Every business requires research and development to create innovative products for consumers. More innovative and creative products and services are more popular among customers, leading to increased revenue and profits for the business. Creating new products or designing changes and testing existinRead more

Every business requires research and development to create innovative products for consumers. More innovative and creative products and services are more popular among customers, leading to increased revenue and profits for the business.

Creating new products or designing changes and testing existing products also forms a part of research and development.

Examples of Research and Development costs are –

- Salaries of employees

- Cost of making prototypes

- Cost of raw material

- Overhead expenses

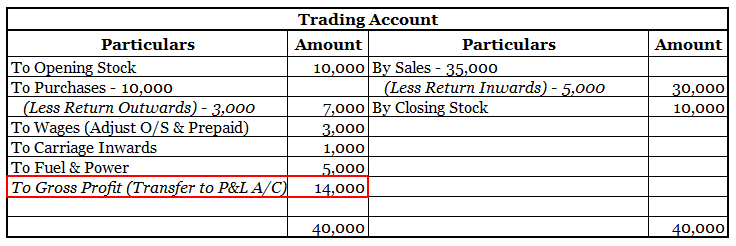

Let us now understand how research and development costs are treated in Financial Statements.

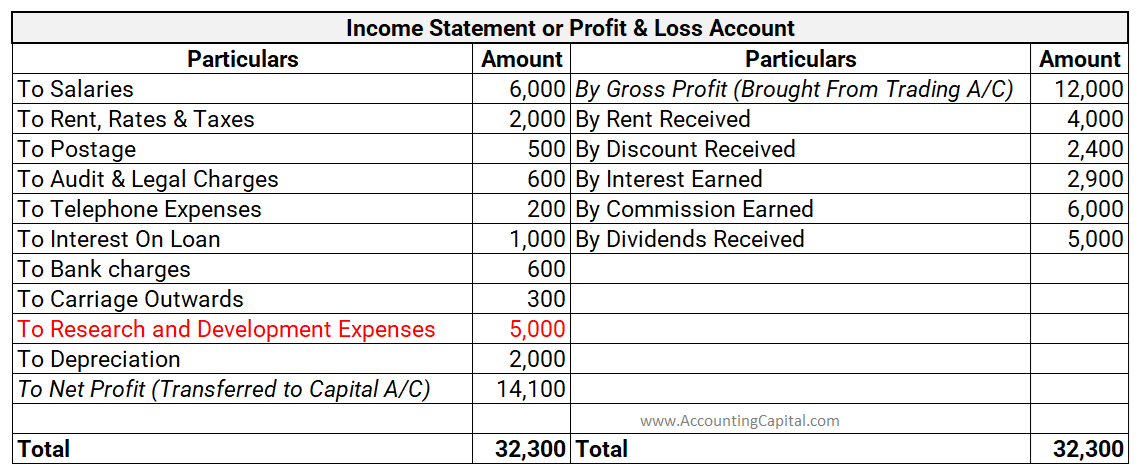

Research and Development Costs are generally shown as an expense in the Income Statement.

IAS-38

IAS-38 majorly governs the accounting of research and development costs. There are two phases in R&D:

- Research: During this phase, costs are incurred for understanding or designing the product. These costs are expensed as incurred costs as there is an uncertainty of a future benefit.

- Development: Economic value can be ascertained during this phase and hence, the costs incurred can be capitalized as Intangible assets. To be recognised as intangible assets, the following conditions shall be satisfied:

1. it is developed with the intention of putting it to use in the future

2. the asset shall hold an economic value

3. the costs can be measured reliably

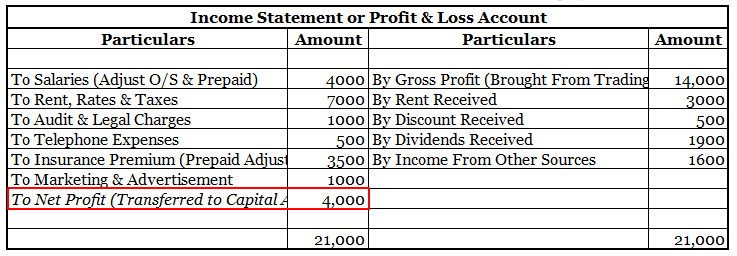

Treatment of R&D costs in the Financial statements:

-

- Income statement: Research costs are shown as expenses in the income statement. However, development costs if capitalized as intangible assets can be amortised over time.

