Plant and Machinery are the equipment attached to the earth that supports the manufacturing of the company or its operations. These are tangible non-current assets to the company and as a result, have a debit balance. Depreciation is the decrease in the value of an asset that is spread over the expeRead more

Plant and Machinery are the equipment attached to the earth that supports the manufacturing of the company or its operations. These are tangible non-current assets to the company and as a result, have a debit balance.

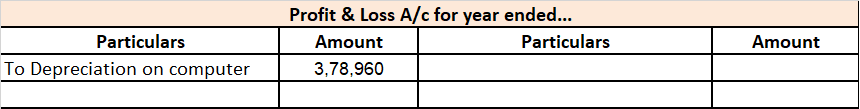

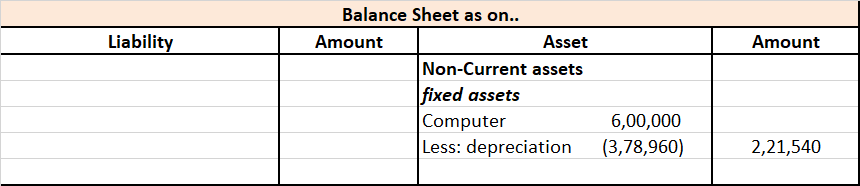

Depreciation is the decrease in the value of an asset that is spread over the expected life of the asset. Not depreciating an asset presents a false image of the company as the asset is recorded at a higher value and profit is overstated as depreciation expense is not provided for.

There are two ways that a company provide depreciation:

- By reducing the balance of an asset in the Asset Account by passing a journal entry.

- By maintaining a separate account for depreciation called Accumulated Depreciation A/c. The nature of this account is naturally credit since it is created to reduce the value of an asset.

For most of the depreciation methods, we need a rate to provide for depreciation every year. Now, for accounting purposes, the management can use a rate they think is suitable depending on the use and expected life of the machinery.

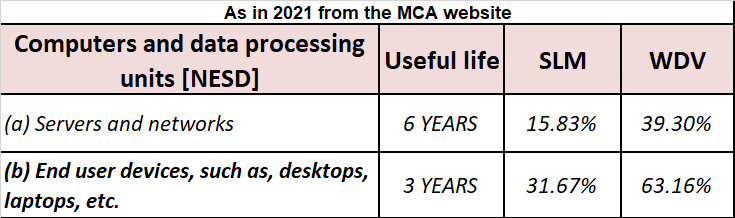

Depreciation is calculated on the basis of the Companies act, 2013 for the purpose of book-keeping. According to Schedule 2 of the Companies Act, depreciation on plant and machinery is calculated on the basis of either SLM or WDV.

Plant and machinery for those special rates are not assigned useful life is considered to be 15 years and depreciation is calculated @ 18.10% on WDV and @6.33% on SLM.

According to the Income Tax Act, 15% depreciation is provided every year on Plant and Machinery and, an additional 20% depreciation is provided in the first year of installation of machinery.

Depreciation on Machinery is charged on the basis of usage of such machinery. if it is used for 180 days or more then full depreciation is allowed and if it is used for less than 180 days then only 50% depreciation is allowed.

See less

Yes, sure! But lets us first understand what a revaluation account is. A revaluation account is prepared to recognise the change in the book value of assets and liabilities of an entity. These changes happen when assets and liabilities are revalued to present their fair value. It is a nominal accounRead more

Yes, sure! But lets us first understand what a revaluation account is.

A revaluation account is prepared to recognise the change in the book value of assets and liabilities of an entity. These changes happen when assets and liabilities are revalued to present their fair value.

It is a nominal account because it represents gain or loss in value of assets and liabilities. However such gain or loss is unrealised because the assets and liabilities are not sold or discharged.

After revaluation of assets and liabilities, the balance of the revaluation account can be debit or credit. The debit balance means ‘loss on revaluation’ and credit balance means ‘gain on revaluation’.

The balance of revaluation is transferred to the capital account.

Journal Entries related to Revaluation Account

1. Increase in value of an asset upon revaluation:

2. Decrease in value of an asset upon revaluation:

3. Increase in value of liabilities upon revaluation:

4. Decrease in value of liabilities upon revaluation:

5. Transfer or distribution of the balance of revaluation account

or

Numerical example

P, Q and R are partners of the firm ‘PQR Trading’. They share profits and losses in the ratio 3:2:1. On 1st May 20X1, they decided to admit S for 1/6th share in profits and losses of the firm. Upon the revaluation:

Let’s prepare the revaluation account.

See less