Yes, accounting is necessary even for not-for-profit organizations. NPOs or not-for-profit organizations are those that are created for the welfare of the society. They intend to advance some social cause. For example charities, orphanages etc Accounting for NPOs becomes necessary as the trustees ofRead more

Yes, accounting is necessary even for not-for-profit organizations.

NPOs or not-for-profit organizations are those that are created for the welfare of the society. They intend to advance some social cause. For example charities, orphanages etc

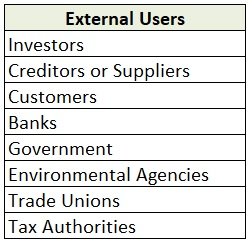

Accounting for NPOs becomes necessary as the trustees of these institutions are liable to their members, the donors and the government. They discharge this function with documenting activities of the institution.

What is a not-for-profit organization?

A not-for-profit organization is an entity that undertakes charitable activities. These institutions do not have earning profit as their primary motive. Their focus is on extending social welfare.

Every not-for-profit organization usually has a group of trustees that are responsible for handling all its operations. These trustees are accountable to the members of the NPO.

A not-for-profit organization usually relies on donations and grants as its primary source of revenue. They do not charge the stakeholders to whom they extend their services or goods.

What does accounting for Not-for-profit organizations entail

The professionals undertaking accounting of not-for-profit organizations must have a significant knowledge of statutory provisions and accounting principles. Here is a brief overview of what accounting for a not-for-profit organizations entails

- Ensuring that the institution fulfills all the legal compliances necessary for it to continue functioning as a NPO.

- Documenting all the activities of the institution and ensuring that the NPO has the necessary permits to carry out those activities.

- Accounting for all the revenue receipts and expenses of the institution. The professional must keep in mind that the interests of the members and other stakeholders are not being subjected to any prejudice.

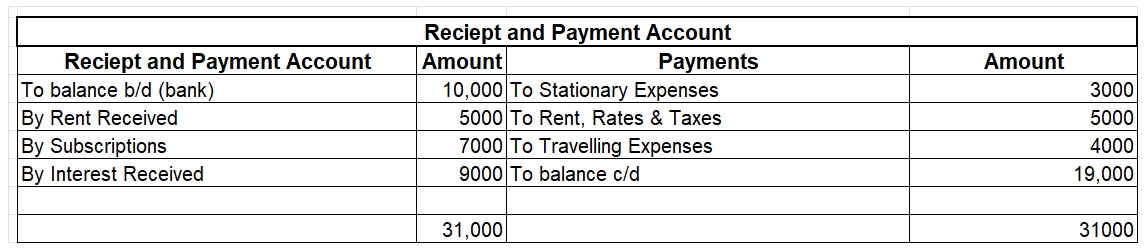

- In India, every NPO has to compulsorily prepare a receipt and payment account, income and expenditure account and a balance sheet. These have to be submitted to the Registrar of Societies before the due dates.

- Every professional undertaking the accounting of a not-for-profit organization must keep in mind that a single non-compliance or partial-compliance can result in the NPO losing out on its tax-exempt status.

- In the past there have been many instances when NPOs have been used for the purpose of money laundering or tax evasion.

- This has resulted in the government making the compliances for these institutions more stringent. The institutions are now required to be more transparent regarding their operations.

We can conclude that accounting is an indispensable requirements for not-for-profit organizations to be able to continue their operations and claim the statutory benefits that the government has extended to them.

See less

Straight Line Depreciation Journal Entry Straight-line depreciation refers to the diminishing value of assets over the life of the asset. In other words, the cost of the asset spreads evenly over the useful life of the assets. The salvage value or Residual value of an asset means the estimated valueRead more

Straight Line Depreciation Journal Entry

Straight-line depreciation refers to the diminishing value of assets over the life of the asset. In other words, the cost of the asset spreads evenly over the useful life of the assets.

The salvage value or Residual value of an asset means the estimated value of the asset at the end of its useful life.

The depreciation can also be charged with another method like Written Down Value (WDV) Method.

Formula

Depreciation per annum = ( Cost of asset – Salvage Value) / Useful Life

The journal entry for the depreciation is:

JOURNAL ENTRIES

Now let us understand this with an example, suppose XYZ Ltd. has an asset of value 90,000 with a useful life of 3 years. The company uses the straight-line method of depreciation to depreciate the asset in its book.

So, the depreciation per annum would be calculated as:-

= 90,000/3

= 30,000

In Year 1, the depreciation will be charged as 30,000 for this year. It will be debited to the depreciation account and credited to the asset account. Thus, the value of the asset at the end of year 1 will be 60,000 (90,000-30,000).

JOURNAL ENTRIES

In Year 2, the depreciation will be charged as 30,000. The entry would be the same as the previous year. The value of the asset at the end of year 2 will be 30,000 (60,000-30,000).

At last in Year 3, the depreciation will be charged 30,000. The entry would be the same. The value of the asset at the end of year 3 will be Nil (30,000- 30,000).

JOURNAL ENTRIES

CR

The depreciation will be charged to the profit and loss account for the year as it is an expense for the company.

The entries will be posted into depreciation account as mentioned:

See less