Tally ERP does not have a voucher for recording closing stock journal entries. It automatically calculates closing stock and reports it in the Profit and Loss account and Balance sheet. However, Tally do have vouchers through which you can adjust the closing stock to be shown at the end of the year.Read more

Tally ERP does not have a voucher for recording closing stock journal entries. It automatically calculates closing stock and reports it in the Profit and Loss account and Balance sheet.

However, Tally do have vouchers through which you can adjust the closing stock to be shown at the end of the year.

Explanation

Tally, as we know is an ERP which can automate many aspects of accounting like calculation of ledger balance, creation of trial balance, financial statements and other reports. Only the data entry in vouchers is done manually.

Tally also calculates closing stock automatically because it already has the required data to do so.

Closing stock = Opening stock + Purchase – Cost of goods sold.

Using the above formula, Tally automatically calculates the closing stock.

But it may happen that the closing stock as per Tally and closing stock as per physical verification of stock do not match.

This may be due to damaged caused to some items of inventory or even theft of inventory items which is usually discovered when stock is physically checked and counted at the end of the financial year.

In that case, we can use the Physical Stock voucher to correct our closing stock in Tally.

Physical Stock Voucher

A physical Stock voucher is an inventory voucher which is used to adjust the amount of closing stock as per the physical stock verified at the end of the year.

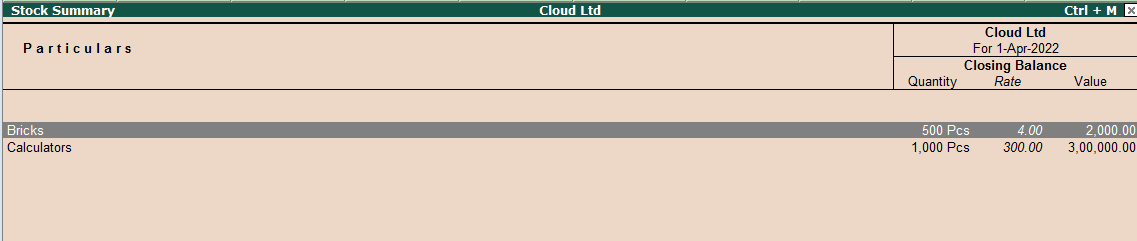

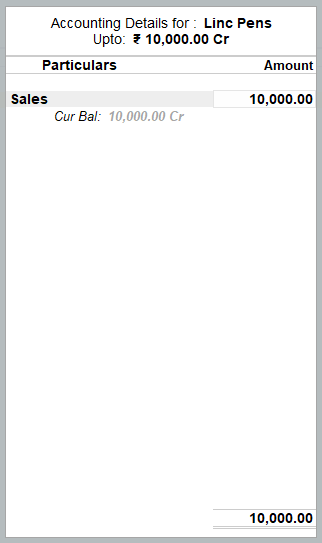

Suppose, if the closing stock for Bricks is 500pcs. Like in my stock summary, the item ‘Bricks’ is shown in the image below:

But after physical verification, it was found that there around there are only 450pcs of whole bricks are there. The rest of the bricks were broken.

