Deferred Tax Liability A deferred tax liability represents an obligation to pay taxes in the future. These taxes are owed by a company but are not due to be paid until a future date. Companies that incur such an obligation prepare and maintain two financial reports every year: a tax statement and anRead more

Deferred Tax Liability

A deferred tax liability represents an obligation to pay taxes in the future. These taxes are owed by a company but are not due to be paid until a future date.

Companies that incur such an obligation prepare and maintain two financial reports every year: a tax statement and an income statement.

This is because companies maintain their books as per book accounting rules (GAAP/IFRS), but they have to pay taxes according to tax accounting rules, and they each have to follow their own guidelines.

For example, a tax statement follows the cash basis of accounting, and an income statement follows the accrual basis of accounting.

Companies calculate their profit as per the accounting rules as well as tax laws known as accounting income and taxable income, respectively. Some differences arise due to the application of different provisions of law.

These temporary differences are accounted for, recognized, and carried forward in the books of accounts and create deferred tax.

Example

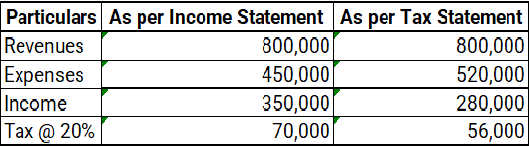

Here is an example of deferred tax liability.

In the given example, tax as per income statement is 70,000, whereas as per tax statement it is 56,000. This temporary difference is termed as deferred tax liability of 14,000.

When accounting income is more than taxable income, it creates Deferred Tax Liability. It will be adjusted in the books of accounts during one or more subsequent year(s).

How Does it Arise?

There are several instances under which a company creates a deferred tax liability. Some other instances are:

Depreciation Methods

- One of the most common reasons for deferred tax liability is when a company uses different depreciation methods in the Income and Tax Statement.

- Assets are depreciated by calculating the straight-line method in the Income Statement, while the written-down value method is used in the Tax Statement.

- Since the straight-line value method produces lower depreciation when compared to the WDV method, accounting income is temporarily higher than taxable income.

- The company recognises deferred tax liability as this difference between accounting income and taxable income.

Treatment of Revenue & Expenses

- Deferred tax liability can also arise when there is a difference in the way revenue and expenses are treated in books of accounts.

- As mentioned earlier, accounting rules follow the accrual basis of accounting while tax laws follow the cash basis of accounting.

- Meaning in the tax statement, income and expenses are recorded when they are received or paid, not when they are incurred or realised.

- This difference in the treatment of revenue and expenses creates deferred tax liability.

Impact on Financial Statements

Recognising deferred tax liability and its subsequent effect on the company’s financial statement is important as it simplifies the process of auditing and analysing financial reports.

Balance Sheet

- Deferred tax liabilities are recorded on the liability side of the balance sheet under non-current liabilities.

Cash Flow Statement

- The deferred tax liability is added back to the net income in calculating cash flow from operating activities to show the actual cash flow.

Definition Gross profit is the excess of the proceeds of goods and services rendered during a period over their cost, before taking into account administration, selling, distribution, and financial expenses. Gross profit and net profit are gross profit estimates of the profitability of a company. WhRead more

Definition

Gross profit is the excess of the proceeds of goods and services rendered during a period over their cost, before taking into account administration, selling, distribution, and financial expenses.

Gross profit and net profit are gross profit estimates of the profitability of a company.

When the result of this computation is negative it is referred to as gross loss

Formula :

Total Revenues – Cost Of Goods Sold

Net profit is defined as the excess of revenues over expenses during a particular period.

Net profit is to show the performance of the company.

When the result of this computation is negative it is called a net loss.

Net profit may be shown before or after tax.

Formula :

Total Revenues – Expenses

Or

Total Revenues – Total Cost ( Implicit And Explicit Cost )

Examples

Now let me explain to you by taking an example which is as follows :

In a business organization there were the following data given as purchases made Rs 73000, inventory, in the beginning, was Rs 10000, direct expenses made were Rs 7000, closing inventory which was Rs 5000, revenue from operation during the period was Rs 100000.

Then,

COST OF GOODS SOLD = Purchases + Opening Inventory + Direct Expenses – Closing Inventory.

= Rs ( 73000 + 10000+ 7000- 5000)

= Rs 85000

GROSS PROFIT = REVENUE – COST OF GOODS SOLD

= Rs ( 100000 – 85000 )

= Rs 15000

Now from the above question keeping the gross profit same if the indirect expenses of the organization are Rs 2000 and the other income is Rs 1000.

Then,

NET PROFIT = GROSS PROFIT – INDIRECT EXPENSES + OTHER INCOMES

= Rs ( 15000 – 2000 + 1000)

= Rs 14000

Treatment

Treatment of gross profit and net profit is given as follows :

Gross profit

• Gross profit appears on the credit side of the trading account.

• Gross profit is located in the upper portion beneath revenue and cost of goods sold.

Net profit

• Net profit appears on the credit side of the profit and loss account.

• It is treated directly in the balance sheet by adding or subtracting from the capital.

Here is an extract of the trading and profit/loss account and balance sheet showing GROSS PROFIT & NET PROFIT :

See less