Revenue also called income is nothing but the income generated by individuals or businesses from the sale of goods or investing capital or assets. Some examples of revenue are as follows:- Sales revenue Dividend received Interest earned Rent received Commission 1. SALES REVENUE Sales revenueRead more

Revenue also called income is nothing but the income generated by individuals or businesses from the sale of goods or investing capital or assets. Some examples of revenue are as follows:-

- Sales revenue

- Dividend received

- Interest earned

- Rent received

- Commission

1. SALES REVENUE

Sales revenue is the income received by the individual or business by selling its product or provision of services. the words “sale” and “revenue” are used interchangeably to mean the same thing. It is to be noted that revenue does not necessarily mean it has been received in cash, it can be partly in cash or partly on credit also.

How to calculate sales revenue?

SALES REVENUE = NO. OF UNITS SOLD * AVERAGE PRICE PER UNIT

For example:- Amazon sold 4000 units of shirts @ 500 each. Therefore sales revenue for amazon is

Sales revenue = 4000 * 500

= 20,00,000

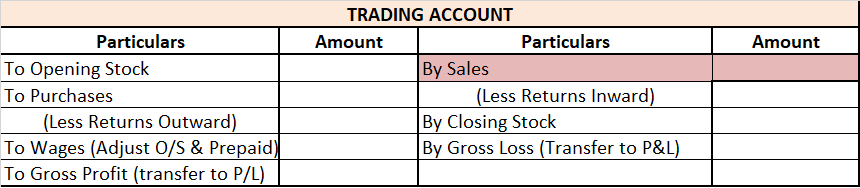

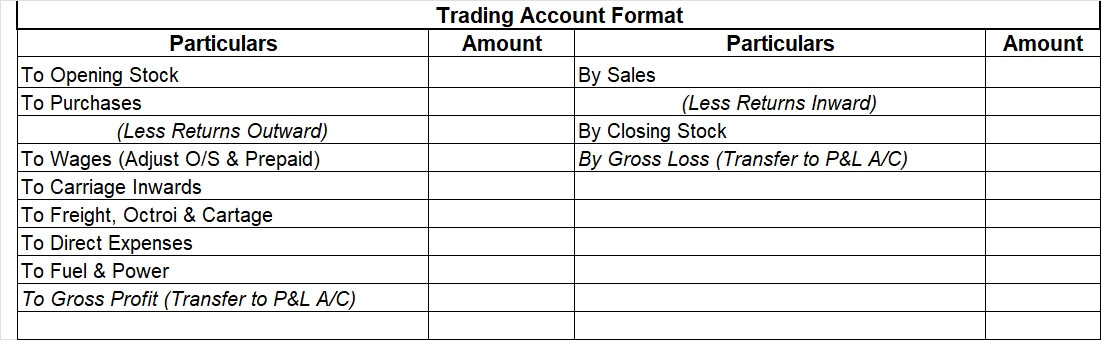

Treatment of sales revenue in the financial statement, since sales are part of a trading account and appear on the credit side of the trading account.

2. DIVIDEND RECEIVED

Naina, this can be explained in simple terms. Suppose you own shares of a company which declares dividend so the dividend received is income for you. Since it does not reduce the assets of a company nor creates a liability it is shown as income and posted on the credit side of profit & loss A/c.

Let me give you a short example of a dividend received, suppose you own 1000 shares of ABC.ltd. the company at the quarter-end calculate its earnings and decides to declare a dividend of Rs 5 per share. Therefore you would receive 1000* 5 i.e Rs 5000 as dividend income.

3. INTEREST INCOME EARNED

Interest income is the earnings the entity receives on any investments made. To be more precise it is money earned by an individual or business for lending their fund either by putting them as deposit in the bank. It is shown on the credit side of the profit & loss A/c.

A very simple example for interest earned is when a business or an individual deposits money in the bank as savings and decided not to touch it for the coming years then such a depositor will gain interest on such savings by the bank. such type of income so received is treated as interest received and shown as income in the profit & loss A/c.