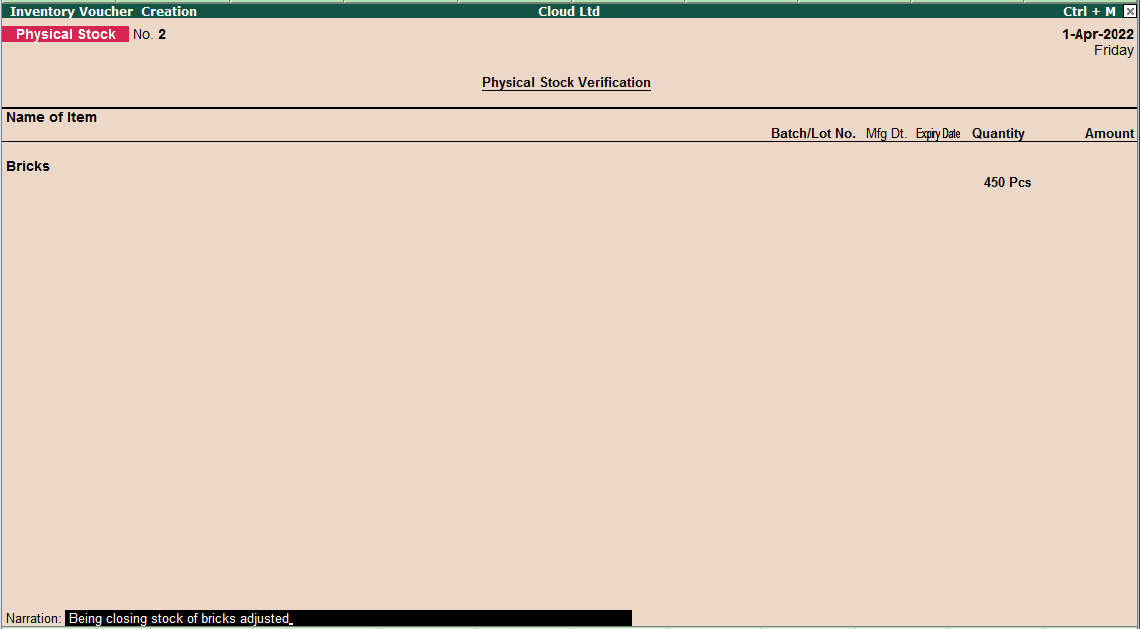

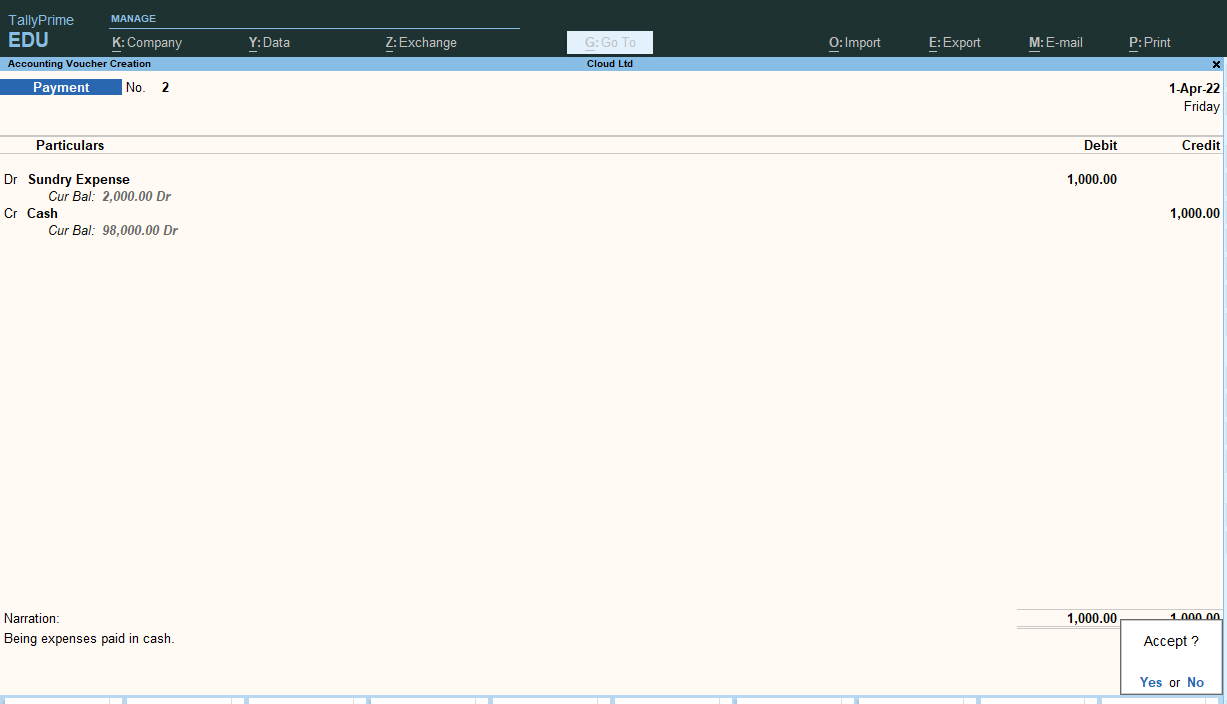

To rectify this, we will open a Physical Stock voucher.

