A profit and loss account is a financial statement which shows the net profit or net loss of an enterprise for an accounting period. It reports all the indirect expenses and indirect income including gross profit or loss derived from trading accounts for an accounting period. When the total revenueRead more

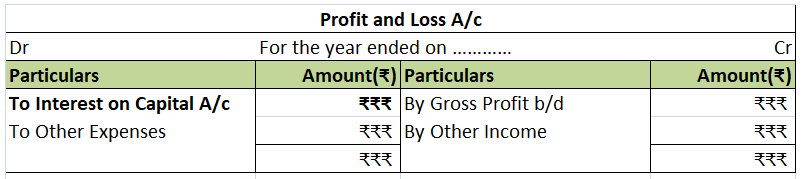

A profit and loss account is a financial statement which shows the net profit or net loss of an enterprise for an accounting period. It reports all the indirect expenses and indirect income including gross profit or loss derived from trading accounts for an accounting period.

When the total revenue i.e. credit side of profit and loss a/c is more than the total of expenses i.e. the debit side of profit and loss a/c, it results in net profit whereas when the total revenue is less than the total of expenses, it results in a net loss.

The debit balance of the profit and loss account is the net loss incurred during the accounting period by an enterprise. It is transferred to a capital account thereby reducing the capital or can be shown as a debit balance on the asset side.

Accounting entry for loss transferred is as follows :

Capital A/c …Dr.

To Profit & Loss A/c

(being net loss transferred to capital account)

Example

A Business has a total income of $50,000 in an accounting year and has expenses amounting to $60,000 in that particular year. The profit and loss account will show a net loss of $10,000 ($60,000-50,000). Net loss will be transferred to capital A/c. Capital of the business will be reduced by $10,000. This loss can also be shown on the asset side of the balance sheet.

Extract of a Profit and loss a/c showing net loss is as under:

Profit and loss A/c for the year ended …..

| Particulars | Amount (Dr.) | Particulars | Amount (Cr.) |

| To gross loss b/d | xxx | By gross profit b/d | xxx |

| To salaries | xxx | By bank interest | xxx |

| To office rent | xxx | By commission received | xxx |

| To printing and stationery | xxx | By rent received | xxx |

| To insurance | xxx | By dividend | xxx |

| To audit fees | xxx | By profit on sale of asset | xxx |

| To electricity chares | xxx | By Net Loss | xxx |

| To depreciation | xxx | ||

| To bad debts | xxx | ||

| To bank charges | xxx | ||

| To miscellaneous expenditure | xxx | ||

| To interest on loans | xxx | ||

| Total | xxx |

The debit balance for a non-corporate entity is shown as a reduction from the capital account

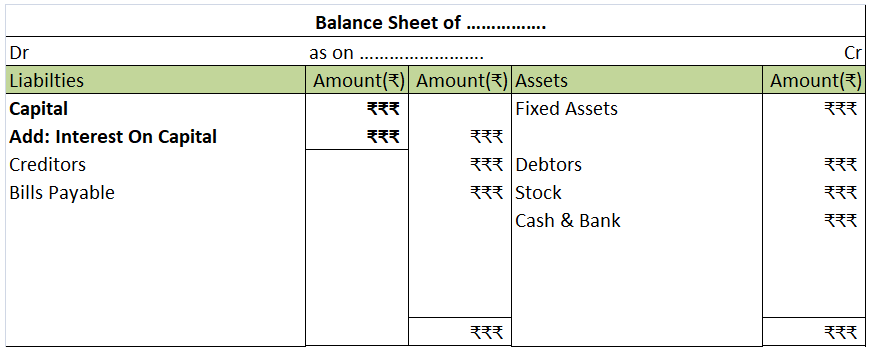

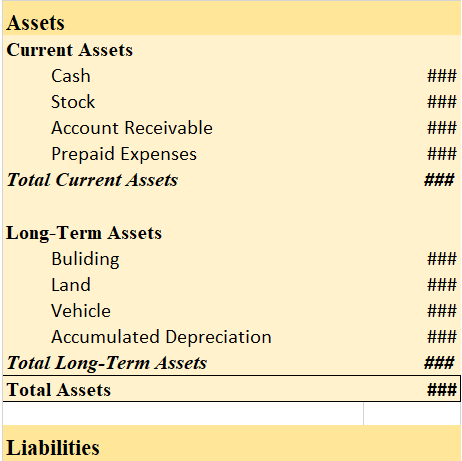

Extract of the Balance sheet showing the debit balance of Profit & Loss A/c is as under :

Balance Sheet as on…

| Liabilities | Amount |

| Equity and liabilities | |

| Capital

Less: Profit & Loss A/c |

While the Debit balance of profit and Loss A/c of a corporate entity is shown as a reduction in Reserves and surplus. If the business doesn’t have reserves then the debit balance is shown on the asset side.

