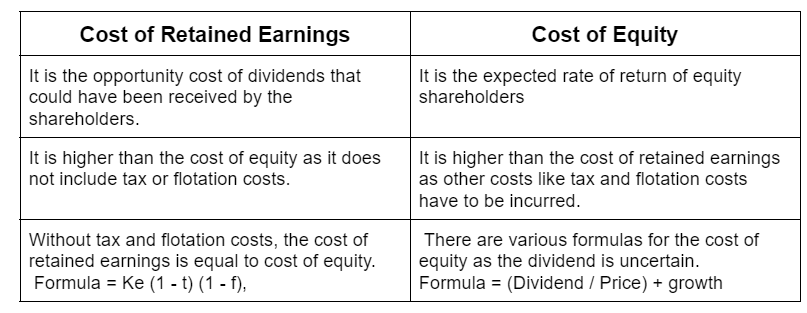

Retained earnings are kept with the company for growth instead of distributing dividends to the shareholders. Therefore the cost of retained earnings refers to its opportunity cost which is the cost of foregoing dividends by the shareholders. Therefore the cost of retained earnings is similar to theRead more

Retained earnings are kept with the company for growth instead of distributing dividends to the shareholders. Therefore the cost of retained earnings refers to its opportunity cost which is the cost of foregoing dividends by the shareholders.

Therefore the cost of retained earnings is similar to the cost of equity without tax and flotation cost. Hence, it can be calculated as

Kr = Ke (1 – t) (1 – f),

Kr = Cost of retained earnings

Ke = Cost of equity

t = tax rate

f = flotation cost

Here, flotation cost means the cost of issuing shares.

EXAMPLE

If cost of equity of a company was 10%, tax rate was 30% and flotation cost was 5%, then

cost of retained earnings = 10% x (1 – 0.30)(1 – 0.05) = 6.65%.

From the above example and formula, it is clear that the cost of retained earnings would always be less than or equal to the cost of equity since retained earnings do not involve flotation costs or tax.

A company usually acquires funds from various sources of finance rather than a single source. Therefore the cost of capital of the company will be the weighted average cost of capital (WACC) of each individual source of finance. The cost of retained earnings is thus an important factor in calculating the overall cost of capital.

Another important factor of WACC is the cost of equity. The cost of equity is sometimes interchanged with the cost of retained earnings. However, they are not the same.

See less

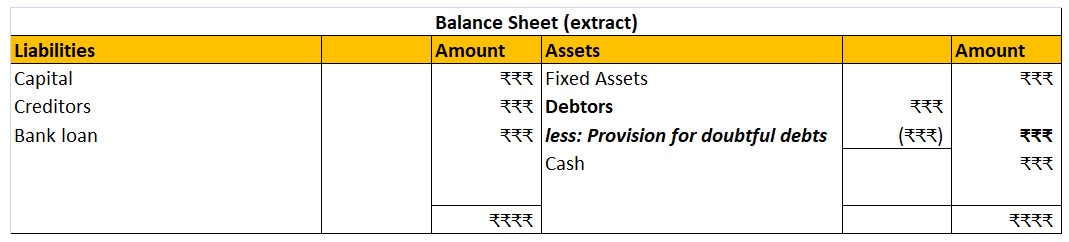

Order of Liquidity Under this method, a company organizes current and fixed assets in the balance sheet in the order of liquidity and the degree of ease by which it is converts converted into cash.On the asset side, we will write most liquid assets at first i.e. cash in hand, cash at bank and so onRead more

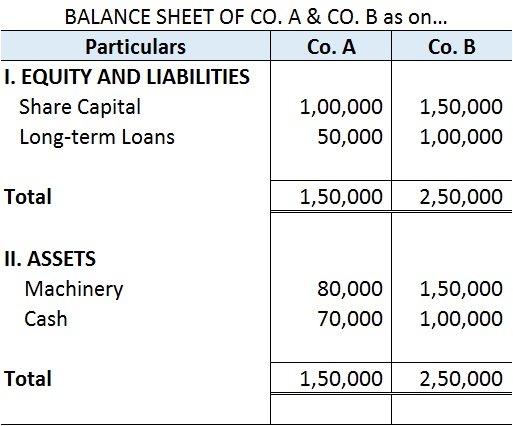

Order of Liquidity

Under this method, a company organizes current and fixed assets in the balance sheet in the order of liquidity and the degree of ease by which it is converts converted into cash.On the asset side, we will write most liquid assets at first i.e. cash in hand, cash at bank and so on and further. In the end, we will write goodwill.