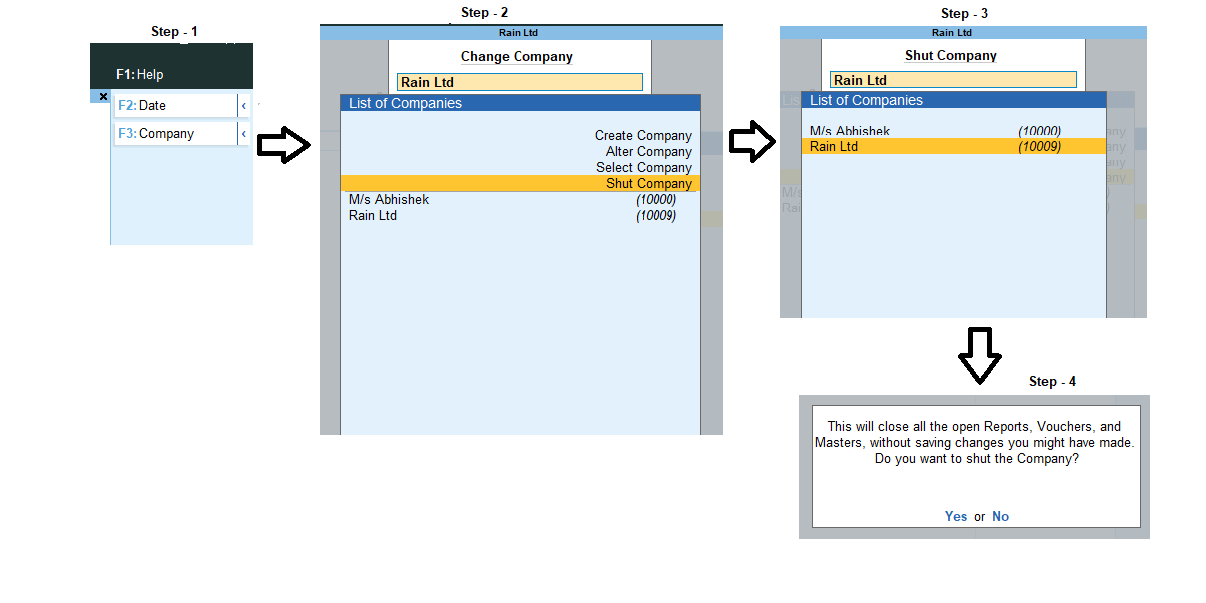

The steps to open a Physical stock voucher are as follows:

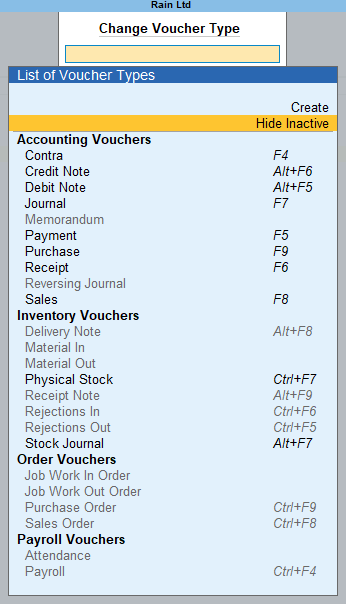

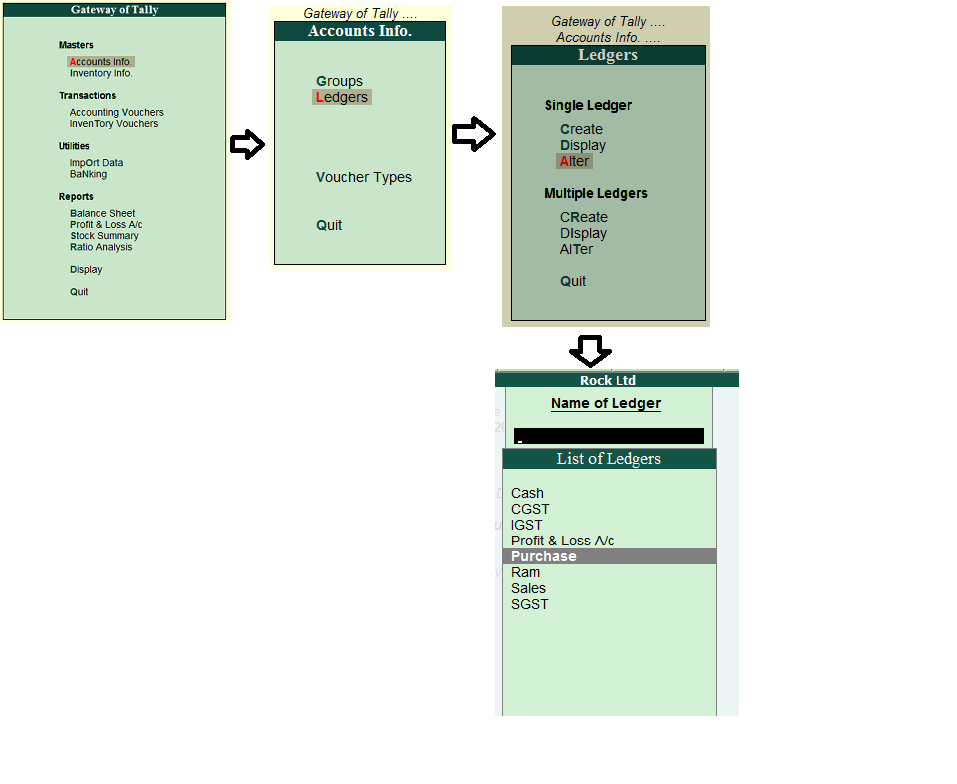

In Tally ERP 9 : Gateway of Tally → Accounting Vouchers → Press Alt + F10

In the physical stock voucher, we will select the stock item and enter the correct quantity, which is 450pcs.

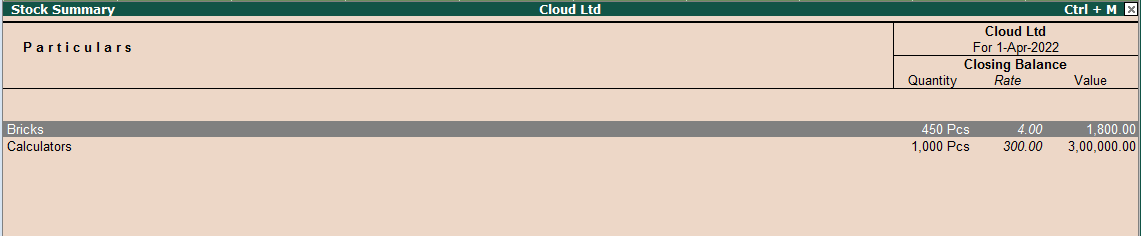

After entering the details above, accept the voucher and open the stock summary again from Gateway of Tally. It will show the Bricks at 450pcs.

Hence, this is how we can adjust our closing stock in Tally.

See less

GST stand for Goods and Services Tax which is levied on almost all the good and services supplied in India. Generally, a business is required to charge GST on all the goods and services supplied by it if its turnover is over the limit as prescribed by respective GST laws. We can also do accounting fRead more