3. RENT RECEIVED

When money is received by the business for exchange of use of assets of the business by the other person, then it will be called rent received. Rent can be received by the business firm in respect of land, building, machinery, etc. As rent received is income for the business firm, it is shown on the credit side of profit & loss A/c.

For example, X. ltd received Rs 20,000 via cash on one of its properties to Mr. Z. Then rent so received shall be treated as income in the books of ABC. ltd and same shall be treated as income and shown in the profit & loss statement.

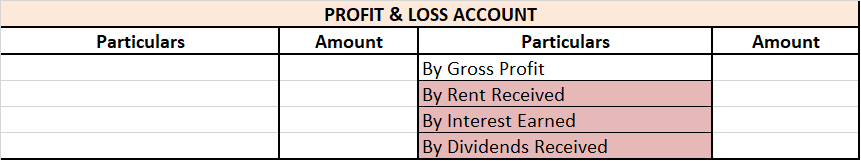

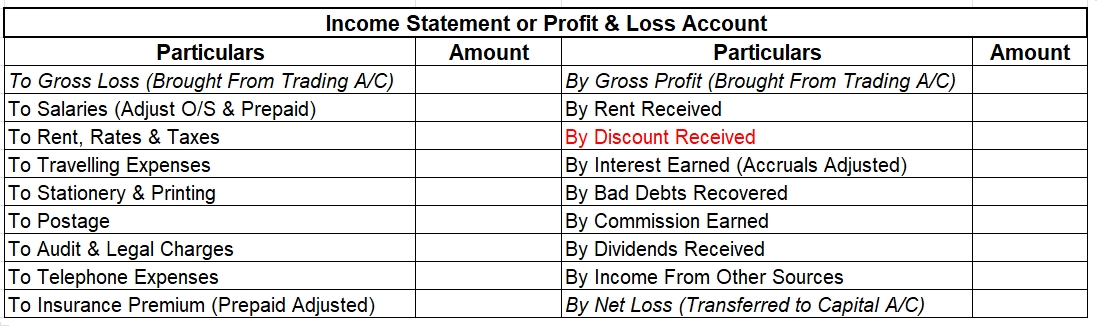

Summarised extract of profit & loss account is shown below for dividend received, Rent received and interest earned.

A bills receivable book is a subsidiary book that shows the details of various bills receivables drawn on customers. It shows the amount, due date, date when the bill was drawn, name of the acceptor, and various other details pertaining to each bill. A bills payable book is a subsidiary book that shRead more

A bills receivable book is a subsidiary book that shows the details of various bills receivables drawn on customers. It shows the amount, due date, date when the bill was drawn, name of the acceptor, and various other details pertaining to each bill.

A bills payable book is a subsidiary book that shows the details of various bills that suppliers have drawn on the business. It shows the amount, due date, date when the bill was drawn, name of the drawer and various other details pertaining to each bill.

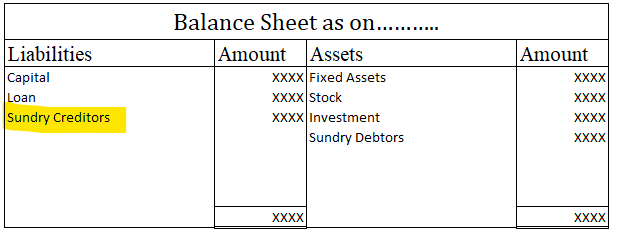

The total of both these books is ultimately transferred to the general ledger. From there, it is used in drafting the balance sheet.

Importance of bills receivable and bills payable books

Bills receivable books help us know the amount that each customer is liable to pay us on specific dates while bills payable books help us know the amounts that we have to pay our various suppliers on certain dates.

Together these books help us handle our cash flows in an efficient manner.

We can evaluate our credit cycle. Bills receivable books help us avoid bad debts while bills payable books help us to avoid defaults.

Difference between bills receivable and bills payable

These are the primary differences between bills payable and bills receivable:

We can conclude that both bills receivable and bills payable books are subsidiary books. Bills receivable shows the details of every bill that the business has drawn on each credit customer. Bills payable show the details of every bill that each credit supplier has drawn on the business.

See less