Extract of the Balance sheet showing the debit balance of Profit & Loss A/c is as under :

Balance Sheet as on..

| Liabilities | Amount |

| Equity and liabilities | |

| Reserves And Surplus

Less: Profit & Loss A/c |

Conclusion: Debit balance of profit and loss a/c represents that expenses are more than the income of a business in an accounting period. Debit balance of profit and loss a/c indicates that company need to increase its income or cut down on unnecessary expenses.

The business needs to find out the reason of excessive expenses because accumulated losses are not good for the health of the company.

See less

A Cash Flow Statement analyzes the effect of various activities in the company on cash and, that is, it shows the inflow and outflow of cash and cash equivalents. A Fund Flow Statement analyzes the financial position of a company by the inflow and outflow of funds. Both the statements are financialRead more

A Cash Flow Statement analyzes the effect of various activities in the company on cash and, that is, it shows the inflow and outflow of cash and cash equivalents.

A Fund Flow Statement analyzes the financial position of a company by the inflow and outflow of funds.

Both the statements are financial statements and are used to analyze the financial performance of the company of two different reporting periods. Both the statements record the inflow and outflow of cash or funds, as the case may be.

The primary objective of preparing a Cash Flow Statement is to gain an understanding of the changes in the net working capital of the company and to classify the activities in the company under three different heads which helps in better analysis of Financial Statements for management, outsiders, and investors.

The primary objective of preparing a Fund Flow Statement is to track the movements of funds in the company, as the extent of use of long-term and short-term borrowings, frequency of their procurement, its application, etc.

The components of the Cash Flow Statement are:

The components of the Fund Flow Statement are:

Sources of Funds:

Application of Funds:

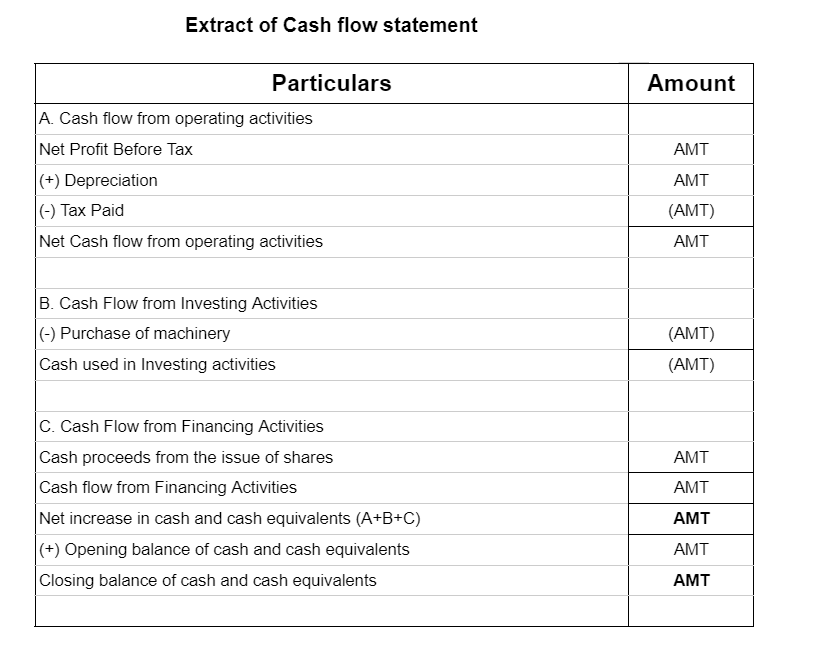

A sample format of the Cash Flow Statement will be:

A sample format of the Fund Flow Statement will be:

To conclude the difference between Fund Flow and Cash Flow Statement will be:

· Sources of Funds

· Application of Funds

See less