The correct option is Option C: Journal Entries. Journal entries are the primary entries in the books of accounts and they are passed when any transaction or event takes place. Every journal entry has a dual effect i.e. two or more accounts are affected. For example, When cash is introduced in the bRead more

The correct option is Option C: Journal Entries.

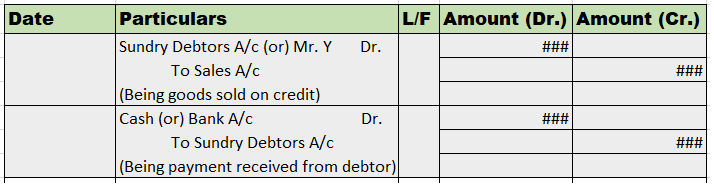

Journal entries are the primary entries in the books of accounts and they are passed when any transaction or event takes place. Every journal entry has a dual effect i.e. two or more accounts are affected.

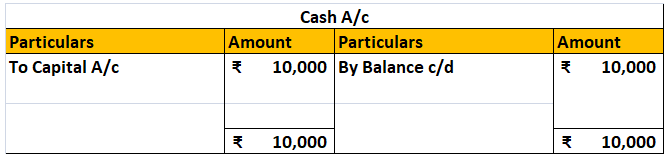

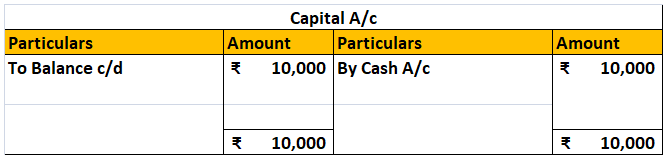

For example, When cash is introduced in the business, the journal entry passed is:

Cash A/c Dr. ₹10,000

To Capital A/c ₹10,000

The accounts affected here are Cash A/c and Capital A/c.

Cash A/c gets debited by ₹10,000,

and Capital A/c get credited by ₹10,000.

All the processes of accounting are conducted in an ordered manner known as the accounting cycle.

The first step in an accounting cycle is to identify the transactions and events which are monetary in nature.

The second step is to record the identified transactions in form of journal entries.

And the third step is to make postings in the general ledger accounts as per the journal entries.

Hence, the preparation of the ledger is the third step in the accounting cycle and is prepared from the journal entries.

See less

Yes, sure! But lets us first understand what a revaluation account is. A revaluation account is prepared to recognise the change in the book value of assets and liabilities of an entity. These changes happen when assets and liabilities are revalued to present their fair value. It is a nominal accounRead more

Yes, sure! But lets us first understand what a revaluation account is.

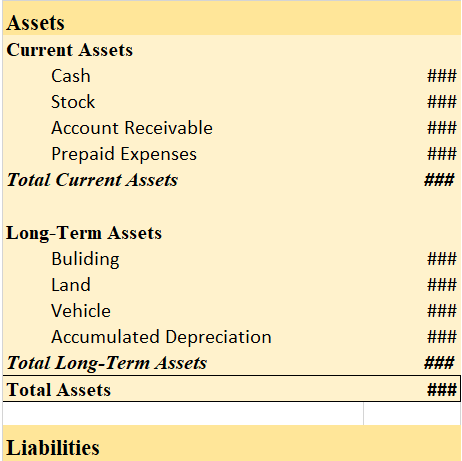

A revaluation account is prepared to recognise the change in the book value of assets and liabilities of an entity. These changes happen when assets and liabilities are revalued to present their fair value.

It is a nominal account because it represents gain or loss in value of assets and liabilities. However such gain or loss is unrealised because the assets and liabilities are not sold or discharged.

After revaluation of assets and liabilities, the balance of the revaluation account can be debit or credit. The debit balance means ‘loss on revaluation’ and credit balance means ‘gain on revaluation’.

The balance of revaluation is transferred to the capital account.

Journal Entries related to Revaluation Account

1. Increase in value of an asset upon revaluation:

2. Decrease in value of an asset upon revaluation:

3. Increase in value of liabilities upon revaluation:

4. Decrease in value of liabilities upon revaluation:

5. Transfer or distribution of the balance of revaluation account

or

Numerical example

P, Q and R are partners of the firm ‘PQR Trading’. They share profits and losses in the ratio 3:2:1. On 1st May 20X1, they decided to admit S for 1/6th share in profits and losses of the firm. Upon the revaluation:

Let’s prepare the revaluation account.

See less