Outstanding expenses are those expenses that have been incurred during the accounting period but are yet to be paid. Basically, any expense which has become due for payment but is not paid will be called an outstanding expense. Outstanding expenses are treated as a liability as the business is yet tRead more

Outstanding expenses are those expenses that have been incurred during the accounting period but are yet to be paid. Basically, any expense which has become due for payment but is not paid will be called an outstanding expense.

Outstanding expenses are treated as a liability as the business is yet to make payment against them. Examples of outstanding expenses include outstanding rent, salary, wages, etc.

At the end of the accounting year, outstanding expenses have to be accounted for in the book of accounts so that the financial statements reflect the accurate profit/loss of the business.

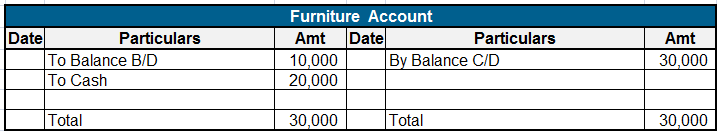

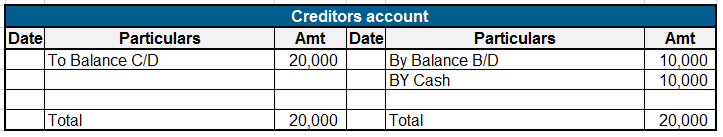

Journal entry for recording outstanding expenses:

| Expense A/c | Debit |

| To Outstanding Expenses A/c | Credit |

| (Being expenses outstanding at the end of the year) |

The concerned expense A/c is debited as there is an increase in expenses. Outstanding expenses are a liability, hence they are credited.

Let me give you a simple example,

Max, a sole proprietor pays 1,00,000 as salary for his employees at the end of every month. Due to the Covid-19 lockdown, he could not pay his employees’ salaries for March month. So the salary for March (1,00,000) will be treated as an outstanding expense. The following entry is made to record outstanding salaries for the year.

| Salary A/c | 1,00,000 |

| To Outstanding Salaries A/c | 1,00,000 |

| (Being salaries outstanding at the end of the year) |

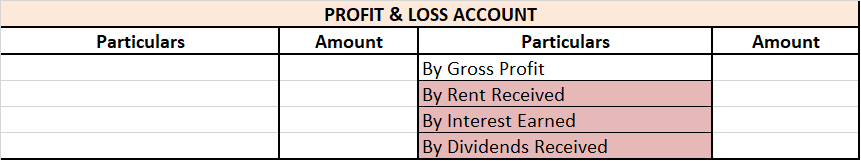

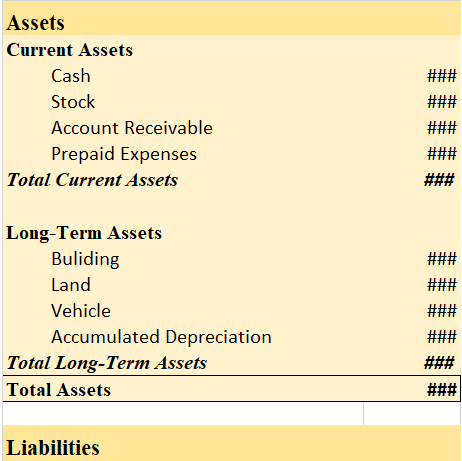

At the end of the year, outstanding salary will be adjusted in the P&L A/c and it will be shown as a Current Liability in the Balance Sheet.

See less

Brands can be considered as an Intangible asset as they are a long-term investment done by the company and it gives benefit to an entity in future periods. Like any other intangible asset, brands require long-term investment and will pay over time. Like any other asset, these brands can be bought anRead more

Brands can be considered as an Intangible asset as they are a long-term investment done by the company and it gives benefit to an entity in future periods.

Like any other intangible asset, brands require long-term investment and will pay over time. Like any other asset, these brands can be bought and sold. Brands are best used when they serve the vision and mission of the company.

So, we can definitely consider an organization brand as an intangible as it is expected to increase sales volume in the future period.

Further, we can understand both terms to get a deep understanding-

BRAND

Brand means a product, or service which has a unique identification and can be distinct from other products in the market. Branding is a process by which expenditure is incurred by an entity to create awareness towards the product in the customer’s eyes.

For example- Maggie, Coca-Cola, BMW

Brands can be created through these elements-

INTANGIBLE ASSETS

Intangible asset are assets that can’t be seen or touched but the benefit of it occur in future periods for the entity. Even though intangible assets have no physical form but their benefits will accrue in future years. Businesses commonly hold intangible assets. Intangible assets can be further bifurcated in

Definite– Intangible assets that stay and give benefit for a limited or specific period of time covered under this

For example- An agreement is entered with an entity to patent a product for 5 years so this will stay for a definite period only

Indefinite– Intangible assets that stay and give benefit for an unlimited period of time covered under this

For example- A brand which is made by an entity will stay for an indefinite period

Intangible assets can be in various forms these are the following –

Trademark– A trademark is a sign, design, and expression that distinguish the company’s product or services from other company. Trademark is considered an Intellectual Property Right.

Goodwill– Goodwill refers to the value of the company that the company gets from its brand, customer base, and brand Reputation associated with its intellectual property.

Patents– A patent refers to a right reserved for a product exclusively by a person or entity. Under this the right of such making of the product gets reserved by the company and other person or entity can’t make this product.

Copyright– Copyright refers to an intellectual property right that protects the work of the original owner from being copied by some other person.

Brand– Brand means a product, or service that has a unique identification and can be distinct from other products in market

So, we can definitely consider that brand is a subpart of an intangible asset and can be considered as an intangible asset as it also can’t be touched or seen. Still, its benefit will accrue till future time. These both help an entity to grow its business till the future

See less