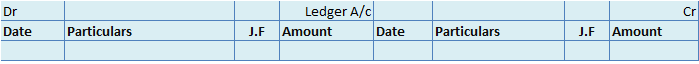

Specimen of Ledger account This is the specimen of a ledger account. J.F. here represents the journal folio. A Ledger account is an account that consists of all the business transactions that take place during the current financial year. For Example, cash, bank, machinery, A/c receivable account, etRead more

Specimen of Ledger account

This is the specimen of a ledger account. J.F. here represents the journal folio.

A Ledger account is an account that consists of all the business transactions that take place during the current financial year.

For Example, cash, bank, machinery, A/c receivable account, etc.

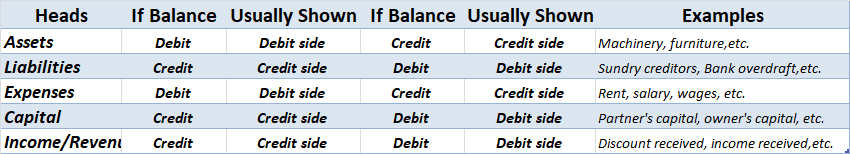

After the financial data is recorded in the Journal. It is then classified according to the nature of accounts viz. Asset, liability, expenses, revenue, and capital to be posted in the ledger account.

With this head, the identification as to whether the opening balance will come under the debit side or the credit side is done.

The table below would help to understand the concept of opening balance in the ledger.

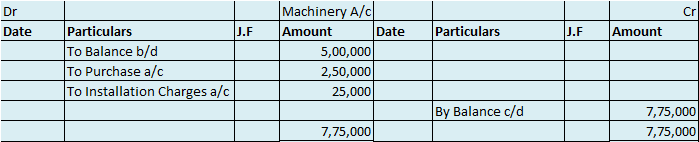

For further clarification of the concept let me give you a practical example.

Suppose, a manufacturing firm Amul purchased machinery for, say, Rs 2,50,000. The installation charges were Rs 25,000 and the opening balance of machinery during the year was Rs 5,00,000.

So as the machinery account comes under the category assets, its opening balance would come under the debit side of the ledger account.

And as purchase and installation charges mean expenses for the firm, they would also come under the debit side of the account.

And in case of any sale of a part of the machinery, it would be posted on the credit side of the account as the sales would generate revenue for the firm.

See less

Yes, Accounts Payable can have a Debit balance. Accounts payable is a liability and thus, has a credit balance but can have a debit balance in case the creditor is overpaid or when there is purchase return (for already-paid goods) ACCOUNTS PAYABLE Accounts payable refers to all short-term liaRead more

Yes, Accounts Payable can have a Debit balance. Accounts payable is a liability and thus, has a credit balance but can have a debit balance in case the creditor is overpaid or when there is purchase return (for already-paid goods)

ACCOUNTS PAYABLE

Accounts payable refers to all short-term liabilities of the business that are to be paid. These are usually paid within a duration of 90 days. It includes both Trade payable (goods and services purchased on credit) as well as expenses payable (used but payment not made yet) like rent payable, electricity bill, etc.

Businesses cannot make every payment on the spot. There can be cases when the business is facing a shortage of funds, can have funds but doesn’t have enough cash (or liquid funds) to make payment or simply doesn’t want to make payment on the spot to reduce its capital requirement.

So, like us businessmen also purchase goods on credit or use services for which payment is to be made soon. All these are liabilities for the business.

However, they must be related to the business to be considered as accounts payable.

DEBIT BALANCE OF ACCOUNTS PAYABLE

Debit balance of accounts payable means money owed by others. There is Debit balance when

OVERPAYMENT is made to the creditors or the supplier. It happens when the wrong amount is paid or payment is made twice for the same transaction.

Suppose you need to pay $10,000 as rent within 30 days. After 25 days you mistakenly made a payment of $12,000.

In this case,

PURCHASE RETURN of already paid goods also result in debit balance of Accounts Payable.

Suppose you bought goods worth $50,000 from Mr A on credit and paid for the same. Later, you returned all the goods because they were defective. Now, there will be Debit balance of Accounts Payable till there is a full refund of $50,000 by Mr A.

How is Accounts Payable Treated Normally?

Accounts Payable are the current liabilities of the firm and are shown under the head Current Liabilities in the Balance Sheet. Its liability, thus has a credit balance which represents the amount owed by the firm to others. It is credited when increases and debited when decreases.

For example – Suppose you purchased goods worth $30,000 and agreed to pay after 30 days. So, Accounts payable will be credited by $30,000 and purchases will be debited by $30,000.

Purchases A/c – $30,000 (debit)

To Accounts Payable A/c – $30,000

After 30 days payment is made in cash, which means the liability decreased. So, Accounts Payable A/c will be debited.

Accounts Payable A/c – $30,00

To Cash – $30,000

See less