If someone can tell me the complete accounting with the percentage that would be great.

The correct option is (A) Original. Journal entry is the book of the original entry. It is because every event or transaction which is of monetary nature is first recorded in the journal. The transactions recorded in the journal are known as journal entries. Journal follows the double-entry system oRead more

The correct option is (A) Original. Journal entry is the book of the original entry. It is because every event or transaction which is of monetary nature is first recorded in the journal. The transactions recorded in the journal are known as journal entries.

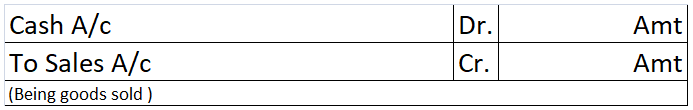

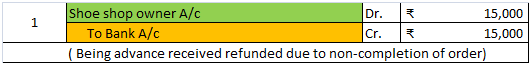

Journal follows the double-entry system of accounting. It means a journal entry affects at least two accounts. It is from the journal entries, the ledger accounts are prepared. For example, the transaction, ‘sale of goods for Rs 1000 for cash’ affects two accounts. The journal entry is:

There are many special journals that record some special set of transactions which are called subsidiary journals or daybooks. Such special journals are not considered the books of original entry.

Option (B) Duplicate is wrong. It is because the journal is the book where monetary events and transactions are recorded. It cannot be the book of duplicate entries. There is no such thing as ‘book of duplicate entry.’

Option (C) Personal is wrong. Personal is a type of account under the golden rules of accounting. A personal account is a type of account that represents a person. But, the journal is not an account, it is a book. Also, there is no such thing as book of personal entry.

Option (D) Nominal is wrong. Nominal is also a type of account under the golden rules of accounting. The nominal account is a type of account that represents an income, expense, gain or loss. Journal is a type of account but a book.

See less

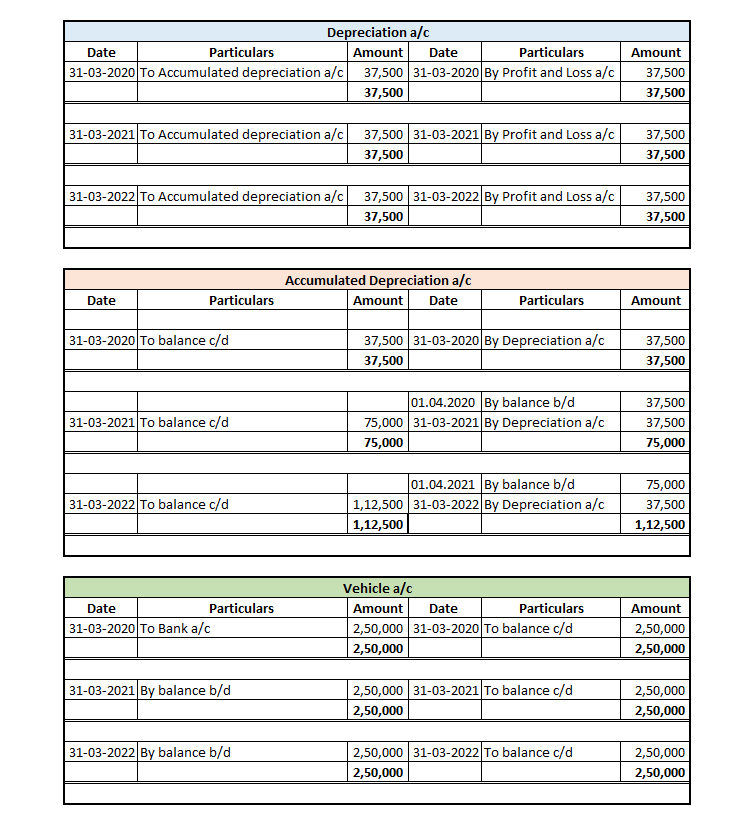

I am assuming that you are asking the question with reference to the sole proprietorship business. In the case of a company, the rates as per the Companies Act, 2013 will apply. A sole proprietor can charge the depreciation in its books of accounts at whatever rate it wants but it should not be moreRead more

I am assuming that you are asking the question with reference to the sole proprietorship business. In the case of a company, the rates as per the Companies Act, 2013 will apply. A sole proprietor can charge the depreciation in its books of accounts at whatever rate it wants but it should not be more than the rates prescribed in the Income Tax Act, 1961.

It is a general practice to take depreciation rate lower than the Income Tax Act, 1961, so that the financial statements look good because of slightly higher profit. There is no harm in it as it is a sole proprietor.

The Income Tax Act, 1961 has prescribed rates at which depreciation is to be given on different blocks of assets. For motor vehicles, the rates are as follows:

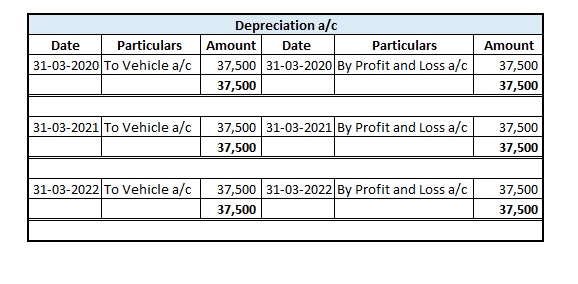

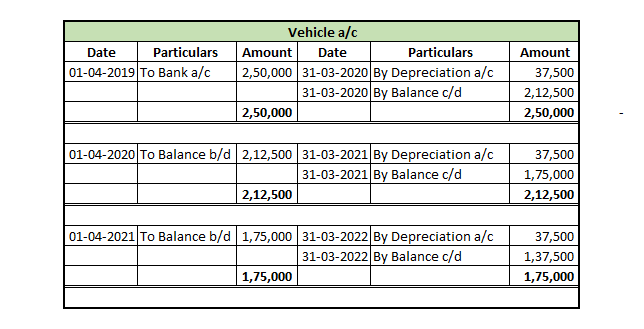

Let’s take an example to understand the accounting treatment:-So a business can choose to charge depreciation at rates slightly lower than the above rates.

Mr A purchased a lorry for ₹1,00,000 on 1st April 2021 for his business, to be used for transportation of the finished goods. Now, Mr A decided to charge depreciation on the WDV method @30% (prescribed rate is 40%).

Following will be the journal entries.

I hope I was able to answer your question.

See less