Any person, company, or organization that owes us money is a debtor. The amount that is owed to us is called debt. When you are unsure if a debtor is going to pay back the amount owed to you, then a provision for doubtful debts is created. Here, the debtor may or may not pay back the amount owed. WhRead more

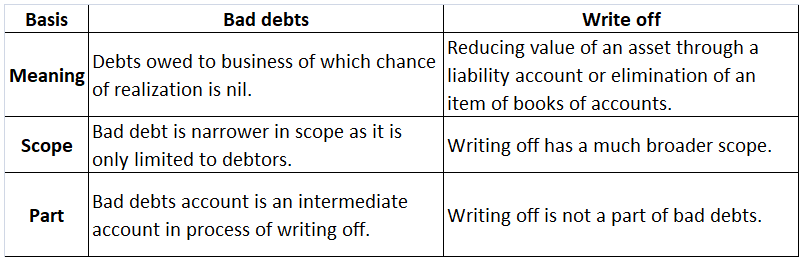

Any person, company, or organization that owes us money is a debtor. The amount that is owed to us is called debt. When you are unsure if a debtor is going to pay back the amount owed to you, then a provision for doubtful debts is created. Here, the debtor may or may not pay back the amount owed. When the debts owed to us is irrecoverable, it is termed as bad debts.

Provision for doubtful debts may become a bad debt at some point. Usually, companies keep a small portion of their debtors as a provision for doubtful debts in accordance with the prudence concept that tells us to account for all possible losses. Provision for doubtful debts is a liability whereas bad debts are recorded as an expense.

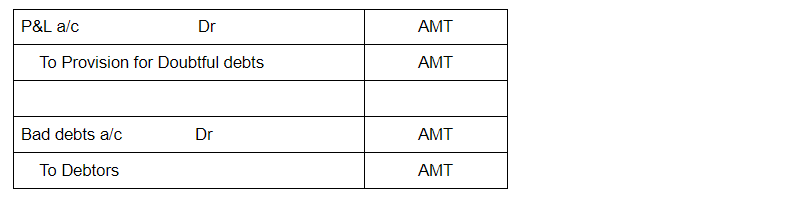

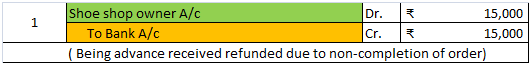

Journal entries for Doubtful debts and bad debts are as follows:

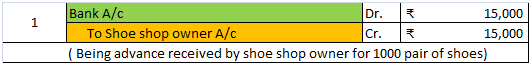

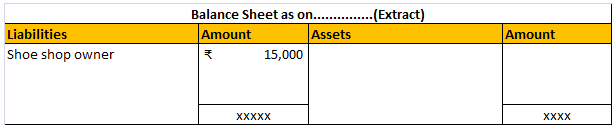

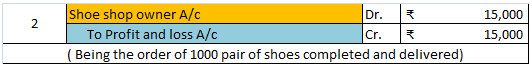

EXAMPLE

If the balance in the debtors’ account shows an amount of Rs 20,000 and 5% of debtors are treated as doubtful, then Rs 1,000 is recorded as a provision for doubtful debts. This amount is deducted from debtors in the balance sheet.

Now if Rs 400 was recorded as actual bad debts, then it is deducted from the provision for doubtful debts instead of debtors. Further another 400 is added back to provision for doubtful debts to maintain the percentage.

See less

Fictitious assets are not actually assets. They are expenses/losses not written off in the year in which they are incurred. They do not have any physical presence. Their expense is spread over more than one accounting period. A part of the expense is amortized/written off every year against the compRead more

Fictitious assets are not actually assets. They are expenses/losses not written off in the year in which they are incurred. They do not have any physical presence. Their expense is spread over more than one accounting period.

A part of the expense is amortized/written off every year against the company’s earnings. The remaining part (which is yet to be written off) is shown as an asset in the balance sheet. They are shown as assets because these expenses are expected to give returns to the company over a period of time.

Here are some examples of fictitious assets:

To make it simple I’ll explain the accounting treatment of preliminary expenses with an example.

The promoters of KL Ltd. paid 50,000 as consultation fees for incorporating the company. The consultation fee is a preliminary expense as they are incurred for the formation of the company. The company agreed to write off this expense over a period of 5 years.

At the end of every year, the company will write off 10,000 (50,000/5) as an expense in the Profit & Loss A/c.

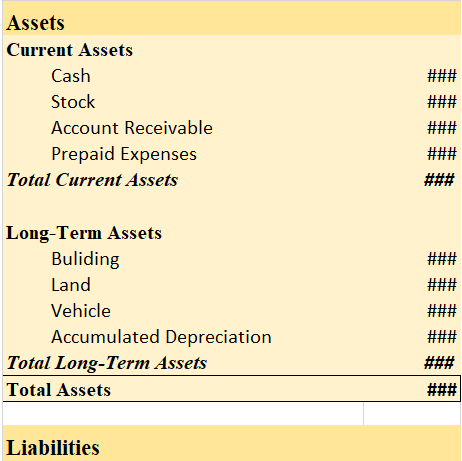

The remaining portion i.e. 40,000 (50,000 – 10,000) will be shown on the Assets side of the Balance Sheet under the head Non – Current Assets and sub-head Other Non – Current Assets.

Here are the financial statements of KL Ltd.,

Note: As per AS 26 preliminary expenses are fully written off in the year they are incurred. This is because such expenses do not meet the definition of assets and must be written off in the year of incurring.

Source: Some fictitious assets examples are from Accountingcapital.com & others from Wikipedia.

See less