Assets can be classified as Financial or Non-financial assets. One might wonder why this is necessary. Let us dive into this concept, beginning with understanding what financial and non-financial assets are and why they are classified as such. What are Assets? Assets are things that have a monetaryRead more

Assets can be classified as Financial or Non-financial assets. One might wonder why this is necessary. Let us dive into this concept, beginning with understanding what financial and non-financial assets are and why they are classified as such.

What are Assets?

Assets are things that have a monetary value and are beneficial for a business. Assets are commonly classified as tangible, intangible, current, fixed, financial, non-financial, etc.

Plant and machinery, land, buildings, cash, bank balance, patents, etc are some of the examples of assets that a business has.

What are Financial Assets?

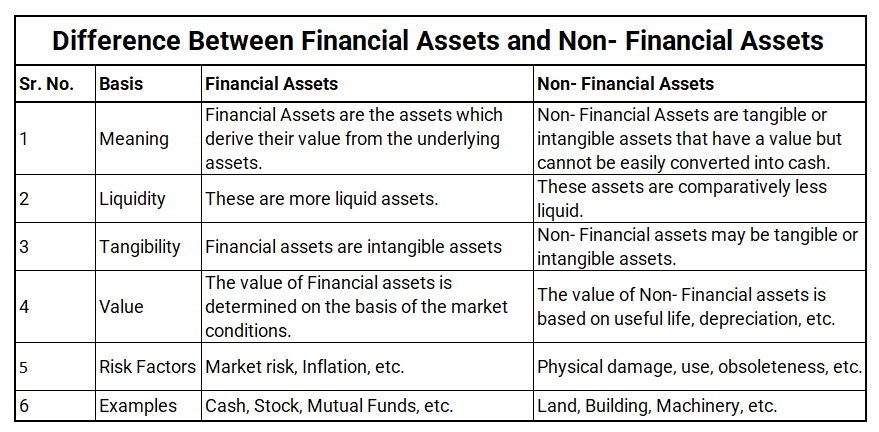

Financial assets are the things of value that are held by a person for their underlying value. They are intangible and do not have a physical form. For example – Stocks, bonds, debentures, options, futures, etc.

The value of these assets may change over time depending upon the market conditions, changes in government policies, fluctuations in interest rates, etc.

In comparison to non-financial or physical assets, financial assets are more liquid as they can be traded and can be converted into cash.

What are Non-financial assets?

Non-financial assets are tangible or intangible assets that have a value but cannot be easily converted into cash. They are not as liquid and generally not traded.

Examples of such assets are buildings, plant and machinery, patents, trademarks, etc.

Why do we separate Financial and Non-Financial Assets?

The following are several important reasons why it is important to segregate the same:

- It helps in the proper classification of assets on the Financial Statements.

- It helps in liquidity management.

- It helps in Risk assessment.

- Tax management can be done accurately.

Difference between Financial and Non – Financial Asset

See less

Yes, Capital Work in Progress is Tangible Asset. To attain an understanding of the same, we first need to understand what are tangible assets. Assets that have a physical existence, that is they can be seen, touched are called Tangible Assets. Capital work in progress is the cost incurred on fixed aRead more

Yes, Capital Work in Progress is Tangible Asset.

To attain an understanding of the same, we first need to understand what are tangible assets. Assets that have a physical existence, that is they can be seen, touched are called Tangible Assets.

Capital work in progress is the cost incurred on fixed assets that are under construction as on the balance sheet date. Since the asset cannot be used for operation it cannot be classified as a Fixed Asset.

For example:

If an asset takes 1.5 years to be constructed as on 1.4.2020 then on the balance sheet date 31.3.2021, the cost incurred on the asset will be classified as Capital Work in Progress.

Common examples of Capital Work in Progress include immovable assets like Plant and Machinery, Buildings.

It is shown under the head Non-Current Assets in the balance sheet. Examples of cost included in Capital Work in Progress can be:

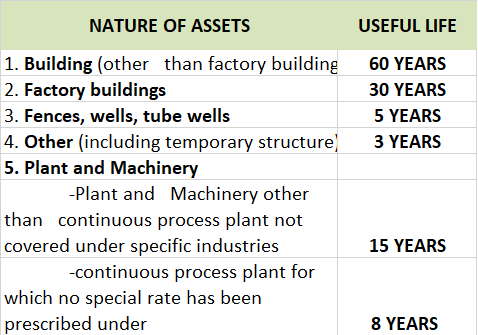

Since the assets under the head Capital Work in Progress are in the process of completion and not completed, hence they are not depreciable until completed. Once the asset is completed it is moved under the head Fixed Assets.

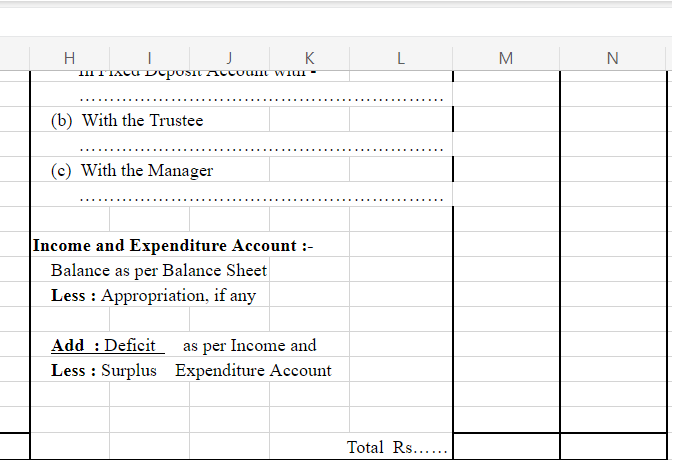

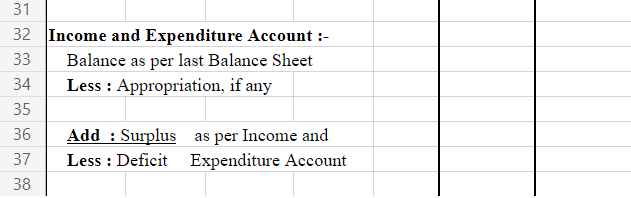

Capital Work in Progress is shown in the Balance Sheet as:

See less