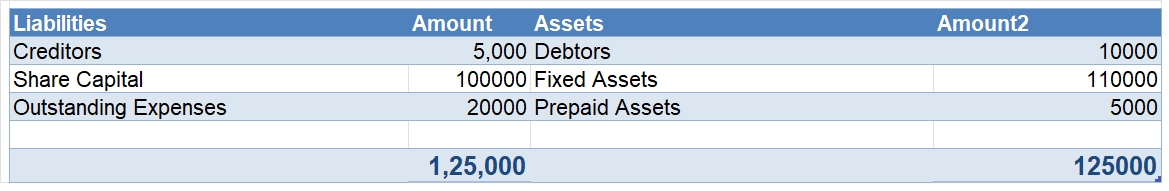

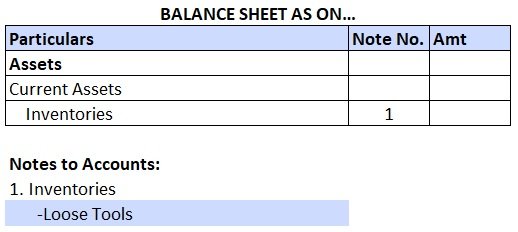

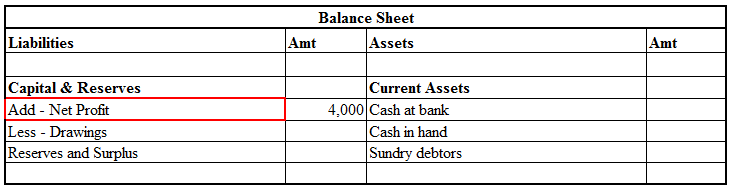

- Balance Sheet: Capitalised development costs are shown as intangible assets under the Assets head of the Balance Sheet.

Conclusion

The above discussion can be summarised as follows:

- Research and development is essential for creating innovative and creative products and services.

- Accounting standard IAS-38 governs the accounting for Research and Development.

- Research costs are usually shown as an expense in the Income statement of the business.

- Development costs when capitalised can be shown as Intangible assets in the Balance Sheet.

Introduction A capital reduction account is an account used to pass entries related to the internal reconstruction of a company. During reconstruction, paid-up capital reduced is credited to this account; hence its name is capital reduction account. It is also known as the reconstruction account. TyRead more

Introduction

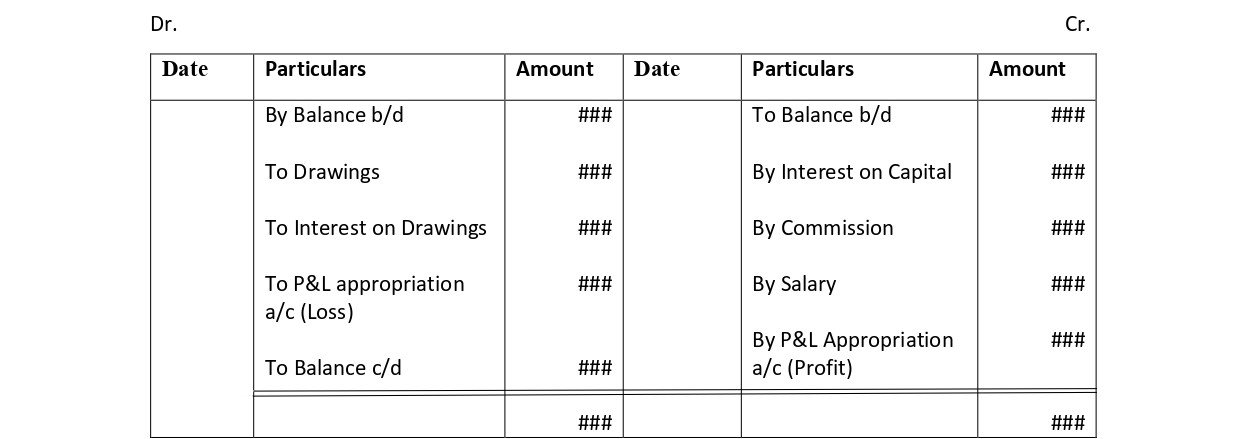

A capital reduction account is an account used to pass entries related to the internal reconstruction of a company. During reconstruction, paid-up capital reduced is credited to this account; hence its name is capital reduction account. It is also known as the reconstruction account.

Type of account

A capital reduction account is a temporary account open just to carry out internal reconstruction. It represents the sacrifices made by the shareholders, debenture holders and creditors. Also, any appreciation in the value of assets is credited to this account. It is closed to capital reduction when internal reconstruction is completed.

Entries passed through capital reduction account

When paid-up capital is cancelled.

When paid-up capital is cancelled, the share capital account is debited and the capital reduction account is debited as share capital is getting reduced.

When assets and liabilities are revalued

At the time of internal reconstruction, the gain or loss on revaluation is transferred to the capital reduction account instead of the revaluation reserve.

Writing off of accumulated losses and intangible assets

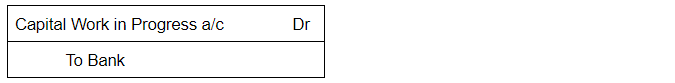

The credit balance of the capital reduction account is used to write off the accumulated losses and intangible assets like goodwill, patents etc which are unrepresented by capital. The capital reduction account is debited and profit and loss account and intangible assets accounts are credited.

Treatment in books of account

The balance in the capital reduction account, whether debit or credit, it is transferred to the capital reduction account. Hence, it doesn’t appear on the balance sheet.

See less