General reserve is the part of profits or money kept aside to meet future uncertainties and obligations of the entity. General reserve is created out of revenue profits for unspecified purposes and therefore is also a part of free reserves. General reserve forms a part of the Profit & Loss ApprRead more

General reserve is the part of profits or money kept aside to meet future uncertainties and obligations of the entity. General reserve is created out of revenue profits for unspecified purposes and therefore is also a part of free reserves.

General reserve forms a part of the Profit & Loss Appropriation account and is created to strengthen the financial position of the entity and serves as a sources of internal financing. It is upon the discretion of the management as to how much of a reserve is to be created. No reserve is created when the entity incurs losses.

General reserve is shown in the Reserves & Surplus head on the liability side of the balance sheet of the entity and carries a credit balance.

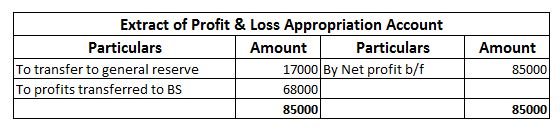

Suppose, an entity, ABC Ltd engaged in the business of electronics earns a profit of 85000 in the current financial year and has an existing general reserve amounting to 100000. The management decides to keep aside 20% of its profits as general reserve.

Then the amount to be transferred to general reserve will be = 85000*20% = 17000.

In the financial statements it will be shown as follows-

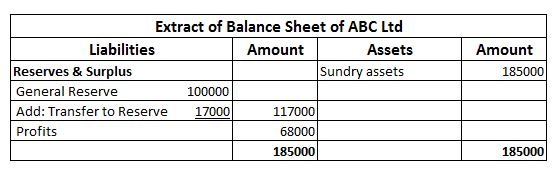

Now, in the next financial year, the entity incurs losses amounting to 45000. In this case, no amount shall be transferred to the general reserve of the entity and will be shown in the financial statement as follows-

The creation of general reserve can sometimes be deceiving since it does not show the clear picture of the entity and absorbs losses incurred.

See less

Non-debt capital receipts As we're aware, there are two main sources of the government’s income — revenue receipts and capital receipts. Revenue receipts are all those receipts that neither create any liability nor cause any reduction in assets for the government, whereas, capital receipts are thoseRead more

Non-debt capital receipts

As we’re aware, there are two main sources of the government’s income — revenue receipts and capital receipts. Revenue receipts are all those receipts that neither create any liability nor cause any reduction in assets for the government, whereas, capital receipts are those money receipts of the government that either create a liability for a government or cause a reduction in assets.

Revenue receipts comprise both tax and non-tax revenues while capital receipts consist of capital receipts and non-debt capital receipts. Non-debt capital receipt is a part of capital receipt.

Definition

Non-debt capital receipts, also known as NDCR, are the taxes and duties levied by the government forming the biggest source of its income. Those receipts of the government lead to a decrease in assets, and not an increase in liabilities. It accounts for just 3% of the central government’s total receipts.

The union government usually lists non-debt capital receipts in two categories:

For Example – Disinvestment and recovery of loans are non-debt creating capital receipts.

See less