Interest on Investment is to be shown on the Credit side of a Trial Balance. Interest on investment refers to the income received on investment in securities. These securities can be shares, debentures etc. of another company. When one invests in securities, they are expected to receive a return onRead more

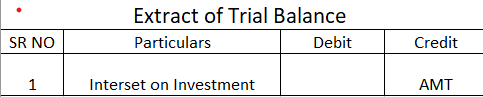

Interest on Investment is to be shown on the Credit side of a Trial Balance.

Interest on investment refers to the income received on investment in securities. These securities can be shares, debentures etc. of another company. When one invests in securities, they are expected to receive a return on investment (ROI).

Since interest on investment is an income, it is shown on the credit side of the Trial Balance. This is based on the accounting rule that all increase in incomes are credited and all increase in expenses are debited. A Trial Balance is a worksheet where the balances of all assets, expenses and drawings are shown on the debit side while the balances of all liabilities, incomes and capital are shown on the credit side.

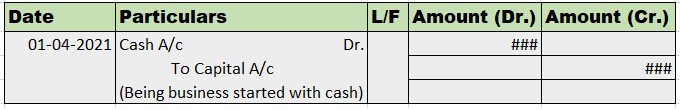

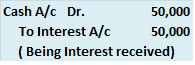

For example, if Jack bought Corporate Bonds of Amazon, worth $50,000 with a 10% interest on investment, then the accounting treatment for interest on investment would be

Cash/Bank A/C Dr 5,000

To Interest on Investment in Corporate Bonds (Amazon) 5,000

As per the above entry, since interest on investment is credited, it will show a credit balance and hence be shown on the credit side of the Trial Balance. Interest on investment account is not to be confused with an Investment account. Investment is an asset whereas interest on investment is an income.

See less

The journal entry for the opening stock will be: Particulars Amt Amt Trading A/c INR To Opening Stock A/c INR (Being opening stock transferred to Trading A/c) Opening stock is the value of inventory that is available with the company for sale at the beginning of the accounting period. ORead more

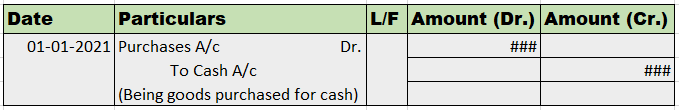

The journal entry for the opening stock will be:

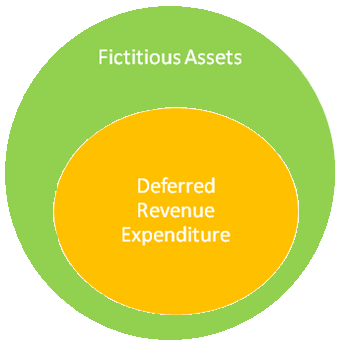

Opening stock is the value of inventory that is available with the company for sale at the beginning of the accounting period. Opening stock may include stock of raw material, semi-finished goods, and finished goods. It is a part of the cost of sales.

Closing stock is the value of unsold inventory left with the company at the end of the year. The previous year’s closing stock is the current year’s opening stock.

Trading Account is a nominal account. According to the golden rules of accounting, the nominal account is the account where “Debit” all expenses and losses, and “Credit” all income and gains.

In the above journal entry, the opening stock account is credited because it is the balance that is carried forward from the previous year and carried forward with the aim of selling it and gaining profit from it. The trading account here is debited as opening stock is carried forward to the next year from the trading account only.

According to modern rules of accounting, “Debit entry” increases assets and expenses, and decreases liability and revenue, a “Credit entry” increases liability and revenues, and decreases assets and expenses.

Here, Trading A/c is debited because an expense is incurred while bringing stock into the business. Opening Stock A/c is credited because indirectly it is creating a source of income for the business.

The formula for calculating opening stock is as follows:

Opening Stock = Cost of Goods Sold + Closing Stock – Purchases

For example, AB Ltd. started a new accounting period for dairy products and introduced opening stock worth Rs.1,00,000 in the business.

Here, the journal entry will be,