Liabilities are presented based on the order of urgency of payment. On the liabilities side, we start from short-term liabilities for example outstanding expenses, creditors and bill payable, and so on. In the end, we write capital adjusted with net profit and drawings if any.

This approach is generally used by sole traders and partnerships firms. The following is the format of Balance sheet in order of liquidity:

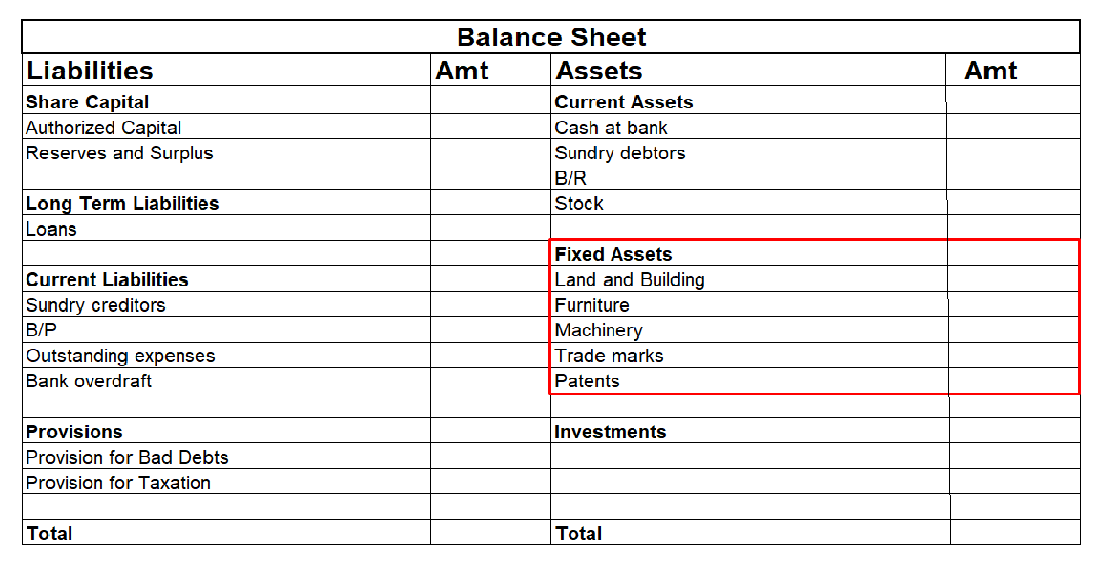

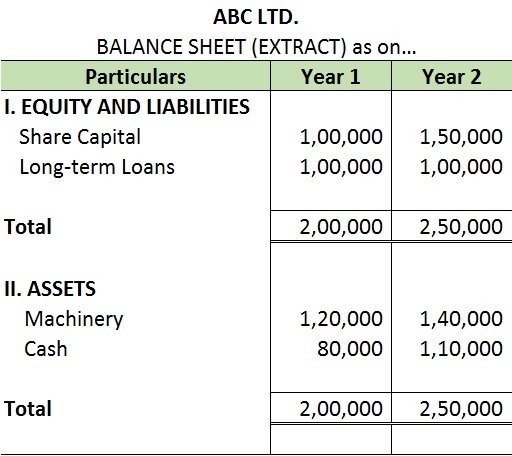

Order of Permanence

Under this method, while preparing a balance sheet by a company assets are listed according to their permanency. Permanent assets are shown at first and then less permanent assets are shown afterward. On the assets side of the balance sheet starts with more fixed and permanent assets i.e. it begins with goodwill, building, machinery, furniture, then investments and ends with cash in hand as the last item.

The fixed or long-term liabilities are shown first under the order of permanence method, and the current liabilities are listed afterward. On the liabilities side, we start from capital, Reserve and surplus, Long term loans and end with outstanding expenses.

The following is the format of the Balance sheet in order of permanence:

Such order or arrangement of balance sheet items are refer as ‘Marshalling of Balance Sheet’.

See less