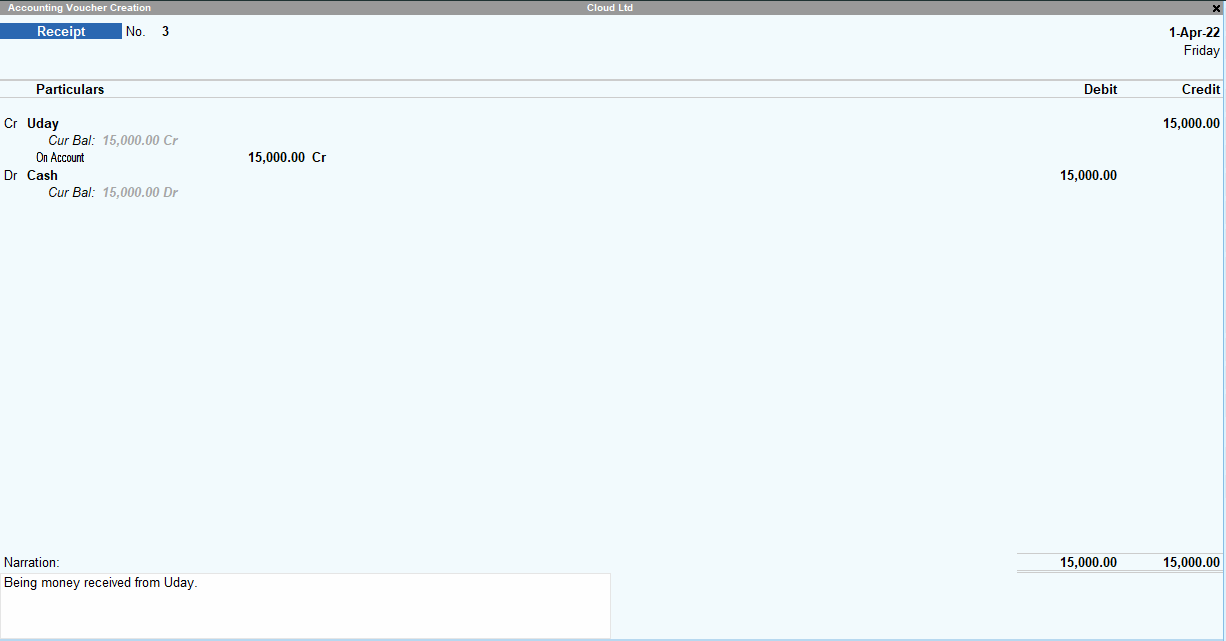

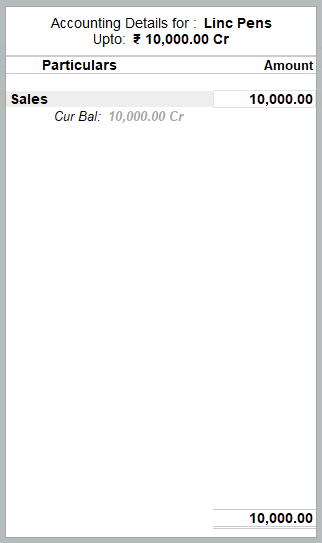

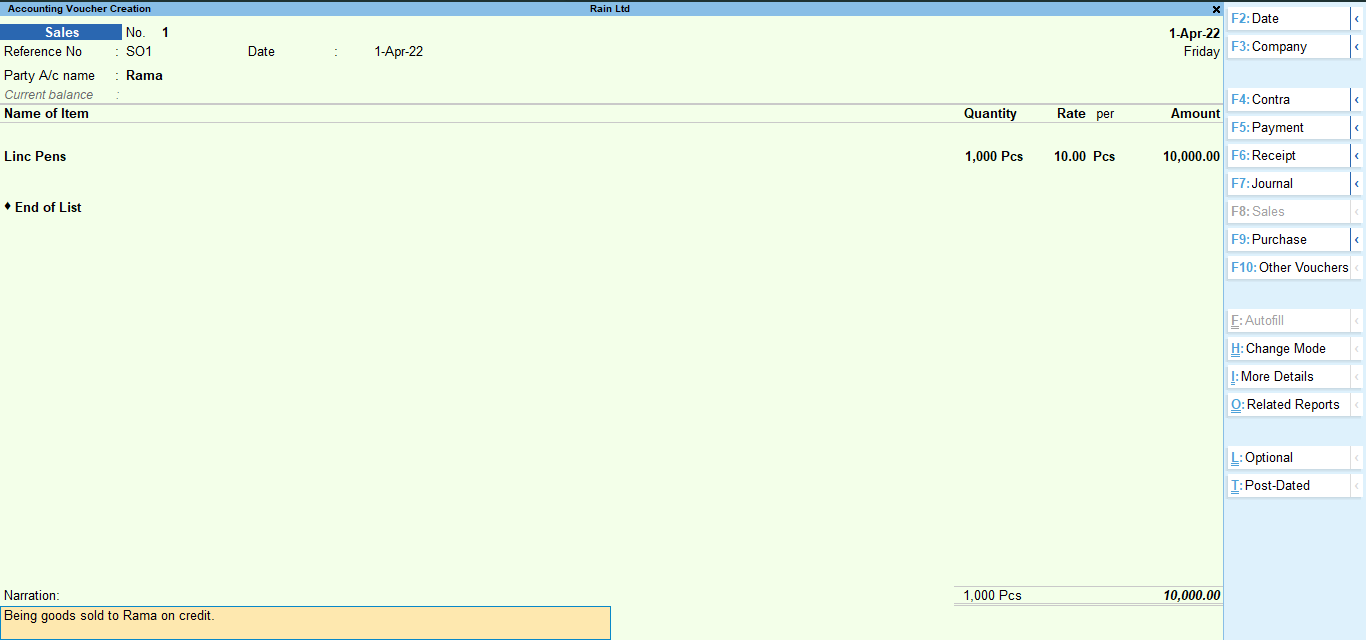

GST stand for Goods and Services Tax which is levied on almost all the good and services supplied in India. Generally, a business is required to charge GST on all the goods and services supplied by it if its turnover is over the limit as prescribed by respective GST laws.

We can also do accounting for GST in Tally by enabling it from the company features.

