Expense Expenditure: Expense expenditures refer to the costs incurred by a company in its day-to-day operations. These expenses are deducted from revenue to calculate the net income. Here are some examples of expense expenditures: Salaries and wages: The payments made to employees for their servicesRead more

Expense Expenditure:

Expense expenditures refer to the costs incurred by a company in its day-to-day operations. These expenses are deducted from revenue to calculate the net income. Here are some examples of expense expenditures:

Salaries and wages: The payments made to employees for their services are considered expense expenditures. This includes salaries, wages, bonuses, and commissions.

Rent: The cost of leasing office space or other business premises is an expense expenditure. It includes monthly rent payments, property taxes, and insurance premiums associated with the rented space.

Utilities: Expenses related to utilities such as electricity, water, gas, and internet services are considered expense expenditures.

Office supplies: The cost of purchasing and replenishing office supplies like stationery, printer ink, pens, paper, and other consumables is categorized as an expense expenditure.

Advertising and marketing: Expenditures incurred to promote a company’s products or services, such as advertising campaigns, online marketing, social media promotions, and print media advertisements, are considered expense expenditures.

Revenue Expenditure:

Revenue expenditures are expenses incurred to acquire or improve assets that are expected to generate revenue over multiple accounting periods. Unlike expense expenditures, revenue expenditures are typically not capitalized. Here are some examples of revenue expenditures:

Repairs and maintenance: Costs incurred to repair and maintain existing assets, such as machinery, equipment, and vehicles, are considered revenue expenditures. Routine maintenance expenses, like oil changes, servicing, and small repairs, fall into this category.

Software and technology upgrades: Expenses incurred to upgrade or enhance software systems, computer hardware, or other technological infrastructure are considered revenue expenditures.

Training and development: Expenditures on employee training programs, workshops, seminars, and skill development courses that enhance the productivity and capabilities of the workforce are classified as revenue expenditures.

Advertising campaigns for new products: While advertising expenses are generally classified as expense expenditures, when they are specifically related to the launch or introduction of new products or services, they can be considered revenue expenditures.

Renovation and improvements: Costs incurred to renovate or improve existing assets, such as office spaces, stores, or warehouses, can be classified as revenue expenditures if they enhance the earning capacity or extend the useful life of the asset.

These examples highlight the distinction between expense and revenue expenditures based on their purpose and treatment in financial statements.

See less

As per the companies act 2013, the rate of depreciation for cars/vehicles and their useful life is mentioned below They are categorized by the companies act as follows: when these car/ motor vehicles are owned with no intention to sell within the accounting period and are generally used to generateRead more

As per the companies act 2013, the rate of depreciation for cars/vehicles and their useful life is mentioned below

They are categorized by the companies act as follows:

Car/motor vehicles are considered as fixed tangible assets. Treatment of these cars/ motor vehicles is similar to those of other fixed assets. The depreciation will be shown as an expense in the profit and loss account and also the value of these assets will be adjusted in the balance sheet.

Explaining with a simple example: Mars.Ltd purchased a car for Rs 10,00,000, and use it for its official purpose. Its useful life as per act is taken as 6 years and the rate of depreciation as 31.23% as per the WDV method.

Therefore depreciation as per WDV is calculated as follows

Cost of car = Rs 10,00,000

Residual value = NIL

Rate of depreciation = 31.23%

depreciation for first-year = Rs (10,00,000 – NIL)*31.23%

= Rs 3,12,300

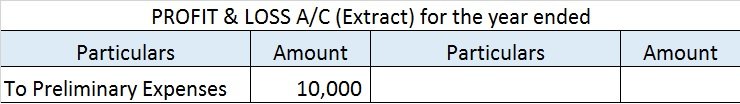

Calculated depreciation on this car will be shown in the profit and loss account as an expense and the same will be treated under the balance sheet every year. Here is the extract of profit and loss and the balance sheet for the above example.

See less