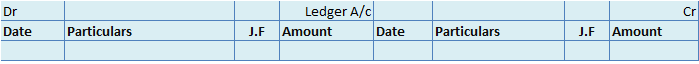

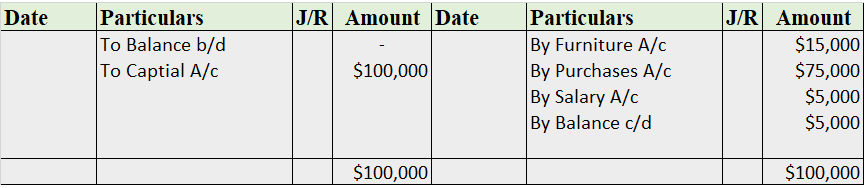

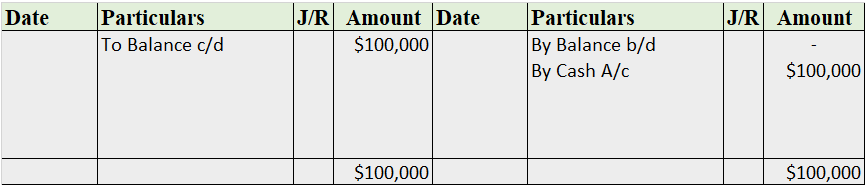

Specimen of Ledger account This is the specimen of a ledger account. J.F. here represents the journal folio. A Ledger account is an account that consists of all the business transactions that take place during the current financial year. For Example, cash, bank, machinery, A/c receivable account, etRead more

Specimen of Ledger account

This is the specimen of a ledger account. J.F. here represents the journal folio.

A Ledger account is an account that consists of all the business transactions that take place during the current financial year.

For Example, cash, bank, machinery, A/c receivable account, etc.

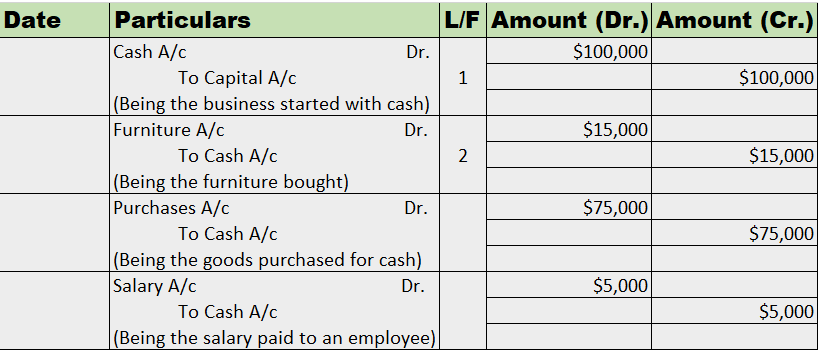

After the financial data is recorded in the Journal. It is then classified according to the nature of accounts viz. Asset, liability, expenses, revenue, and capital to be posted in the ledger account.

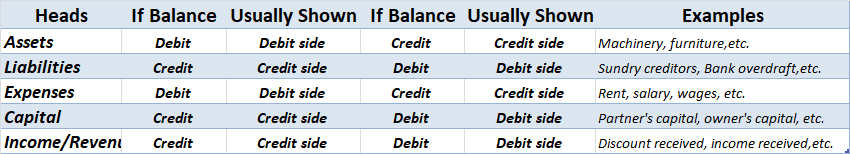

With this head, the identification as to whether the opening balance will come under the debit side or the credit side is done.

The table below would help to understand the concept of opening balance in the ledger.

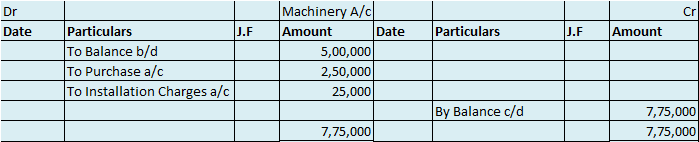

For further clarification of the concept let me give you a practical example.

Suppose, a manufacturing firm Amul purchased machinery for, say, Rs 2,50,000. The installation charges were Rs 25,000 and the opening balance of machinery during the year was Rs 5,00,000.

So as the machinery account comes under the category assets, its opening balance would come under the debit side of the ledger account.

And as purchase and installation charges mean expenses for the firm, they would also come under the debit side of the account.

And in case of any sale of a part of the machinery, it would be posted on the credit side of the account as the sales would generate revenue for the firm.