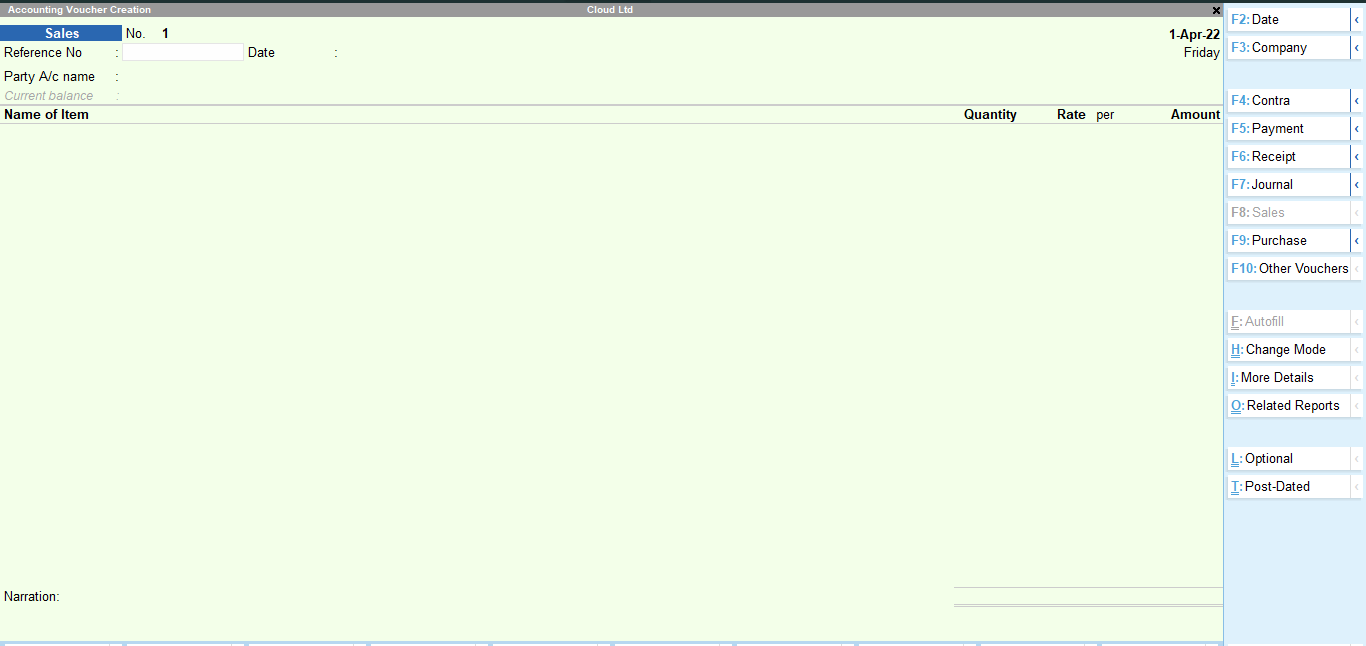

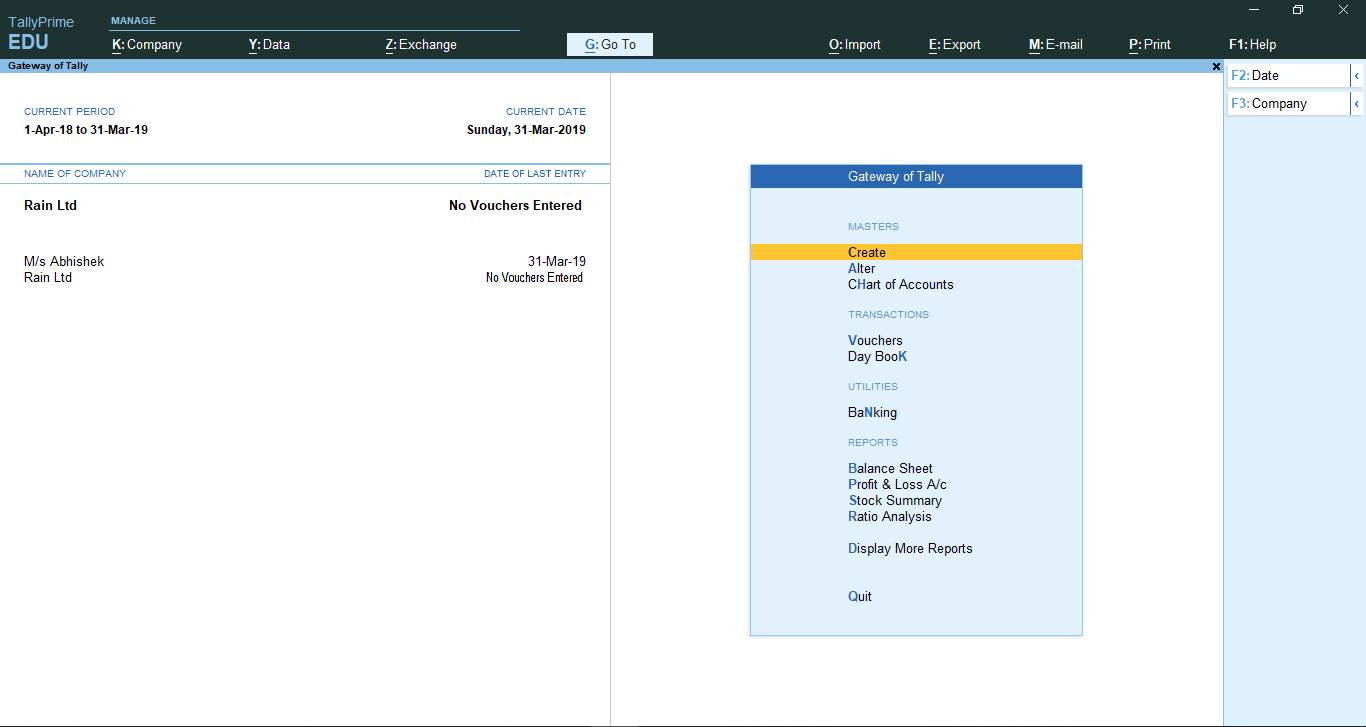

The steps to enable GST and perform GST accounting in Tally are as given below.

Enabling GST in Tally

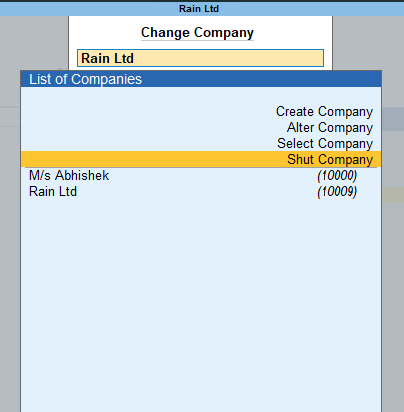

GST can be enabled in Tally from the ‘Company features’ menu which opens just after the creation of a company. There is an option called ‘Enable Goods and Services Tax (GST)’. You have to enter ‘Yes’.

