Revenue and income are two accounting terms that are often used interchangeably. However, it is important to understand that these two terms are different. Let us know the difference between the two through the discussion below: What is Revenue? Revenue is the total amount of a business's sales. ItRead more

Revenue and income are two accounting terms that are often used interchangeably. However, it is important to understand that these two terms are different. Let us know the difference between the two through the discussion below:

What is Revenue?

Revenue is the total amount of a business’s sales. It is the total amount earned by a business before deducting any expenses. Revenue is recognized in accounting as soon as a sale happens, even if the payment hasn’t been received yet.

For example, XYZ Ltd sold 100 pens at a selling price of 10 per pen. The total revenue of the business is hence 1,000.

What is Income?

Income is the amount earned by a business after deducting any direct or indirect expenses. It is the amount that is left after subtracting all expenses, taxes and other costs from Revenue.

Which is a broader term between the two?

Revenue is a broader term as it includes the total earnings a business generates before deducting any expenses. It includes all sales of goods or services during a specific period.

On the other hand, income is calculated after deducting certain expenses like taxes, interest, etc. This makes it more specific and refined than revenue.

Revenue provides a measure of a company’s ability to generate sales and income reflects the efficiency in managing costs and generating profits.

See less

The term ‘contra’ means 'opposite'. Therefore, a contra revenue account is an account that is opposite of the revenue accounts of a business i.e. sales account. It has the opposite balance of the revenue account i.e. debit balance. The purpose of the contra revenue account is to ascertain the actuaRead more

The term ‘contra’ means ‘opposite’. Therefore, a contra revenue account is an account that is opposite of the revenue accounts of a business i.e. sales account. It has the opposite balance of the revenue account i.e. debit balance.

The purpose of the contra revenue account is to ascertain the actual amount of sales and record the items which have reduced the sales.

These are the contra revenue accounts commonly seen in businesses:

The total sales return is deducted from the sales in the balance sheet. Though being opposite of the sales account, the sale return account is not an expense account. It is considered an indirect loss as it reduces sales.

Sales discount is an expense hence it is debited to the profit and loss account.

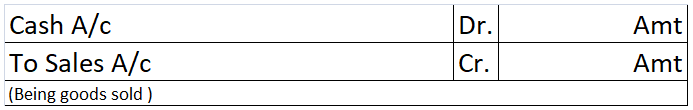

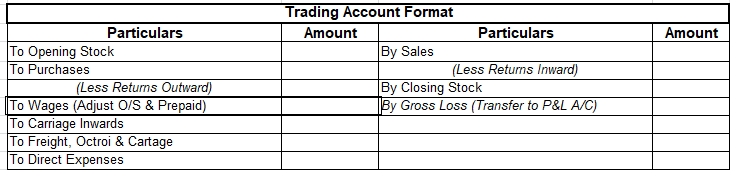

Sales returns and sales discounts are shown in the trading and profit and loss account in the following manner:

See less