General reserve is the part of profits or money kept aside to meet future uncertainties and obligations of the entity. General reserve is created out of revenue profits for unspecified purposes and therefore is also a part of free reserves. General reserve forms a part of the Profit & Loss ApprRead more

General reserve is the part of profits or money kept aside to meet future uncertainties and obligations of the entity. General reserve is created out of revenue profits for unspecified purposes and therefore is also a part of free reserves.

General reserve forms a part of the Profit & Loss Appropriation account and is created to strengthen the financial position of the entity and serves as a sources of internal financing. It is upon the discretion of the management as to how much of a reserve is to be created. No reserve is created when the entity incurs losses.

General reserve is shown in the Reserves & Surplus head on the liability side of the balance sheet of the entity and carries a credit balance.

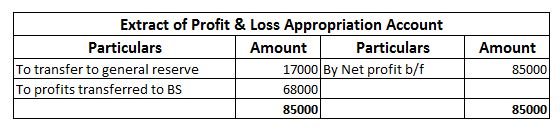

Suppose, an entity, ABC Ltd engaged in the business of electronics earns a profit of 85000 in the current financial year and has an existing general reserve amounting to 100000. The management decides to keep aside 20% of its profits as general reserve.

Then the amount to be transferred to general reserve will be = 85000*20% = 17000.

In the financial statements it will be shown as follows-

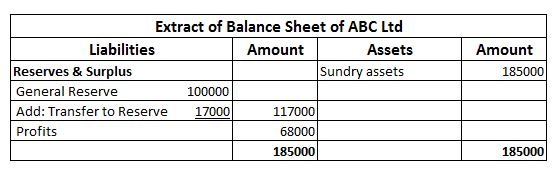

Now, in the next financial year, the entity incurs losses amounting to 45000. In this case, no amount shall be transferred to the general reserve of the entity and will be shown in the financial statement as follows-

The creation of general reserve can sometimes be deceiving since it does not show the clear picture of the entity and absorbs losses incurred.

See less

Non-current assets are long-term investments that are not easily converted into cash within an accounting year. They are required for the long term in the business. They have a useful life of more than an accounting year. Non-current assets can be fixed assets and intangible assets. Fixed assets areRead more

Non-current assets are long-term investments that are not easily converted into cash within an accounting year. They are required for the long term in the business. They have a useful life of more than an accounting year.

Non-current assets can be fixed assets and intangible assets. Fixed assets are tangible assets that can be seen and touched. Whereas, intangible assets are those assets that can not be seen and touched.

You can correlate examples of Non-Current Assets with tangible and intangible assets as mentioned below:

Land and building – They are fixed assets that will give long-term benefits and will be classified as noncurrent assets.

Plant and Machinery – They are tangible assets will give future benefits and are thus mentioned under noncurrent assets.

Office Equipment – They are tangible assets that will give future economic benefits to the company, and comes under noncurrent assets.

Vehicles – They are tangible assets that will give long-term benefits, and will be classified as noncurrent assets.

Furniture – They are also tangible assets that will give future benefits and are classified as non-current assets.

Trademarks – These are intangible assets that will not be easily converted into cash and will be classified as noncurrent assets.

Goodwill – They are intangible assets that can’t be easily converted into cash, and are classified as non-current assets.

Patents – They are intangible assets that will not be converted into cash within an accounting period, and are classified as non-current assets.

Copyrights – They are intangible assets that will not be converted into cash within an accounting period, and are classified as non-current assets.

Long-term Investments – They are long-term investments that will not be easily converted into cash within an accounting period and are classified as non-current assets.

Non-current Assets = Total Liabilities – Current Assets

Current Assets are the assets that will be converted into cash within an accounting year. They include cash, bank, debtors, etc.

BALANCE SHEET

See less