Capital maintenance is a principle that states profit should not be recorded until its cost or capital has been maintained. In other words, profit should not be recognized unless net assets have been maintained. Capital maintenance states that profit recognized is the increase in the value of net asRead more

Capital maintenance is a principle that states profit should not be recorded until its cost or capital has been maintained. In other words, profit should not be recognized unless net assets have been maintained.

Capital maintenance states that profit recognized is the increase in the value of net assets. However, there are two exceptions to it:

- Cash increased because of sale of stock to shareholders

- Cash decreased because of dividend payout to its shareholders

It is important because:

- It protects the interest of shareholders

- It protects the interest of creditors

- Accurately analyzing the performance of the company

Capital maintenance is of two types:

- Financial Capital Maintenance

It is measured by the value of assets at the beginning and end of the financial year.

- Physical Capital Maintenance

It is measured by the production capacity at the beginning and end of the financial year.

Capital maintenance is concerned with keeping proper account balances of assets and not the physical assets.

Inflation is the increase in the economic value of goods due to the lower purchasing power and not an actual increase in the value of assets. So, if the value of an asset is increased due to inflation it does not depict the right picture for the company.

Hence, if the value of assets increases due to inflation, companies need to adjust the value of assets to assess if capital maintenance has occurred.

See less

Realization is an important principle in accounting. It is the basis of revenue recognition and it gives to accrual accounting. When we used the word realization, it is usually regarding revenue recognition. Realization of revenue means when revenue to be earned from the sale of goods or rendering oRead more

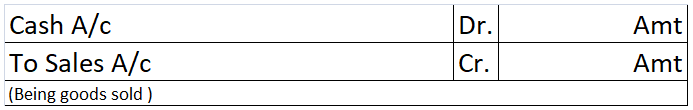

Realization is an important principle in accounting. It is the basis of revenue recognition and it gives to accrual accounting. When we used the word realization, it is usually regarding revenue recognition.

Realization of revenue means when revenue to be earned from the sale of goods or rendering of services or any other activity or source becomes absolute and certain. An item is to be shown as revenue in the books of accounts only after it is realized.

Realization in case of sale of goods

Realization occurs in the following situations:

i) When the goods are delivered to the customer for a certain price

ii) All significant risks and rewards of ownership have been transferred to the customer and the seller retains no effective control over the goods.

Let’s take an example. Mr Peter received an order of 500 units of goods from Mr Parker on 1st April. The goods were delivered to Mr Parker on 15Th April and payment for goods was received on 30Th April.

The realization of revenue from the sale of goods will be considered to have occurred on 15th April because the goods were delivered to the customer on that date. The entry of sale of goods will be entered on this day.

Realization is not considered to have occurred on 1st April i.e the date of order because the seller had effective control on goods on that date.

Realization in case of rendering of services

The realization of revenue from the rendering of services occurs as per the performance of service.

Now there arise two situations:

Realization of income from other sources:

Realization with regards to other sources of income is considered to have occurred only when there exist no significant uncertainty as to measurability or collectability.

See less