The major affairs of the company are handled by the manager and hence he is entitled to receive some compensation for his efforts. This is termed Managerial Remuneration. The manager has to bring out the maximum potential of the employees while ensuring that the interests of the shareholders and othRead more

The major affairs of the company are handled by the manager and hence he is entitled to receive some compensation for his efforts. This is termed Managerial Remuneration. The manager has to bring out the maximum potential of the employees while ensuring that the interests of the shareholders and other stakeholders are secured.

MAXIMUM REMUNERATION

As per section 197 of the Companies Act, the Company has certain limits on paying maximum remuneration, depending on whether he is working full-time or part-time. If the company has only one whole-time manager, he is entitled to a maximum remuneration of 5% of net profits. If there is more than one whole time manager, then the percentage increases to 10%.

For part-time directors, the remuneration allowed is 1% of net profits (if there is a whole-time director present) and if no whole-time manager is present, then remuneration for a part-time director is 3%.

Therefore, a company can only pay a maximum remuneration of 11% of net profits.

A public company is allowed to pay remuneration in excess of 11% by :

- Passing a special resolution approved by the shareholders

- Subject to compliance with Schedule V conditions

Remuneration can be paid to such managers who do not have any direct interest in the company and also possesses special knowledge and expertise along with a graduate-level qualification.

PENALTY

Any person who fails to comply with the provisions of managerial remuneration shall be punishable with a fine that can vary from Rs. 1 Lakh to a maximum of Rs. 5 Lakhs.

However, Sec 197 applies to only public companies and hence private companies are free to pay managerial remuneration with no upper limit.

See less

Let the business in our example be X Trading. The 15 transactions are as follows: 1st April - X Trading started its business with Rs. 10,000 cash and furniture of Rs. 5,000. 5th April - Purchased 1,000 units of goods for Rs. 1,000 in cash from Ram. 10th April – Bought stationery for Rs. 100 in cash.Read more

Let the business in our example be X Trading. The 15 transactions are as follows:

We will prepare the journal, ledgers and the trial balance from the above transactions.

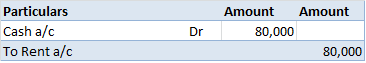

Journal

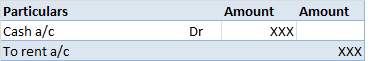

Journal is known as the book of primary entry or book of original entry. It is because every transaction is recorded in form of journal entries in the journal. Every journal entry affects at least two accounts (dual effect). A transaction has to be a monetary transaction otherwise it cannot be recorded as a journal entry.

The procedure of recording transactions as journal entries is simple if we follow the modern rules of accounting.

So first we have to identify which and what type of account does a transaction affect. The types of accounts are:

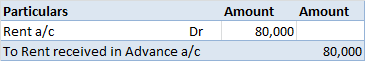

Ledger

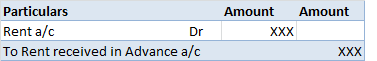

Ledgers are known as the books of principal entry or book of final entry. All the journal entries recorded in the journal are posted to the ledgers. A Ledger is where the entries related to a particular account are recorded. For example, all the transactions related to salary will be recorded in the salary account ledger.

It is very important to prepare the ledger to arrive at the balance of each account in the books of concern so that it can prepare its trial balance.

The procedure of posting journal entries in the ledger account is done is as follows:

The ledgers are as follows:

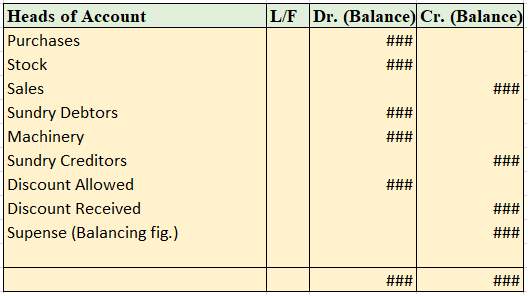

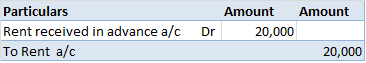

Trial Balance

The trial balance is not a part of the books of accounts. It is just a statement prepared to check the arithmetical accuracy of the books of the accounts. It also helps to know about the omission and posting mistakes. It is prepared after the ledger accounts have been drawn and their balances have been ascertained.

The balance of all the ledger accounts is posted on either side of the trial balance. Debit balance of the account on the debit side and credit balance of the account on the credit side.

Also, the closing stock from the financial statements of the previous year is posted on the debit side of the trial balance as opening stock to account for the stock with the business at the beginning of the financial year.

Following is the trial balance of X trading:

See less