A) No entries made at all in the general ledger for items paid by petty cash B) The same number of entries in the general ledger. C) Fewer entries made in the ...

In accounting, sales returns are the goods returned by the customer to the seller. This can be due to goods delivered is damaged or defective. A return can also be due to late delivery, or the wrong items being sent to the buyer. Sales return is a subsidiary book in which all the details are recordeRead more

In accounting, sales returns are the goods returned by the customer to the seller. This can be due to goods delivered is damaged or defective. A return can also be due to late delivery, or the wrong items being sent to the buyer.

Sales return is a subsidiary book in which all the details are recorded for the goods returned which were sold on credit. It is also known as return inwards.

Accounting for Sales Return

Whenever there is a sale return, the seller will debit the sales return account and credit the debtor’s account. The total amount of sales returns is deducted from the gross sales for the period giving the figure for net sales. Debtor’s account is credited because the amount receivable from debtors will reduce.

The sales return is a contra account to the sales.

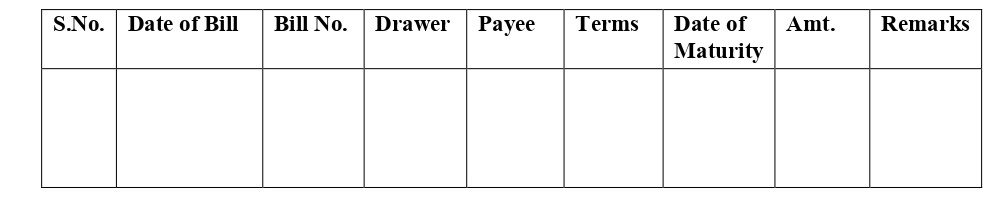

Format of sales return book:

In the above format, a credit note is a statement prepared by the seller and sent to the buyer. In this statement, all the details are mentioned in respect of the goods sent by the buyer and are an indication that the buyer’s account is credited in respect of the goods received.

For example, Mr. A sold goods to Mr. B costing Rs 50,000 on 1 December. On 5 December, goods amounting to Rs 15,000 were found defective and were returned immediately to Mr. A.

Mr. A will account for this in the following way:

See less

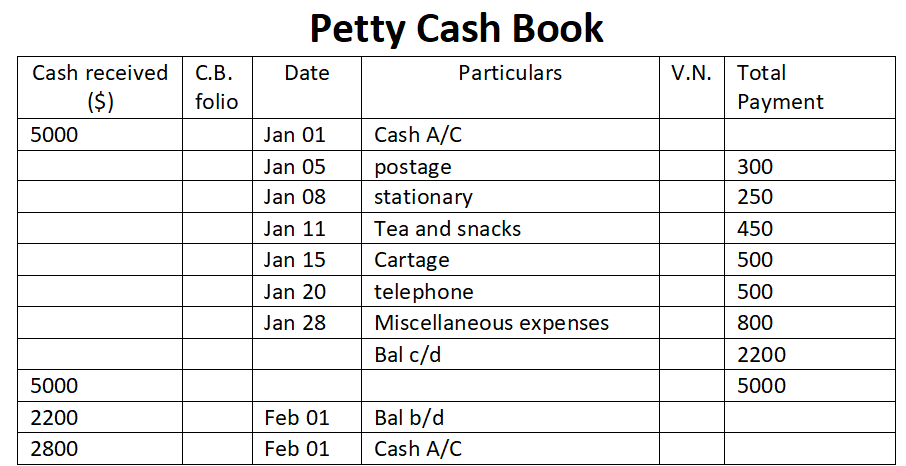

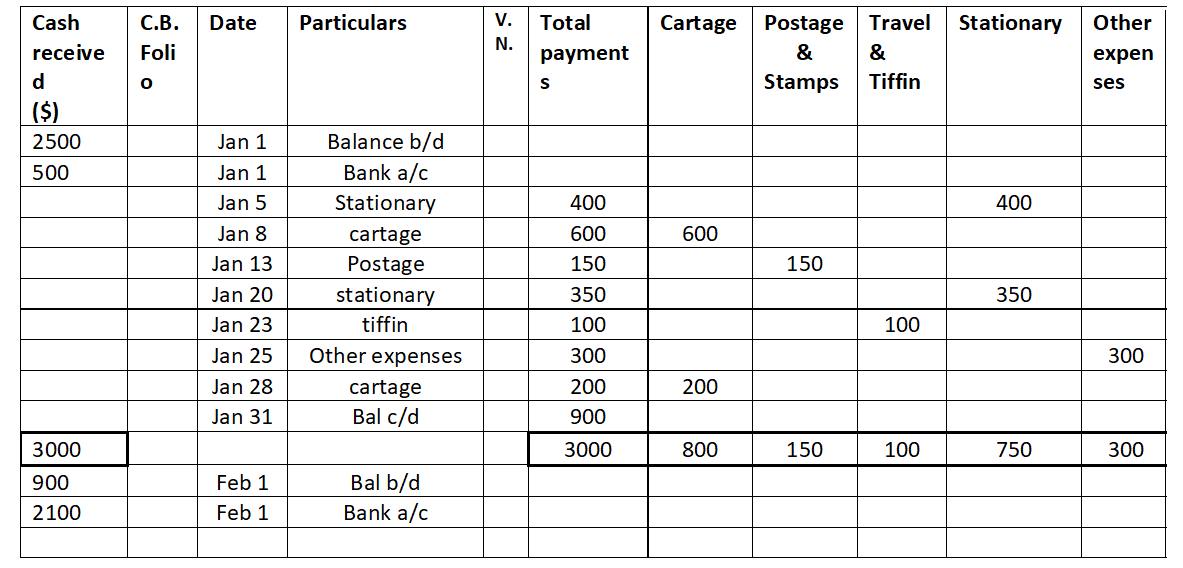

The correct option is D) Fewer entries in the general ledger To understand why option D is correct, we need to understand the concept. Petty cashbook is a special cashbook prepared for recording petty or small cash expenses. The benefit is that the chief cashier can focus on large cash and bank tranRead more

The correct option is D) Fewer entries in the general ledger

To understand why option D is correct, we need to understand the concept.

Option A ‘No entries made at all in the general ledger for items paid by petty cash ‘ is wrong. It is not possible to omit entries of petty expense just because there is a petty cashbook. There will be entries related to:

Petty cash A/c Dr. Amt

To Cash A/c Amt

Option (B) ‘The same number of entries in the general ledger is wrong because there can never be the same number of entries as all the petty expenses are recorded in the petty cashbook and only the entries for transfer of cash to the petty cashier is recorded in the main cash book.

Option D ‘More entries made in the general ledger’ is wrong because the number of entries actually reduce as only petty cash transfer entries are recorded in the main cashbook instead of numerous entries of petty cash transactions.

See less