The word, “deferred” means delayed or postponed and “revenue” in layman’s terms means income. Therefore deferred revenue means the revenue which is yet to be recognised as income. It is actually unearned income. In accrual accounting, income is recognised only when it is accrued or earned. DeferredRead more

The word, “deferred” means delayed or postponed and “revenue” in layman’s terms means income. Therefore deferred revenue means the revenue which is yet to be recognised as income. It is actually unearned income.

In accrual accounting, income is recognised only when it is accrued or earned. Deferred revenue is the income received before the performance of the economic activity to earn it.

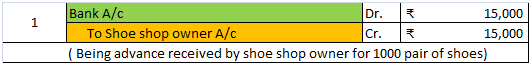

Example: A shoe shop owner gives an order to a shoe manufacturer of 1000 pair of shoes which is to be delivered after 4 months. He also gives him a cheque of ₹15,000 in advance, the rest ₹5000 is to be given at the time of delivery.

So, in this case, the ₹15,000 is actually is unearned revenue i.e. deferred revenue. It will be recognised as revenue when the shoe manufacture completes the order and deliver it.

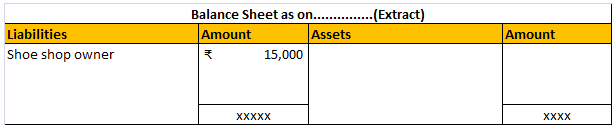

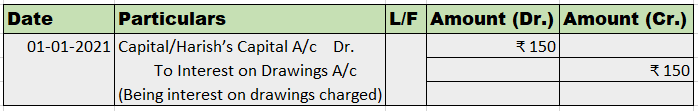

Till then, the deferred revenue is reported as a liability in the balance sheet. Like this:

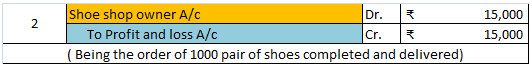

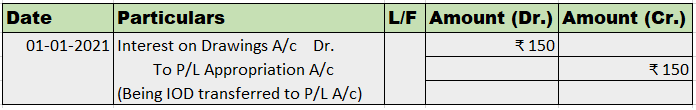

After recognition as revenue, it will be reported in the statement of profit or loss:

Hence, to summarise, deferred revenue is:

- Unearned revenue

- Recognised as income till it is earned

- Till then it is recognised and reported as a liability in the balance sheet.

Some examples of deferred revenue are as follows:

- Advance rent received

- Advance payment for goods to be delivered.

- Advanced payment for services to be provided.

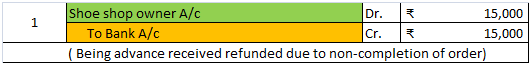

Now the question arises why deferred revenue is recognised as a liability. It is due to the fact that the business may not be able to perform the economic activity successfully to earn that revenue.

Taking the above example, suppose the shoe manufacturer is not able to honour its commitment and the shoe shop owner can wait no more, then the advanced money of ₹ 15,000 is to be refunded. That’s why deferred revenue is recognised as a liability because it is a liability if we consider the principle of conservatism (GAAP).

The land is a fixed asset and is treated as a long-term asset account. Explanation The land is a fixed asset which is also referred to as a long-term asset. The fixed assets are those assets that are not expected to be cashed, consumed, last, sold, or written off within one accounting year and areRead more

The land is a fixed asset and is treated as a long-term asset account.

Explanation

The land is a fixed asset which is also referred to as a long-term asset.

The fixed assets are those assets that are not expected to be cashed, consumed, last, sold, or written off within one accounting year and are purchased for long-term use. The fixed assets are also called non-current assets and the reason behind it is that current assets are easily converted into cash within one year and they are not.

Fixed assets are planned by the company to be used for the long term in order to generate income.

Example- Land, building, furniture, plants & equipment, etc.

Why is land an asset?

Although the land is not depreciated, it is still considered to be an asset because just like other assets the business spends its own money to acquire it.

It can also be used by the business for different operations and it doesn’t create any liability for the business. Instead, reselling the land after a few years can help the company earn a huge margin of profit.

Land in the balance sheet

On the asset side of the balance sheet, the land is stated under the heading long-term assets.

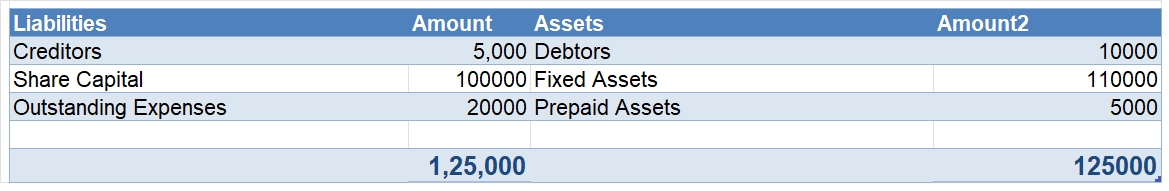

Balance Sheet (for the year…)

Therefore, the land is a fixed asset and is treated as a long-term asset account.

See less