Definition Debit balance may arise due to timing differences in which case income will be accrued at the year's end to offset the debit. The amount is shown in the record of a company s finances, by which its total debits are greater than its total credits. The account which has debit balances are aRead more

Definition

Debit balance may arise due to timing differences in which case income will be accrued at the year’s end to offset the debit.

The amount is shown in the record of a company s finances, by which its total debits are greater than its total credits.

The account which has debit balances are as follows:

• Assets accounts

Land, furniture, building machinery, etc

• Expenses accounts

Salary, rent, insurance, etc

• Losses

Bad debts, loss by fire, etc

• Drawings

Personal drawings of cash or assets

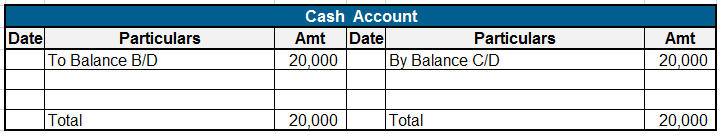

• Cash and bank balances

Balances of these accounts

In class 11th, we learned about all these accounts that have debit balances.

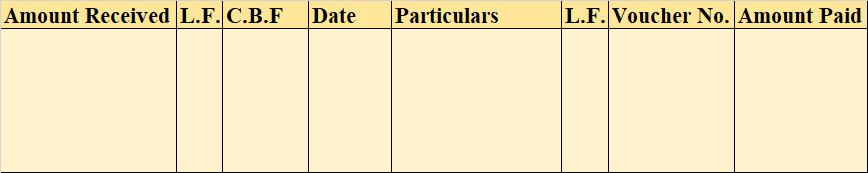

Where the total of the debit side is more than the credit side therefore the difference is the debit balance and is placed credit side as “ by balance c/d “

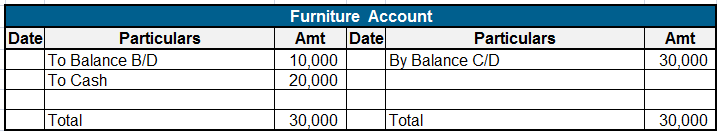

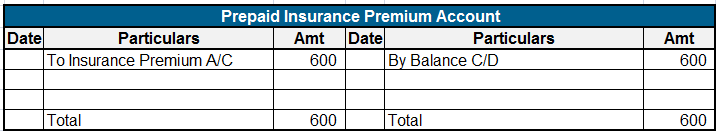

Here are some examples showing the debit balances of the accounts :

Current Assets & Examples Current Assets are those assets that are bought by the company for a short duration and are expected to be converted into cash, consumed, or written off within one accounting year. They are also called short-term assets. These short-term assets are typically called currRead more

Current Assets & Examples

Current Assets are those assets that are bought by the company for a short duration and are expected to be converted into cash, consumed, or written off within one accounting year. They are also called short-term assets.

These short-term assets are typically called current assets by the accountants and have no long-term future in the business. Current assets may be held by a company for a duration of a complete accounting year, 12 months, or maybe less. A major reason for the conversion of current assets into cash within a very short amount of time is to pay off the current liabilities.

Examples

Some of the major examples of current assets are – cash in hand, cash at the bank, bills receivables, sundry debtors, prepaid expenses, stock or inventory, other liquid assets, etc.

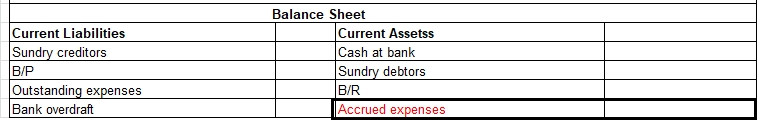

Current assets on the balance sheet

Balance Sheet (for the year…)

See less