If the company is already created and the GST was not enabled earlier, then just press F11 and select the company for which you want to enable GST. The ‘company features’ menu will open again, from there you have to enter ‘Yes’ beside the ‘Enable Goods and Services Tax (GST)’ option.

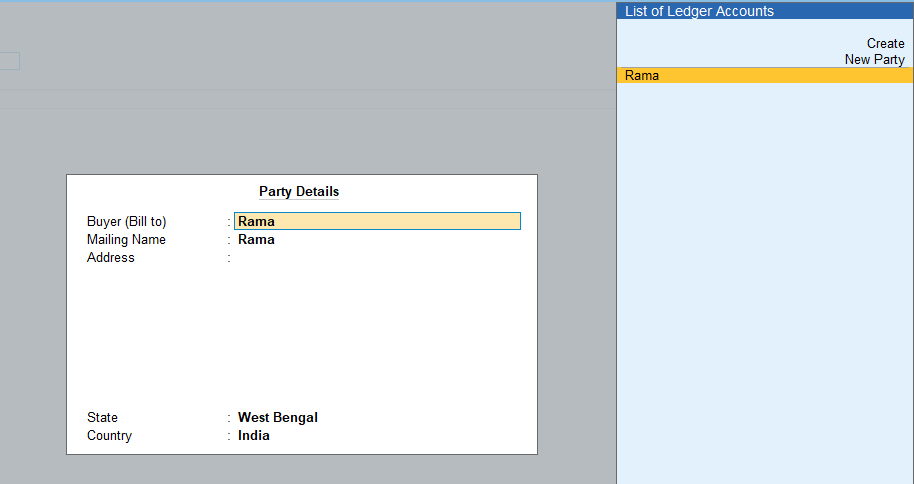

In both cases, this menu will open:

Do have look at the details I have filled in. You have to:

These settings are enough if you are to just practice GST in Tally.

See less