Journal entry for commission earned but not received Commission earned but not received is called accrued income. As we know there are two types of accounting, cash basis of accounting, in which the transaction is recorded only when cash is received or paid, and accrual basis of accounting, in whichRead more

Journal entry for commission earned but not received

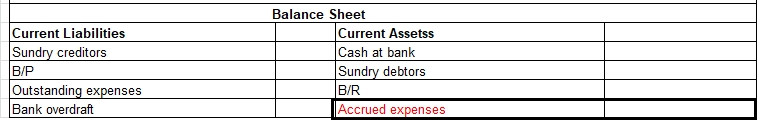

Commission earned but not received is called accrued income. As we know there are two types of accounting, cash basis of accounting, in which the transaction is recorded only when cash is received or paid, and accrual basis of accounting, in which even if money is yet to be accepted or paid, the transactions are still recorded.

E.g of accrual income- rent earned but not collected, interest on the investment earned but not received, etc.

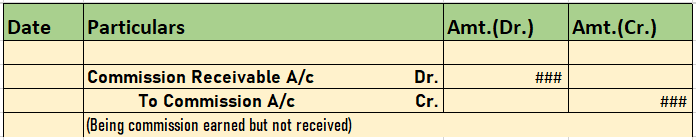

Journal entry

- The commission that is to be received is debited, indicating the increase in assets whereas, the commission account (which will be giving you the commission) is credited.

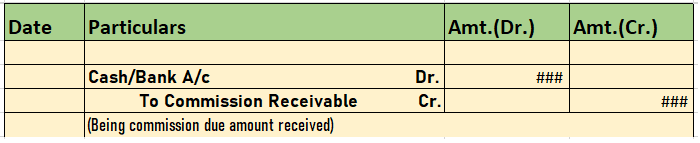

- Later on, upon receiving the cash an entry is passed crediting the commission receivable as shown below:

- These are adjusted while making the final accounts for the business.

Simplifying with an example

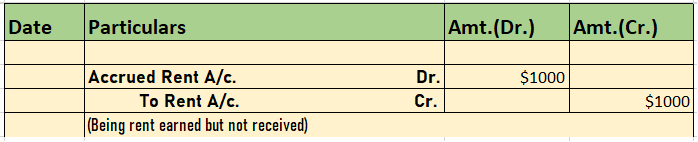

If the rent earned was $1,000 and it’s yet to be received, we’ll be passing this entry-

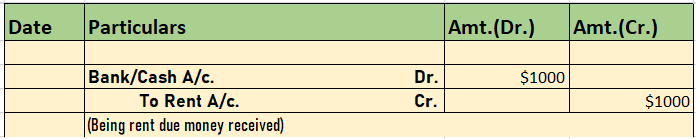

When it’s received, this entry is passed

See less

Plant and Machinery are the equipment attached to the earth that supports the manufacturing of the company or its operations. These are tangible non-current assets to the company and as a result, have a debit balance. Depreciation is the decrease in the value of an asset that is spread over the expeRead more

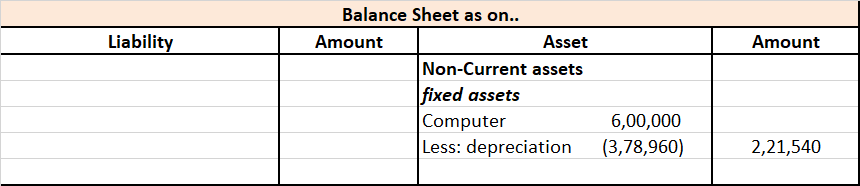

Plant and Machinery are the equipment attached to the earth that supports the manufacturing of the company or its operations. These are tangible non-current assets to the company and as a result, have a debit balance.

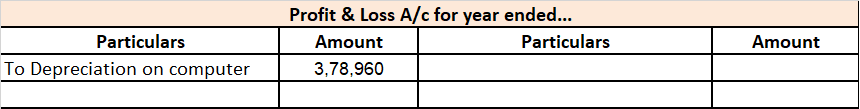

Depreciation is the decrease in the value of an asset that is spread over the expected life of the asset. Not depreciating an asset presents a false image of the company as the asset is recorded at a higher value and profit is overstated as depreciation expense is not provided for.

There are two ways that a company provide depreciation:

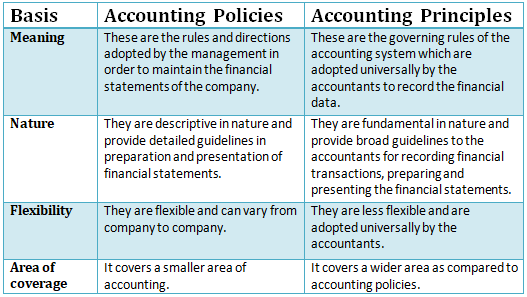

For most of the depreciation methods, we need a rate to provide for depreciation every year. Now, for accounting purposes, the management can use a rate they think is suitable depending on the use and expected life of the machinery.

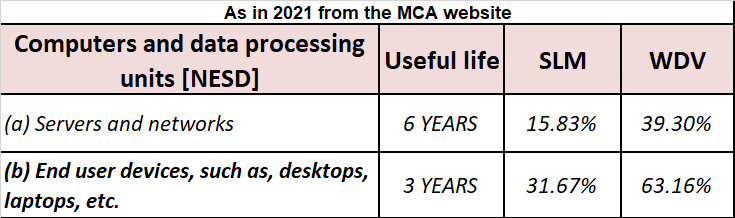

Depreciation is calculated on the basis of the Companies act, 2013 for the purpose of book-keeping. According to Schedule 2 of the Companies Act, depreciation on plant and machinery is calculated on the basis of either SLM or WDV.

Plant and machinery for those special rates are not assigned useful life is considered to be 15 years and depreciation is calculated @ 18.10% on WDV and @6.33% on SLM.

According to the Income Tax Act, 15% depreciation is provided every year on Plant and Machinery and, an additional 20% depreciation is provided in the first year of installation of machinery.

Depreciation on Machinery is charged on the basis of usage of such machinery. if it is used for 180 days or more then full depreciation is allowed and if it is used for less than 180 days then only 50% depreciation is allowed.

See less