Realisation account A realisation account is a nominal account prepared at the time of dissolution of a business. All the assets and liabilities except cash and bank balance are transferred to the realisation account. A realisation account is prepared to calculate the profit or loss on the dissoluRead more

Realisation account

A realisation account is a nominal account prepared at the time of dissolution of a business. All the assets and liabilities except cash and bank balance are transferred to the realisation account. A realisation account is prepared to calculate the profit or loss on the dissolution or closing of the firm.

All the assets are transferred to the debit of the realisation account and all the liabilities are transferred to the credit of the realisation account. When assets are sold, Cash A/c is debited and Reliastion A/c is credited and when liabilities are paid off, Cash A/c is credited and Realisation A/c is credited.

If the credit side exceeds the debit side of the realisation account, it results in profit. In contrast, if the debit side exceeds the credit side of the realisation account, it results in a loss. in case of profit, the Capital account is credited and in case of loss, the Capital account is debited.

Credit side of realisation account

- Liabilities: All the liabilities including sundry creditors, outstanding expenses, bills payable, loans and advances, bank overdrafts and cash credit are transferred to the credit side of the realisation account. Capital account of partners, profit and loss balance and loans from partners are not transferred.

- Accounting entry for this is as follows:

Liabilities A/c Dr…..

To Realisation A/c …..

(All the liabilities transferred to realisation account)

- Provisions: All the provisions including provision for doubtful debts and provision for taxation are transferred to the credit side of the realisation account.

- Accounting entry for this is as follows:

Provision A/c Dr…..

To Realisation A/c …..

(All the provisions transferred to the realisation account)

- Cash and bank A/c: Sale proceeds of all the assets including Land and building, Plant and machinery, furniture, stock, debtor and investment are transferred to the credit side of the Realisation account.

-

- Accounting entry for this is as follows:

Bank A/c Dr…..

To Realisation A/c …..

(Asset sold for cash)

- Loss on realisation: If the debit side of the realisation account exceeds the credit side, it results in loss then the capital account is debited.

-

- Accounting entry for this is as follows:

Capital A/c Dr…..

To Realisation A/c …..

(Being loss transferred to the capital account)

The debit side of the realisation account

All the assets including Land and building, Plant and machinery, furniture, stock, debtor and investment are transferred to the debit of the realisation account and payment of outside liabilities is also recorded on the debit side of the realisation account. Payment made for dissolution expenses is also recorded on the debit side of the realisation account.

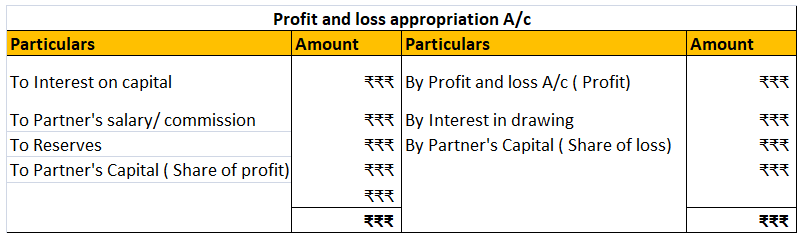

Format for realisation Account is as under:

| Realisation A/c | |||

| Particulars | Amount | Particulars | Amount |

| To Land & Building | By Provision for Doubtful Debts A/c | ||

| To Plant & Machinery | By Sundry Creditors A/c | ||

| To Furniture | By Bills Payable A/c | ||

| To Debtors | By Outstanding Expenses A/c | ||

| To Goodwill A/c | By Bank Loan, Overdraft, Cash Credit A/c | ||

| To Investment A/c | By Bank/ Cash A/c (Assets realized): | ||

| To Bank/ Cash A/c (Liabilities Paid): | Land and Building | ||

| Sundry Creditors | Plant and Machinery | ||

| Bill Payable | Furniture | ||

| Outstanding Expenses | Stock | ||

| Bank Loan, | Debtors | ||

| Overdraft, | Bad Debts recovered | ||

| Cash Credit | Investment | ||

| To Bank/ Cash A/c | By Partner’s Capital A/cs | ||

| (Realisation Expenses) | (assets taken over) | ||

| To Partner’s Capital A/c | By Partner’s Capital A/cs | ||

| (Realisation Expenses) | (Loss on Realisation) | ||

| To Partner’s Capital A/cs | |||

| (Profit on Realisation) | |||

| Total | Total |

See less

Dissolution of partnership means partnership coming to an end while the firm still stands. Various reasons for the dissolution of partnership could be: Admission of a partner Death of a partner Retirement of a partner Dissolution of firm In the event of the above cases, the existing partnership is dRead more

Dissolution of partnership means partnership coming to an end while the firm still stands. Various reasons for the dissolution of partnership could be:

In the event of the above cases, the existing partnership is dissolved and a new partnership is created with the new partners without affecting the firm.

A new partnership deed is created, in case there is a partnership deed agreed among partners and new profit-sharing ratios among the partners are decided, while the assets and liabilities of the firm remain the same.

Dissolution of a firm means the firm no longer exists. Various reasons for the dissolution of a partnership firm could be:

A partnership firm is dissolved by a court of law when there has been a non-compliance of law, the firm is engaged in illegal practices, or that the court’s opinion is that it is in the public interest for the firm to be dissolved.

The partnership is also dissolved with the dissolution of the firm but the converse need not be true.

When a firm is dissolved, there is a sequence that is followed to pay creditors and partners.

Dissolution of the firm can be done by the partners themselves and they could also appoint a third person to do so on the payment of fees, charges, the proportion of surplus, or any contract that has been agreed to.

To summarize, we can a draw a difference table as follows:

· Admission

· Retirement

· Death

· By court

· Mutual decision of partners