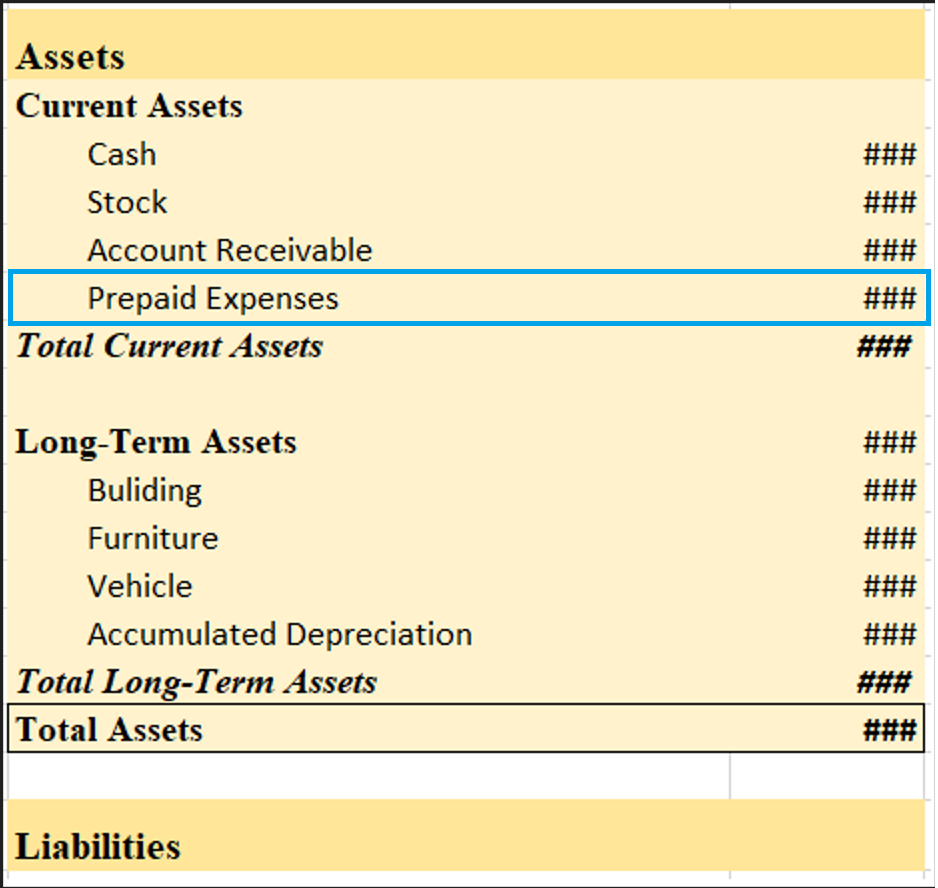

Presentation in the Balance Sheet

Both current assets and non-current assets are shown on the asset side(Right side) of the balance sheet.

Difference between Current Asset and Non-Current Asset

Current assets are the resources held for a short period of time and are mainly used for trading purposes whereas Fixed assets are assets that last for a long time and are acquired for continuous use by an entity.

The purpose to spend on fixed assets is to generate income over the long term and the purpose of the current assets is to spend on fixed assets to generate income over the long term.

At the time of the sale of fixed assets, there is a capital gain or capital loss but at the time of the sale of current assets, there is an operating gain or operating loss.

The main difference between the fixed asset and current asset is, although both are shown in the balance sheet fixed assets are depreciated every year and it is valued by (the cost of the asset – depreciation) and current asset is valued as per their current market value or cost value, whichever is lower.

See less

The term ‘contra’ means opposite or against. In financial accounting, we encounter the term ‘contra’ in: Contra accounts Contra entries The meaning of contra in the above mention terms is also the same as their general meaning. Contra accounts mean the account which is opposite of the account it corRead more

The term ‘contra’ means opposite or against. In financial accounting, we encounter the term ‘contra’ in:

The meaning of contra in the above mention terms is also the same as their general meaning. Contra accounts mean the account which is opposite of the account it corresponds to.

Contra entries are entries of the debit and credit aspects related to the same parent account. Let’s discuss them in detail.

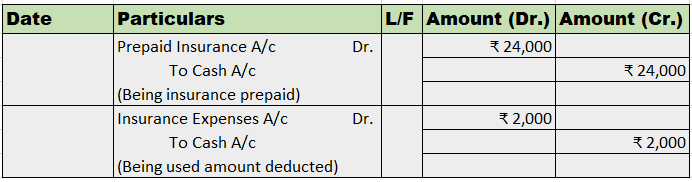

Contra accounts

Any account which is created with the purpose of reducing or offsetting the balance of another account is known as a contra account.

A contra account is just the opposite of the account to which it relates. The most common examples are the sales discount account and sales return account which is the contra account of the sales account. They are just the opposite of the sales accounts.

Contra Entries

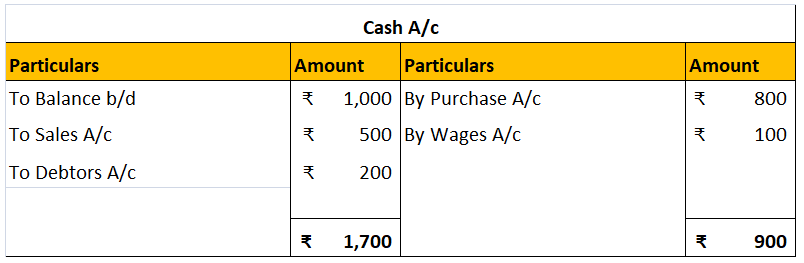

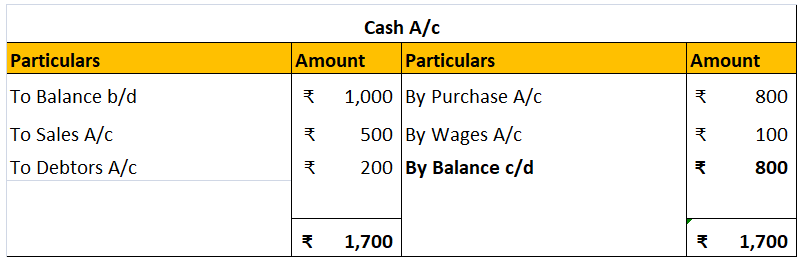

Contra entries refer to the entries which show the movement of the amount within the same parent account. Here, the debit and credit entry is posted on the debit and credit side respectively of a single parent account. Mainly, contra entries are the entries involving cash and bank accounts.

The following transactions are recorded as contra entries:

Contra entries are marked by the letter ‘C’ beside the postings in the ledger. Deposit of cash in to bank will be posted in cashbook as below:

See less