Let us first understand what working capital is. Working capital means the funds available for the day-to-day operations of an enterprise. It is a measure of a company’s liquidity and short term financial health. They are cash or mere cash resources of a business concern. It also represents the exceRead more

Let us first understand what working capital is.

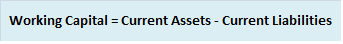

Working capital means the funds available for the day-to-day operations of an enterprise. It is a measure of a company’s liquidity and short term financial health. They are cash or mere cash resources of a business concern.

It also represents the excess of current assets, such as cash, accounts receivable and inventories, over current liabilities, such as accounts payable and bank overdraft.

Sources of Working Capital

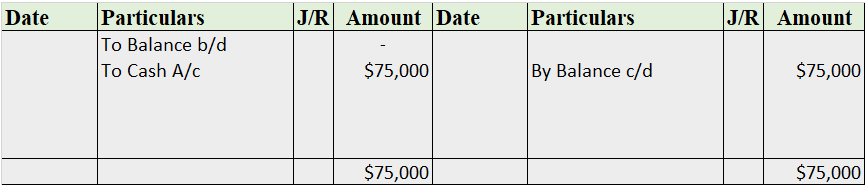

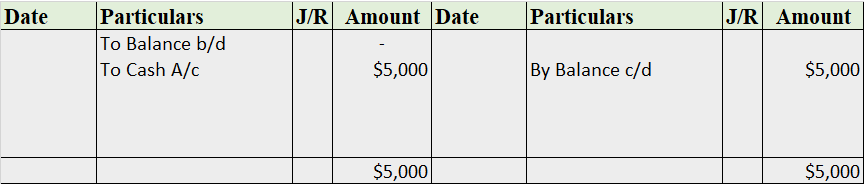

Any transaction that increases the amount of working capital for a company is a source of working capital.

Suppose, Amazon sells its goods for $1,000 when the cost is only $700. Then, the difference of $300 is the source of working capital as the increase in cash is greater than the decrease in inventory.

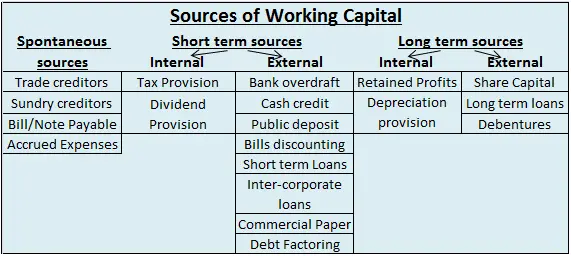

Sources of working capital can be classified as follows:

Short Term Sources

- Trade credit: Credit given by one business firm to the other arising from credit sales. It is a spontaneous source of finance representing credit extended by the supplier of goods and services.

- Bills/Note payable: The purchaser gives a written promise to pay the amount of bill or invoice either on-demand or at a fixed future date to the seller or the bearer of the note.

- Accrued expenses: It refers to the services availed by the firm, but the payment for which is yet to be done. It represents an interest-free source of finance.

- Tax/Dividend provisions: It is a provision made out of current profits to meet the tax/dividend obligation. The time gap between provision made and payment of actual payment serves as a source of short-term finance during the intermediate period.

- Cash Credit/Overdraft: Under this arrangement, the bank specifies a pre-determined limit for borrowings. The borrower can withdraw as required up to the specified limits.

- Public deposit: These are unsecured deposits invited by the company from the public for a period of six months to 3 years.

- Bills discounting: It refers to an activity wherein a discounted amount is released by the bank to the seller on purchase of the bill drawn by the borrower on their customers.

- Short term loans: These loans are granted for a period of less than a year to fulfil a short term liquidity crunch.

- Inter-corporate loans/deposits: Organizations having surplus funds invest with other organizations for up to six months at rates higher than that of banks.

- Commercial paper: These are short term unsecured promissory notes sold at discount and redeemed at face value. These are issued for periods ranging from 7 to 360 days.

- Debt factoring: It is an arrangement between the firm (the client) and a financial institution (the factor) whereby the factor collects dues of his client for a certain fee. In other words, the factor purchases its client’s trade debts at a discount.

Long Term Sources

- Retained profits: These are profits earned by a business in a financial year and set aside for further usage and investments.

- Share Capital: It is the money invested by the shareholders in the company via purchase of shares floated by the company in the market.

- Long term loans: These loans are disbursed for a period greater than 1 year to the borrower in his account in cash. Interest is charged on the full amount irrespective of the amount in use. These shareholders receive annual dividends against the money invested.

- Debentures: These are issued by companies to obtain funds from the public in form of debt. They are not backed by any collateral but carry a fixed rate of interest to be paid by the company to the debenture holders.

Another point I would like to add is that, although depreciation is recorded in expense and fixed assets accounts and does not affect working capital, it still needs to be accounted for when calculating working capital.

See less

Every business requires research and development to create innovative products for consumers. More innovative and creative products and services are more popular among customers, leading to increased revenue and profits for the business. Creating new products or designing changes and testing existinRead more

Every business requires research and development to create innovative products for consumers. More innovative and creative products and services are more popular among customers, leading to increased revenue and profits for the business.

Creating new products or designing changes and testing existing products also forms a part of research and development.

Examples of Research and Development costs are –

Let us now understand how research and development costs are treated in Financial Statements.

Research and Development Costs are generally shown as an expense in the Income Statement.

IAS-38

IAS-38 majorly governs the accounting of research and development costs. There are two phases in R&D:

1. it is developed with the intention of putting it to use in the future

2. the asset shall hold an economic value

3. the costs can be measured reliably

Treatment of R&D costs in the Financial statements:

Conclusion

The above discussion can be summarised as follows:

- Research and development is essential for creating innovative and creative products and services.

- Accounting standard IAS-38 governs the accounting for Research and Development.

- Research costs are usually shown as an expense in the Income statement of the business.

- Development costs when capitalised can be shown as Intangible assets in the Balance Sheet.

See less