Firstly, let’s understand the meaning of both terms. Revenue receipts: The term 'revenue' suggests these are the amounts received by a business due to its operating activities. These receipts arise in a recurring manner in a business. Such receipts don’t affect the balance sheet. They are shown inRead more

Firstly, let’s understand the meaning of both terms.

Revenue receipts: The term ‘revenue‘ suggests these are the amounts received by a business due to its operating activities. These receipts arise in a recurring manner in a business. Such receipts don’t affect the balance sheet. They are shown in the statement of profit or loss. Such receipts are essential for the survival of the business.

Examples of revenue receipts are as follows:

- Proceeds from the sale of goods.

- Proceeds from the provision of services

- Rent received

- Interest received from deposits in banks or financial institutions

- Discount received from creditors (shown in the debit side of P/L A/c)

Capital receipts: The term ‘capital’ that such receipts are do not arise due to operating activities, hence not shown in the Profit and loss statement. These are the money received by a business when they sell any asset or undertake any liability. These receipts do not arise in a recurring manner in a business. They don’t affect the profit or loss of the business. They are not essential for the survival of the business.

Examples of capital receipts are as follows:

- Loan from a bank or financial institution. (Increase in liabilities)

- Proceeds from the sale of an asset. (decrease in assets)

- Proceeds from sale of investments. (decrease in assets)

- Proceeds from the issue of equity shares. (Increase in liabilities)

- Proceeds from issue of debentures. (Increase in liabilities)

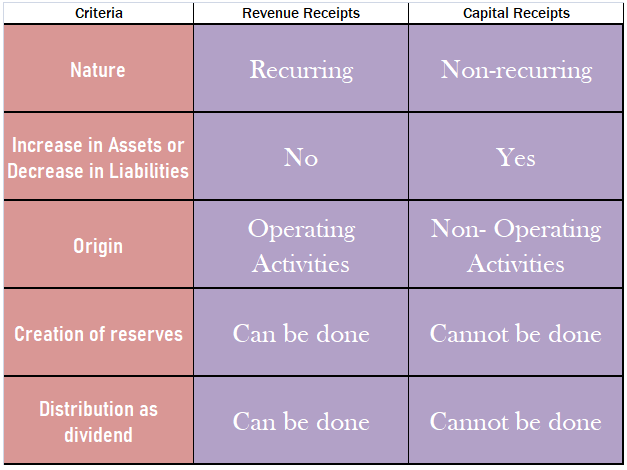

I have given a table below for more understanding:

Definition Debit balance may arise due to timing differences in which case income will be accrued at the year's end to offset the debit. The amount is shown in the record of a company s finances, by which its total debits are greater than its total credits. The account which has debit balances are aRead more

Definition

Debit balance may arise due to timing differences in which case income will be accrued at the year’s end to offset the debit.

The amount is shown in the record of a company s finances, by which its total debits are greater than its total credits.

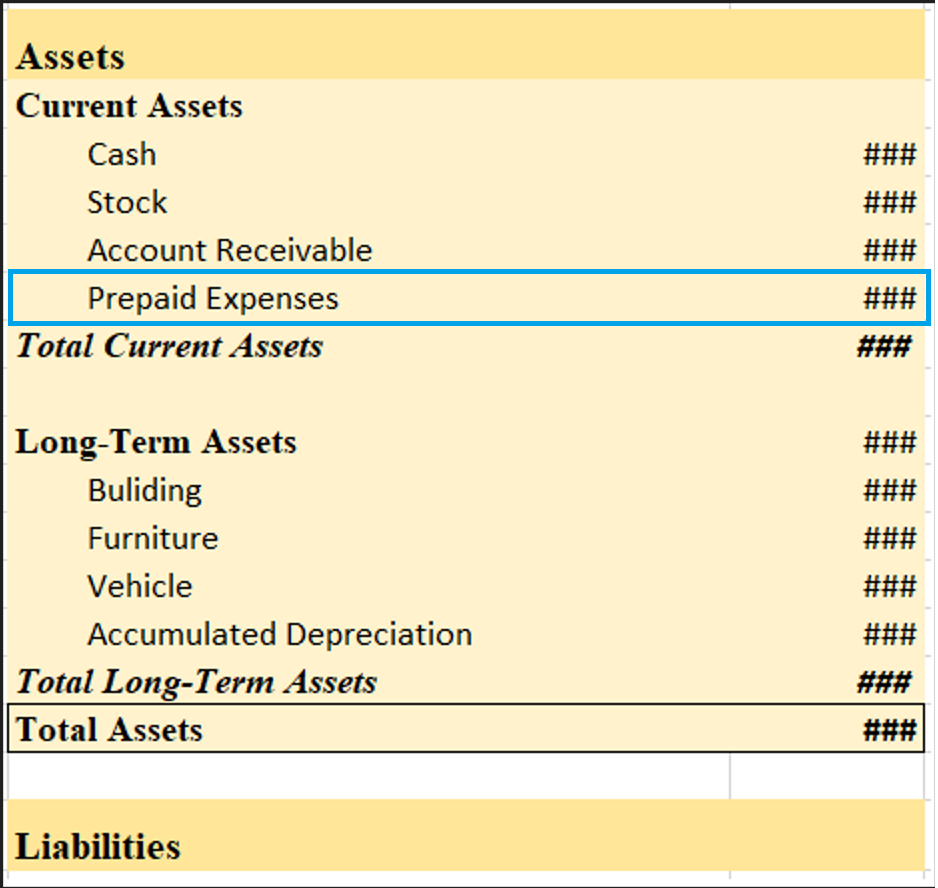

The account which has debit balances are as follows:

• Assets accounts

Land, furniture, building machinery, etc

• Expenses accounts

Salary, rent, insurance, etc

• Losses

Bad debts, loss by fire, etc

• Drawings

Personal drawings of cash or assets

• Cash and bank balances

Balances of these accounts

In class 11th, we learned about all these accounts that have debit balances.

Where the total of the debit side is more than the credit side therefore the difference is the debit balance and is placed credit side as “ by balance c/d “

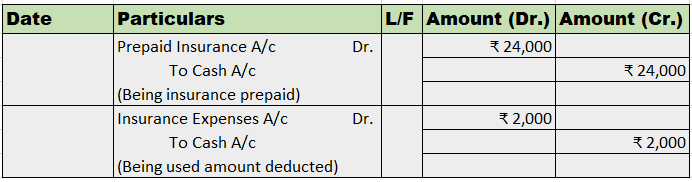

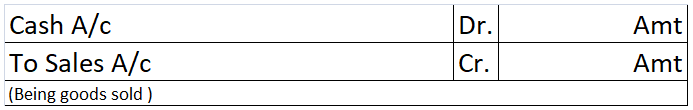

Here are some examples showing the debit balances of the accounts :

See less