Fictitious assets are expenses or losses not written off entirely in the profit and loss account during the accounting year in which they occur. Fictitious assets have no realizable value or physical existence. In the above, (C) preliminary expense is a fictitious asset. Preliminary expenses are theRead more

Fictitious assets are expenses or losses not written off entirely in the profit and loss account during the accounting year in which they occur. Fictitious assets have no realizable value or physical existence.

In the above, (C) preliminary expense is a fictitious asset. Preliminary expenses are the expenses incurred before the incorporation of a business. The word ‘fictitious’ means fake, these are not actually the assets of a company even though they are represented in the assets of the balance sheet.

Since the benefit of a fictitious asset is received over a period of time, the whole amount is not charged to the profit and loss account. The amount is amortized over several years. These expenses are non-recurring in nature. These expenses are shown as assets under the head miscellaneous expenditure. Also known as deferred revenue expenditure.

For example: A company incurred $50,000 as promotion costs before the formation of the business. This promotion cost will be deferred over 5 years. In the first year, $10,000 will be charged to the profit and loss account and the remaining $40,000 will be shown as an asset under the heading miscellaneous expenditure. Subsequently, $10000 will be charged to profit and loss for the next 4 years. The amount of $50,000 will be deferred over a span of 5 years.

Some other examples of fictitious assets :

- Promotional expenses: Expenses incurred for the promotion of business before the formation of the company such as advertising expenditures are amortized over many years.

- Loss on the issue of shares or debentures: When a company issues shares or debentures at a discount, the discount is classified as a fictitious asset and is not treated as an expense or loss. It is amortized over several years.

- Incorporation costs: Costs incurred during the formation of a business are incorporation costs. These include registration costs, licensing fees, legal fees and other costs incurred in setting up the business. These are fictitious assets and are amortized over several years.

- Loss on Sale of Machinery: When a loss is incurred on the sale of machinery or equipment, that loss is also treated as a fictitious asset and is amortized over several years.

Goodwill

Goodwill is not a fictitious asset because goodwill has a realizable value and can be sold in the market. Goodwill is an intangible asset which does not have a physical existence but can be traded for monetary value. Goodwill has an indefinite life and is sold when the business is sold. Goodwill can be self-generated or purchased. Goodwill is shown as an intangible asset under the heading fixed asset in the financial statements.

Patents

Patents are intangible assets which do not have a physical existence but have realizable value and can be sold in the market. So, patents do not come under the category of fictitious assets. Patents are basically intellectual property. The purchase price of the patent is the initial purchase cost which is amortized over the useful life of the asset. Patents are shown as intangible assets under the heading fixed asset in the balance sheet of the company.

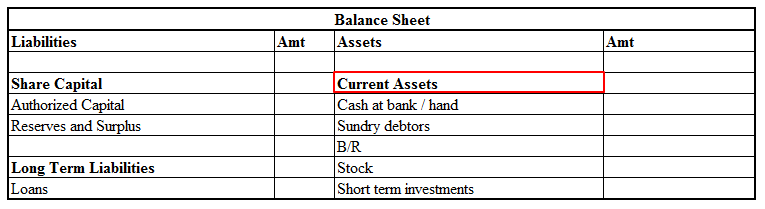

Claim receivable

Claim receivable is an asset if the claim has been authorized by the insurance company. Claim receivable has a monetary value, so does not come under the category of a fictitious asset. If the claim is not yet authorized by an insurance company, it will be shown as a footnote in the financial statements. Authorized claim receivable is shown as a current asset in the financial statement.

See less

The major affairs of the company are handled by the manager and hence he is entitled to receive some compensation for his efforts. This is termed Managerial Remuneration. The manager has to bring out the maximum potential of the employees while ensuring that the interests of the shareholders and othRead more

The major affairs of the company are handled by the manager and hence he is entitled to receive some compensation for his efforts. This is termed Managerial Remuneration. The manager has to bring out the maximum potential of the employees while ensuring that the interests of the shareholders and other stakeholders are secured.

MAXIMUM REMUNERATION

As per section 197 of the Companies Act, the Company has certain limits on paying maximum remuneration, depending on whether he is working full-time or part-time. If the company has only one whole-time manager, he is entitled to a maximum remuneration of 5% of net profits. If there is more than one whole time manager, then the percentage increases to 10%.

For part-time directors, the remuneration allowed is 1% of net profits (if there is a whole-time director present) and if no whole-time manager is present, then remuneration for a part-time director is 3%.

Therefore, a company can only pay a maximum remuneration of 11% of net profits.

A public company is allowed to pay remuneration in excess of 11% by :

Remuneration can be paid to such managers who do not have any direct interest in the company and also possesses special knowledge and expertise along with a graduate-level qualification.

PENALTY

Any person who fails to comply with the provisions of managerial remuneration shall be punishable with a fine that can vary from Rs. 1 Lakh to a maximum of Rs. 5 Lakhs.

However, Sec 197 applies to only public companies and hence private companies are free to pay managerial remuneration with no upper limit.

See less