See less

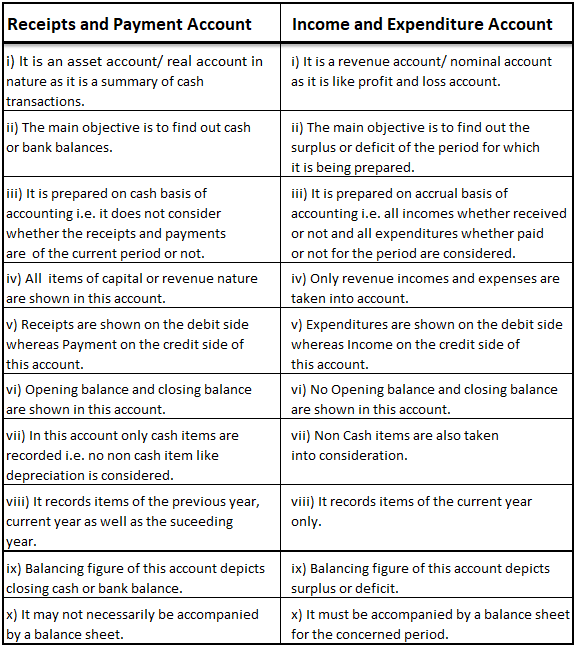

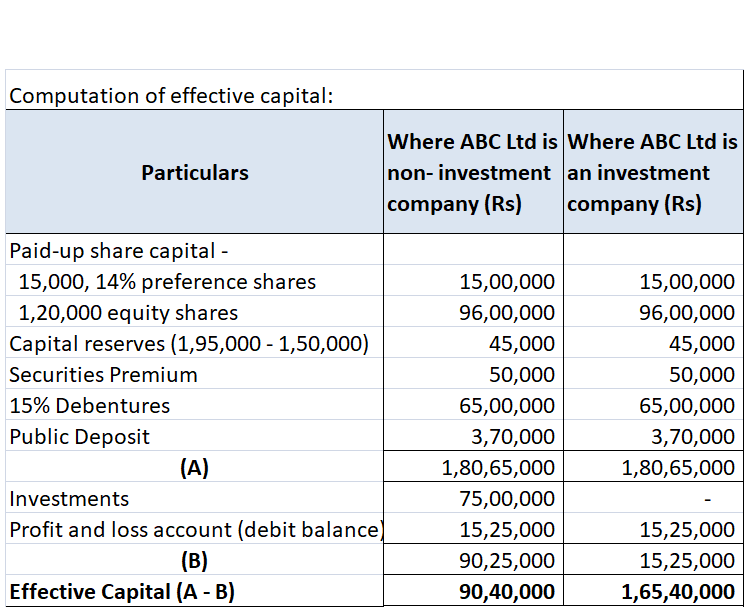

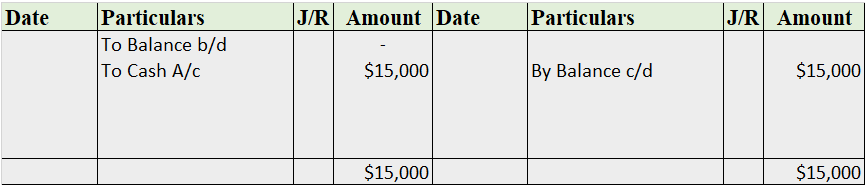

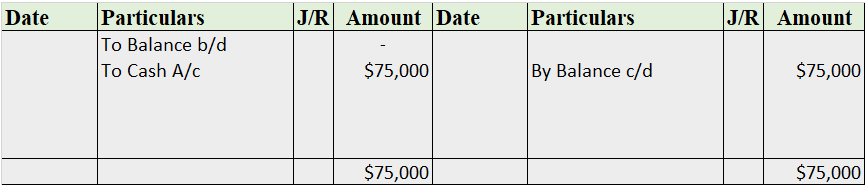

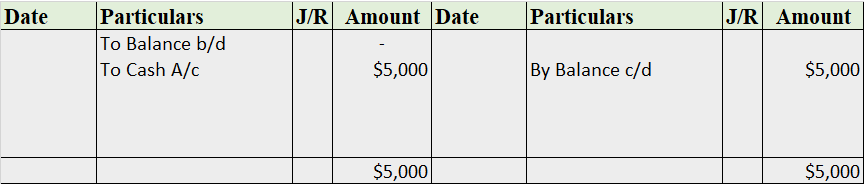

Let us first understand what working capital is. Working capital means the funds available for the day-to-day operations of an enterprise. It is a measure of a company’s liquidity and short term financial health. They are cash or mere cash resources of a business concern. It also represents the exceRead more

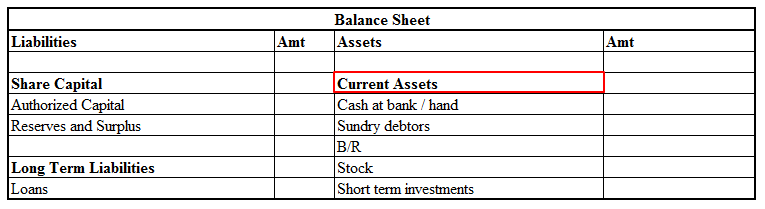

Let us first understand what working capital is.

Working capital means the funds available for the day-to-day operations of an enterprise. It is a measure of a company’s liquidity and short term financial health. They are cash or mere cash resources of a business concern.

It also represents the excess of current assets, such as cash, accounts receivable and inventories, over current liabilities, such as accounts payable and bank overdraft.

Sources of Working Capital

Any transaction that increases the amount of working capital for a company is a source of working capital.

Suppose, Amazon sells its goods for $1,000 when the cost is only $700. Then, the difference of $300 is the source of working capital as the increase in cash is greater than the decrease in inventory.

Sources of working capital can be classified as follows:

Short Term Sources

Long Term Sources

Another point I would like to add is that, although depreciation is recorded in expense and fixed assets accounts and does not affect working capital, it still needs to be accounted for when calculating working capital.

See less